Region:Middle East

Author(s):Rebecca

Product Code:KRAD4927

Pages:99

Published On:December 2025

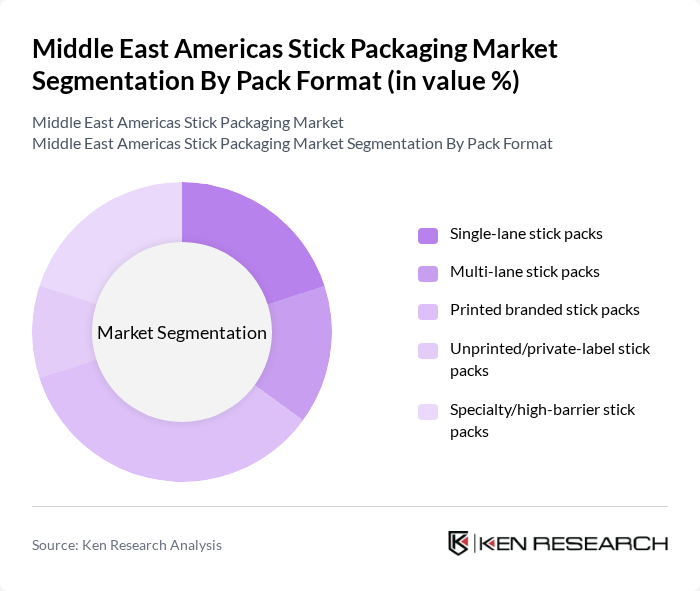

By Pack Format:The pack format segmentation includes various types of stick packs that cater to different consumer needs and preferences. The subsegments are Single-lane stick packs, Multi-lane stick packs, Printed branded stick packs, Unprinted/private-label stick packs, and Specialty/high-barrier stick packs. Single- and multi?lane formats are widely used on vertical form-fill-seal (VFFS) and horizontal form-fill-seal (HFFS) machinery for high-speed packing of powders, granules, and liquids in food, beverage, nutraceutical, and pharmaceutical applications. Among these, the Printed branded stick packs are increasingly favored due to their ability to enhance brand visibility, support promotional graphics and regulatory information, and improve consumer engagement at retail shelves and in e?commerce shipments. The trend towards personalized packaging, premium graphics, and targeted branding for single-serve beverages, instant mixes, and nutraceutical supplements has driven the demand for printed options, making them a preferred choice for manufacturers.

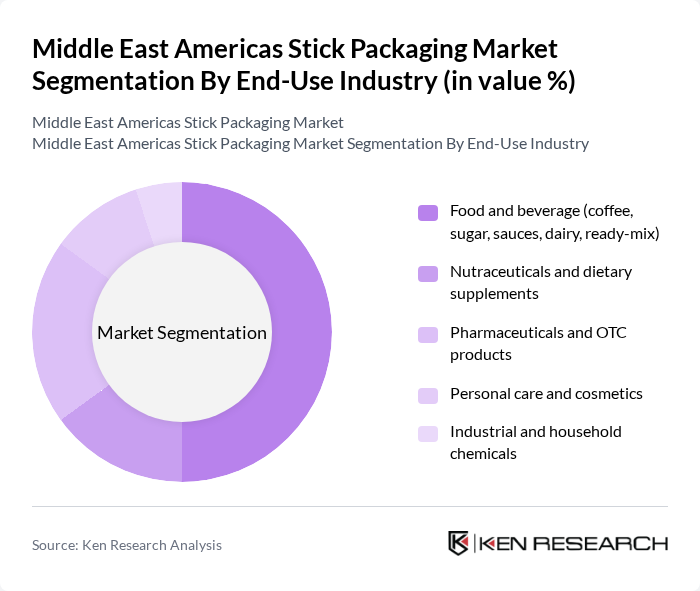

By End-Use Industry:The end-use industry segmentation encompasses various sectors utilizing stick packaging, including Food and beverage, Nutraceuticals and dietary supplements, Pharmaceuticals and OTC products, Personal care and cosmetics, and Industrial and household chemicals. The Food and beverage sector is the dominant segment globally, driven by the increasing demand for convenient packaging solutions for products like coffee, sugar, instant beverages, dairy powders, and ready-mix sauces. In parallel, nutraceuticals and dietary supplements are one of the fastest-growing uses for stick packs, as brands adopt single-serve formats for vitamins, electrolyte powders, collagen, and functional blends to support dosing accuracy and portability. The trend towards ready-to-eat, on-the-go food options and health-and-wellness products has significantly boosted the adoption of stick packaging in these industries across North American, Latin American, and Middle Eastern markets.

The Middle East Americas Stick Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Constantia Flexibles Group GmbH, Huhtamaki Oyj, ProAmpac LLC, Glenroy, Inc., Berry Global, Inc., Sealed Air Corporation, Sonoco Products Company, WestRock Company, Amcor Flexibles Latin America (AFS), Taghleef Industries, Gulf Packaging Industries Ltd. (GPIL), Napco National Packaging, ePac Flexible Packaging, Eliteflex Packaging LLC (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East Americas stick packaging market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are likely to invest in eco-friendly materials and innovative designs. Additionally, the expansion of e-commerce and online food delivery services will further enhance the demand for convenient packaging solutions. Companies that adapt to these trends and focus on sustainable practices are expected to gain a competitive edge in the market.

| Segment | Sub-Segments |

|---|---|

| By Pack Format | Single-lane stick packs Multi-lane stick packs Printed branded stick packs Unprinted/private-label stick packs Specialty/high-barrier stick packs |

| By End-Use Industry | Food and beverage (coffee, sugar, sauces, dairy, ready-mix) Nutraceuticals and dietary supplements Pharmaceuticals and OTC products Personal care and cosmetics Industrial and household chemicals |

| By Material Structure | Plastic films (PE, PP, PET, BOPP) Paper and paper-based laminates Aluminum foil laminates Mono-material recyclable structures Bio-based and compostable films |

| By Filling Technology | Horizontal form-fill-seal (HFFS) Vertical form-fill-seal (VFFS) Pre-made stick pack filling Contract packing (co-packing) Others |

| By Region | North America (U.S., Canada, Mexico) Latin America (Brazil, Argentina, Rest of LATAM) Middle East (GCC, Turkey, Rest of Middle East) Caribbean Rest of Americas & Middle East |

| By Application Format | Powders and granules Liquids and gels Tablets and capsules Pastes and semi-solids Others |

| By Packaging Function | Barrier and protection packaging Portion control and single-serve packaging Promotional and sample packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FMCG Stick Packaging Usage | 120 | Product Managers, Brand Strategists |

| Pharmaceutical Packaging Trends | 90 | Regulatory Affairs Specialists, Packaging Engineers |

| Food & Beverage Packaging Innovations | 110 | Supply Chain Managers, Quality Assurance Officers |

| Consumer Preferences in Stick Packaging | 70 | Market Researchers, Consumer Insights Analysts |

| Sustainability Practices in Packaging | 60 | Sustainability Managers, Environmental Compliance Officers |

The Middle East Americas Stick Packaging Market is valued at approximately USD 1.25 billion, reflecting a significant growth trend driven by the demand for convenient and portion-controlled packaging solutions across various industries, including food, beverages, and pharmaceuticals.