Region:Middle East

Author(s):Rebecca

Product Code:KRAB8173

Pages:83

Published On:October 2025

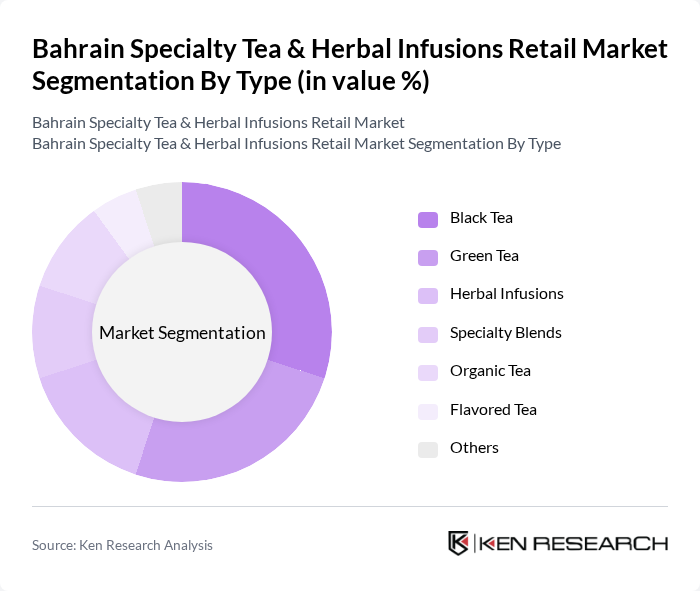

By Type:The market is segmented into various types of specialty teas and herbal infusions, including Black Tea, Green Tea, Herbal Infusions, Specialty Blends, Organic Tea, Flavored Tea, and Others. Among these, Black Tea and Green Tea are the most popular due to their traditional significance and health benefits. The demand for Organic Tea is also rising as consumers become more health-conscious and environmentally aware.

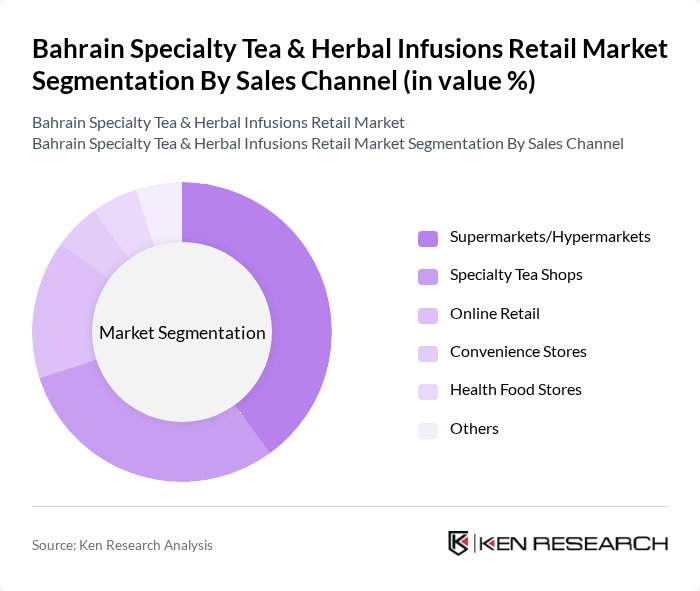

By Sales Channel:The sales channels for specialty tea and herbal infusions include Supermarkets/Hypermarkets, Specialty Tea Shops, Online Retail, Convenience Stores, Health Food Stores, and Others. Supermarkets and Specialty Tea Shops dominate the market due to their wide product range and consumer accessibility, while Online Retail is gaining traction as e-commerce continues to grow in popularity.

The Bahrain Specialty Tea & Herbal Infusions Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ahmad Tea, Dilmah Tea, Twinings, Harney & Sons, Teavana, Yogi Tea, Pukka Herbs, Celestial Seasonings, Tazo Tea, Stash Tea, Bigelow Tea, Numi Organic Tea, Rishi Tea, Kusmi Tea, The Republic of Tea contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain specialty tea and herbal infusions market appears promising, driven by evolving consumer preferences and innovative product offerings. As health consciousness continues to rise, brands are likely to focus on developing unique blends that cater to specific wellness needs. Additionally, the integration of technology in retail, such as mobile apps for personalized recommendations, will enhance consumer engagement. The market is expected to adapt to these trends, fostering growth and diversification in product lines.

| Segment | Sub-Segments |

|---|---|

| By Type | Black Tea Green Tea Herbal Infusions Specialty Blends Organic Tea Flavored Tea Others |

| By Sales Channel | Supermarkets/Hypermarkets Specialty Tea Shops Online Retail Convenience Stores Health Food Stores Others |

| By Packaging Type | Loose Leaf Tea Bags Bottled Tea Canned Tea Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences |

| By Flavor Profile | Floral Spicy Fruity Earthy Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Specialty Tea Outlets | 100 | Store Owners, Retail Managers |

| Consumer Preferences for Herbal Infusions | 150 | Health-Conscious Consumers, Tea Enthusiasts |

| Market Trends in Online Tea Sales | 80 | E-commerce Managers, Digital Marketing Specialists |

| Distribution Channels for Specialty Teas | 70 | Wholesale Distributors, Supply Chain Managers |

| Consumer Awareness and Education on Herbal Benefits | 90 | Health Practitioners, Wellness Coaches |

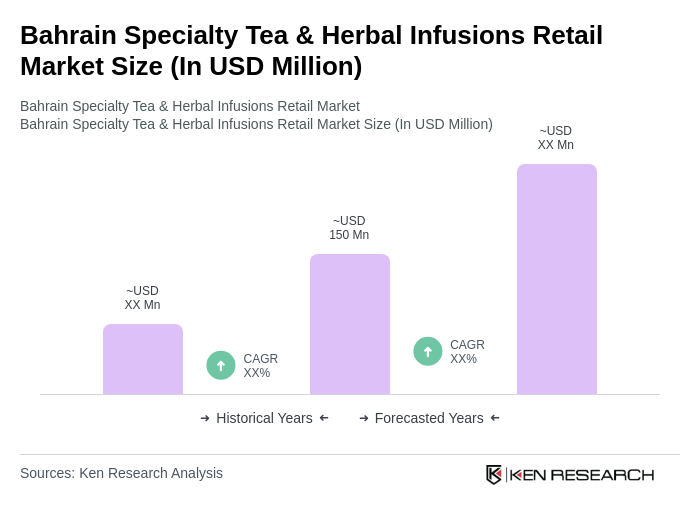

The Bahrain Specialty Tea & Herbal Infusions Retail Market is valued at approximately USD 150 million, reflecting a growing consumer interest in health benefits associated with specialty teas and herbal infusions, as well as a trend towards premium beverage choices.