Region:Middle East

Author(s):Dev

Product Code:KRAC4154

Pages:90

Published On:October 2025

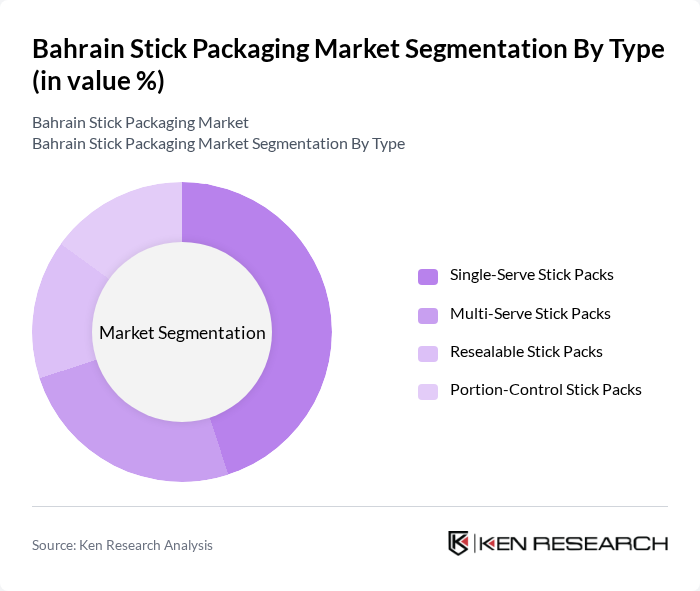

By Type:The stick packaging market can be segmented into various types, including Single-Serve Stick Packs, Multi-Serve Stick Packs, Resealable Stick Packs, and Portion-Control Stick Packs. Among these, Single-Serve Stick Packs are currently dominating the market due to their convenience and suitability for on-the-go consumption. The increasing trend of single-serve products in the food and beverage sector, particularly in snacks and beverages, has led to a significant rise in demand for this sub-segment. Consumers prefer these packs for their ease of use and portion control, making them a popular choice among manufacturers .

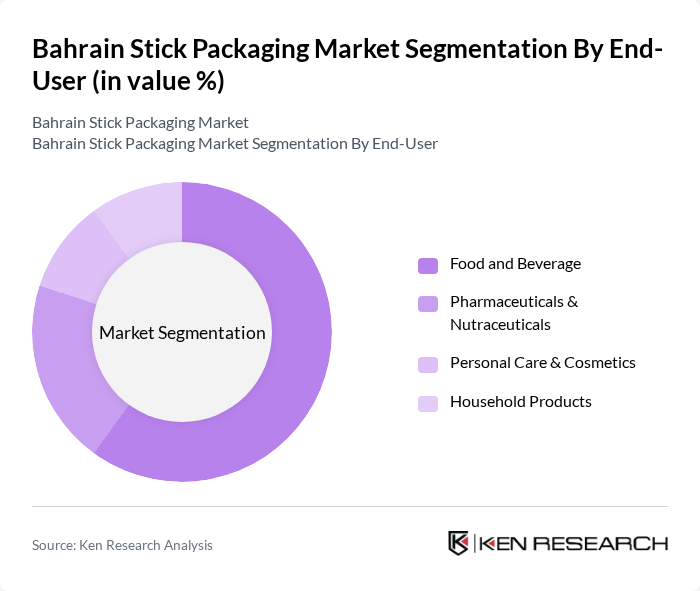

By End-User:The end-user segmentation of the stick packaging market includes Food and Beverage, Pharmaceuticals & Nutraceuticals, Personal Care & Cosmetics, and Household Products. The Food and Beverage sector is the leading end-user, driven by the growing demand for convenient and portable packaging solutions. The rise in health-conscious consumers has also led to an increase in the demand for single-serve and portion-controlled products, particularly in snacks and beverages. This trend is further supported by the expansion of retail channels and the increasing availability of packaged food products .

The Bahrain Stick Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Packaging Industry W.L.L., Gulf Closures W.L.L., Al Ahlia Packaging Co. B.S.C., United Paper Industries (Bahrain Pack), Al Jazeera Packaging Co. W.L.L., Al Khamis Group, United Gulf Manufacturing Co. W.L.L., Zain Pack, Arabian Flexible Packaging Co., Al Mufeedh Group, Al Mufeedh Packaging, Al Jazeera Packaging Co. W.L.L., Gulf Packaging Industries, Bahrain Packaging Company B.S.C., United Gulf Manufacturing Co. W.L.L. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the stick packaging market in Bahrain appears promising, driven by evolving consumer preferences and technological advancements. As the demand for convenient and sustainable packaging solutions continues to rise, manufacturers are likely to invest in innovative materials and processes. Additionally, the expansion of e-commerce is expected to further boost the market, as online retailers increasingly seek efficient packaging options that enhance product delivery and customer satisfaction. Overall, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Serve Stick Packs Multi-Serve Stick Packs Resealable Stick Packs Portion-Control Stick Packs |

| By End-User | Food and Beverage Pharmaceuticals & Nutraceuticals Personal Care & Cosmetics Household Products |

| By Material | Plastic (PET, PE, PP) Paper & Paperboard Aluminum Foil Compostable/Biodegradable Films |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Direct B2B Sales |

| By Application | Snacks & Confectionery Beverage Powders Condiments & Sauces Pharmaceuticals & Supplements |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Flexible Packaging Semi-Rigid Packaging Rigid Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 45 | Product Managers, Packaging Engineers |

| Cosmetics and Personal Care Packaging | 38 | Brand Managers, Marketing Directors |

| Pharmaceutical Packaging Solutions | 42 | Regulatory Affairs Specialists, Quality Control Managers |

| Retail Sector Insights | 40 | Store Managers, Merchandising Executives |

| Distribution and Logistics Perspectives | 35 | Supply Chain Managers, Logistics Coordinators |

The Bahrain Stick Packaging Market is valued at approximately USD 145 million, reflecting a robust growth trajectory driven by increasing demand for convenient packaging solutions, particularly in the food and beverage sector.