Region:North America

Author(s):Geetanshi

Product Code:KRAD4028

Pages:80

Published On:December 2025

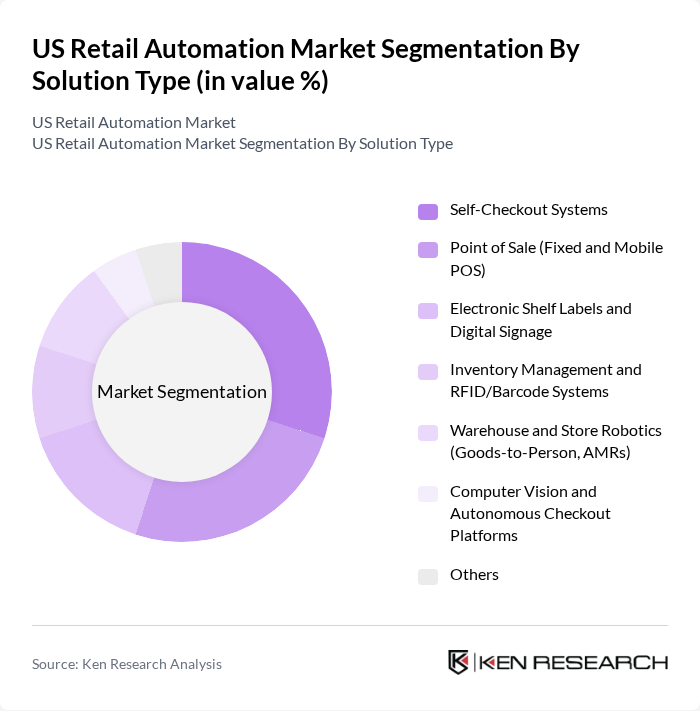

By Solution Type:The solution type segmentation includes various subsegments that cater to different aspects of retail automation. The primary subsegments are Self-Checkout Systems, Point of Sale (Fixed and Mobile POS), Electronic Shelf Labels and Digital Signage, Inventory Management and RFID/Barcode Systems, Warehouse and Store Robotics (Goods-to-Person, AMRs), Computer Vision and Autonomous Checkout Platforms, and Others. Among these, Self-Checkout Systems are leading the market due to their ability to enhance customer experience by reducing wait times and providing a seamless checkout process.

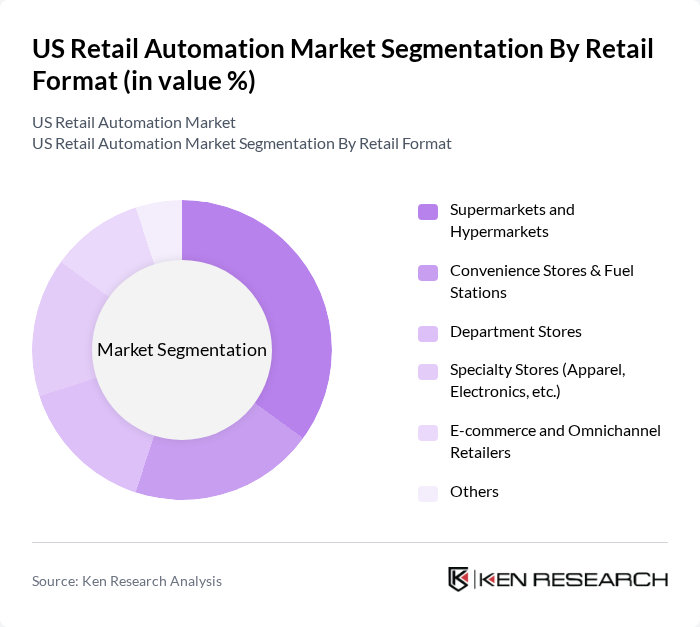

By Retail Format:The retail format segmentation encompasses various types of retail environments, including Supermarkets and Hypermarkets, Convenience Stores & Fuel Stations, Department Stores, Specialty Stores (Apparel, Electronics, etc.), E-commerce and Omnichannel Retailers, and Others. Supermarkets and Hypermarkets dominate this segment due to their extensive product offerings and high foot traffic, which necessitate efficient automation solutions to manage operations effectively.

The US Retail Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon (Amazon Go, Amazon Retail Technologies & Amazon Robotics), Walmart (Symbotic Partnership and In-Store Automation Initiatives), NCR Voyix Corporation, Toshiba Global Commerce Solutions, Diebold Nixdorf, Incorporated, Zebra Technologies Corporation, Honeywell International Inc., Fujitsu Limited, Blue Yonder (A Panasonic Company), Shopify Inc., Block, Inc. (Square), NCR-licensed Aloha POS (Hospitality and Quick-Service Retail), BrightSign LLC, Caper AI (Instacart), Standard AI (Standard Cognition) contribute to innovation, geographic expansion, and service delivery in this space.

The US retail automation market is poised for transformative growth, driven by technological advancements and changing consumer behaviors. As retailers increasingly adopt AI, robotics, and data analytics, operational efficiencies will improve significantly. The focus on sustainability and omnichannel strategies will further shape the landscape, encouraging innovation. In future, the integration of advanced technologies will redefine customer experiences, making automation a critical component of retail strategies to remain competitive in a rapidly evolving market.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Self-Checkout Systems Point of Sale (Fixed and Mobile POS) Electronic Shelf Labels and Digital Signage Inventory Management and RFID/Barcode Systems Warehouse and Store Robotics (Goods-to-Person, AMRs) Computer Vision and Autonomous Checkout Platforms Others |

| By Retail Format | Supermarkets and Hypermarkets Convenience Stores & Fuel Stations Department Stores Specialty Stores (Apparel, Electronics, etc.) E-commerce and Omnichannel Retailers Others |

| By Application | In-Store Operations Automation (Checkout, Pricing, Replenishment) Warehouse and Fulfillment Automation Inventory Visibility and Tracking Customer Engagement and Personalization Solutions Loss Prevention and Security Analytics Others |

| By Technology | AI and Machine Learning Analytics Computer Vision and Image Recognition Internet of Things (IoT) and Connected Devices Cloud and Edge Computing Platforms RFID, Sensors, and Advanced Barcode Technologies Others |

| By Deployment Mode | On-Premises Cloud-Based (SaaS) Hybrid Others |

| By Business Size | Small and Independent Retailers Mid-sized Retail Chains Large and Tier-1 Retailers Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Automation | 100 | Store Managers, IT Directors |

| Apparel Retail Technology Adoption | 80 | Operations Managers, E-commerce Directors |

| Electronics Retail Automation Solutions | 70 | Supply Chain Managers, Technology Officers |

| Warehouse Automation in Retail | 90 | Logistics Managers, Warehouse Supervisors |

| Customer Experience Automation | 75 | Customer Service Managers, Marketing Directors |

The US Retail Automation Market is valued at approximately USD 10 billion, reflecting a five-year historical analysis. This growth is driven by the demand for operational efficiency, improved customer experiences, and the integration of advanced technologies like AI and IoT in retail operations.