Region:Middle East

Author(s):Rebecca

Product Code:KRAD2820

Pages:87

Published On:November 2025

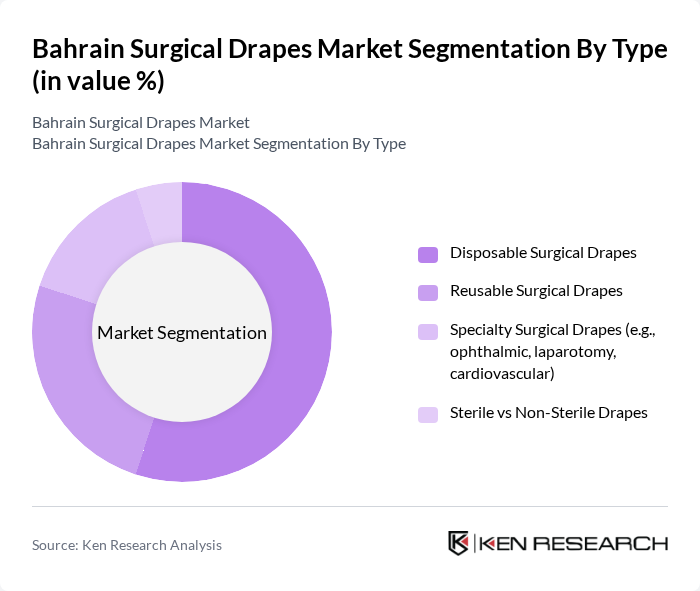

By Type:The market can be segmented into various types of surgical drapes, including Disposable Surgical Drapes, Reusable Surgical Drapes, Specialty Surgical Drapes (e.g., ophthalmic, laparotomy, cardiovascular), and Sterile vs Non-Sterile Drapes. Disposable surgical drapes dominate the market due to their convenience, single-use nature, and reduced risk of cross-contamination, while reusable drapes are favored for their cost-effectiveness and sustainability in long-term use .

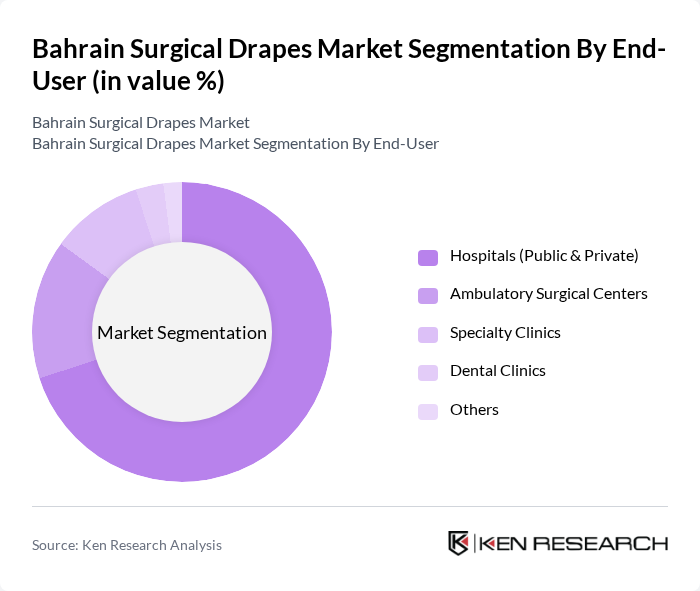

By End-User:The end-user segmentation includes Hospitals (Public & Private), Ambulatory Surgical Centers, Specialty Clinics, Dental Clinics, and Others. Hospitals, both public and private, are the largest consumers of surgical drapes due to the high volume of surgical procedures performed, followed by ambulatory surgical centers that cater to outpatient surgeries. Specialty clinics and dental clinics represent smaller but growing segments as procedural volumes increase across Bahrain’s private healthcare sector .

The Bahrain Surgical Drapes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medline Industries, LP, Cardinal Health, Inc., Owens & Minor, Inc. (including Halyard Health), 3M Company, Smith & Nephew plc, Mölnlycke Health Care AB, Paul Hartmann AG, Ahlstrom-Munksjö Oyj, Lohmann & Rauscher GmbH & Co. KG, B. Braun Melsungen AG, Johnson & Johnson (Ethicon), Stryker Corporation, Ecolab Inc., Medica Group PLC, TIDI Products, LLC contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain surgical drapes market appears promising, driven by ongoing advancements in healthcare technology and a commitment to improving patient safety. As healthcare facilities continue to expand and upgrade their services, the demand for innovative and high-quality surgical drapes will likely increase. Additionally, the integration of smart technologies and eco-friendly materials is expected to shape product offerings, aligning with global sustainability trends and enhancing operational efficiency in surgical settings.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Surgical Drapes Reusable Surgical Drapes Specialty Surgical Drapes (e.g., ophthalmic, laparotomy, cardiovascular) Sterile vs Non-Sterile Drapes |

| By End-User | Hospitals (Public & Private) Ambulatory Surgical Centers Specialty Clinics Dental Clinics Others |

| By Material | Non-woven Fabrics (e.g., SMS, spunlace) Woven Fabrics (cotton, polyester blends) Plastic Films (polyethylene, polypropylene) Eco-friendly/Biodegradable Materials Others |

| By Application | General Surgery Orthopedic Surgery Cardiothoracic Surgery Obstetrics & Gynecology Neurosurgery Others |

| By Distribution Channel | Direct Sales (to hospitals/clinics) Online Sales/E-commerce Distributors/Wholesalers Tender-based Procurement Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Local Content Requirements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Procurement | 60 | Procurement Managers, Hospital Administrators |

| Private Healthcare Facilities | 50 | Clinical Directors, Surgical Coordinators |

| Surgical Equipment Suppliers | 40 | Sales Managers, Product Specialists |

| Healthcare Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Medical Device Distributors | 45 | Distribution Managers, Supply Chain Analysts |

The Bahrain Surgical Drapes Market is valued at approximately USD 16 million, reflecting a five-year historical analysis and regional market share estimates within the Middle East and Africa surgical drapes sector.