Region:Middle East

Author(s):Shubham

Product Code:KRAA8551

Pages:98

Published On:November 2025

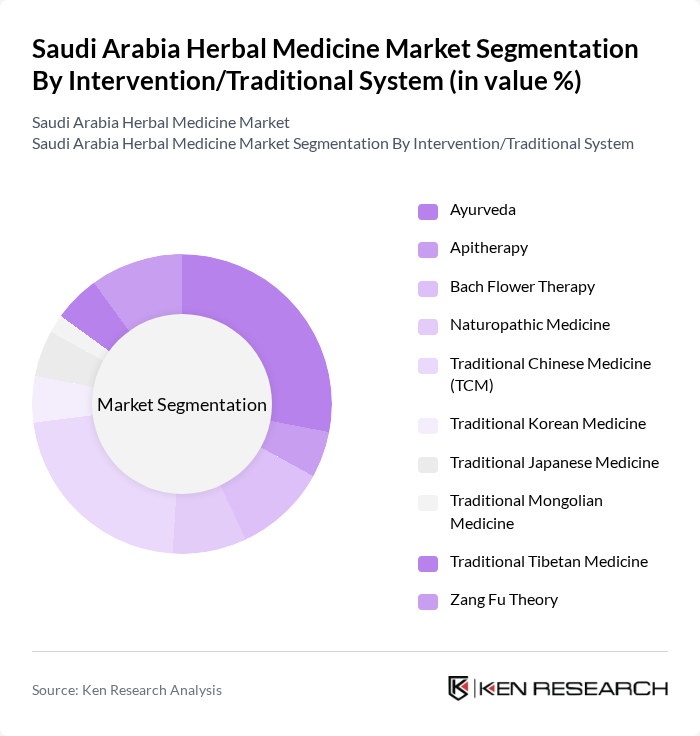

By Intervention/Traditional System:The herbal medicine market in Saudi Arabia is characterized by various traditional systems, including Ayurveda, Traditional Chinese Medicine (TCM), and others. Among these, Ayurveda is currently the largest segment by revenue, driven by its established reputation for treating a wide range of ailments and its holistic approach. Traditional Chinese Medicine (TCM) continues to gain traction due to growing interest in alternative therapies and its integration into wellness centers. The market is witnessing increased consumer demand for diverse traditional systems, reflecting a broader shift towards natural and integrative health solutions .

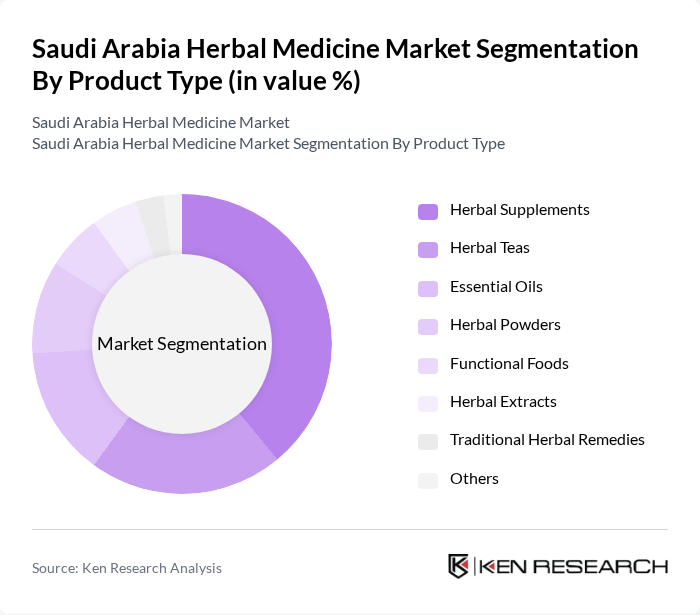

By Product Type:The product type segmentation in the herbal medicine market includes herbal supplements, herbal teas, essential oils, and more. Herbal supplements are currently the leading product type, driven by their convenience, the growing trend of self-medication, and increasing health consciousness among consumers. The expansion of e-commerce platforms has further boosted accessibility and sales of herbal supplements, making them a significant contributor to overall market growth .

The Saudi Arabia Herbal Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tabuk Pharmaceuticals Manufacturing Company, Jamjoom Pharma, SPIMACO (Saudi Pharmaceutical Industries & Medical Appliances Corporation), Riyadh Pharma, Nature’s Way Products, LLC, Himalaya Drug Company, Dabur India Ltd., Blackmores Limited, NOW Foods, Garden of Life, Pure Encapsulations, Swisse Wellness Pty Ltd., BioCare Copenhagen, Herbalife Nutrition Ltd., NaturesPlus contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian herbal medicine market appears promising, driven by increasing consumer demand for natural health solutions and government initiatives supporting traditional practices. As the population becomes more health-conscious, the integration of technology in herbal medicine, such as mobile health applications, is expected to enhance accessibility and personalization of treatments. Additionally, the focus on sustainability in sourcing herbs will likely attract environmentally conscious consumers, further propelling market growth.

| Segment | Sub-Segments |

|---|---|

| By Intervention/Traditional System | Ayurveda Apitherapy Bach Flower Therapy Naturopathic Medicine Traditional Chinese Medicine (TCM) Traditional Korean Medicine Traditional Japanese Medicine Traditional Mongolian Medicine Traditional Tibetan Medicine Zang Fu Theory |

| By Product Type | Herbal Supplements Herbal Teas Essential Oils Herbal Powders Functional Foods Herbal Extracts Traditional Herbal Remedies Others |

| By Application | Nutritional Health Immunity Boosting Digestive Health Stress Relief Weight Management Cosmetic Applications Therapeutic Uses Others |

| By Source | Barks Leaves Roots Others |

| By Formulation Type | Syrups Powders Capsules & Tablets Liquids Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Direct Sales Wellness Centers Others |

| By End-User | Individual Consumers Healthcare Providers Retail Pharmacies Wellness Centers Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Herbal Products | 120 | Health-conscious Consumers, Herbal Product Users |

| Practitioner Insights on Herbal Medicine | 60 | Traditional Healers, Herbalists |

| Retailer Perspectives on Market Trends | 50 | Retail Managers, Store Owners, Product Buyers |

| Supplier Feedback on Distribution Challenges | 40 | Distributors, Wholesalers, Supply Chain Managers |

| Regulatory Insights from Health Authorities | 40 | Regulatory Officials, Policy Makers, Health Advisors |

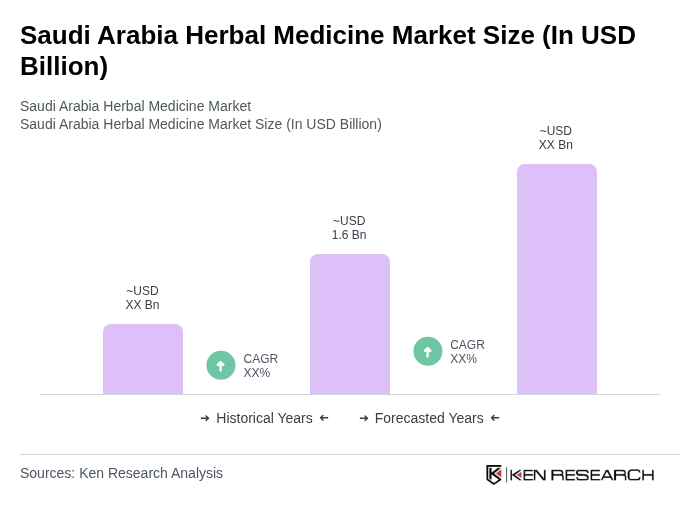

The Saudi Arabia Herbal Medicine Market is valued at approximately USD 1.6 billion, reflecting a significant growth trend driven by increasing consumer awareness of natural remedies and a shift towards preventive healthcare.