Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3773

Pages:100

Published On:October 2025

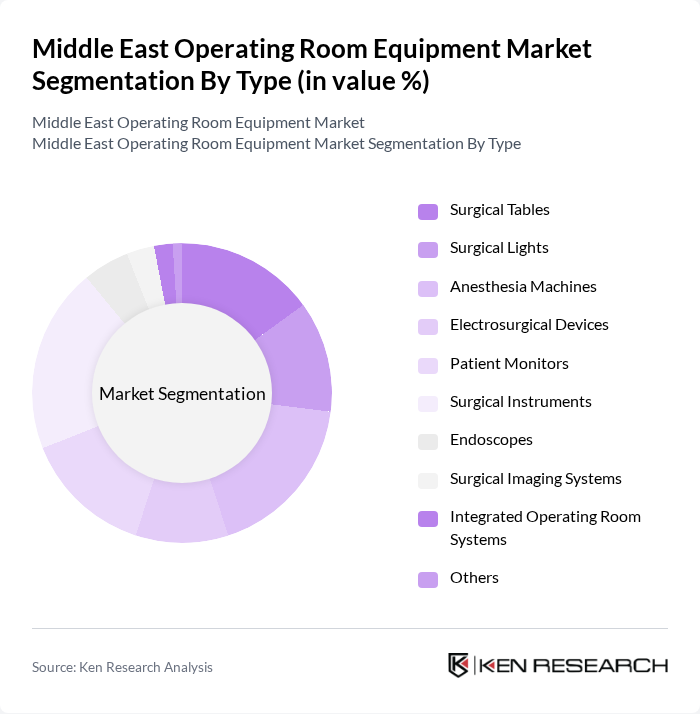

By Type:The market is segmented into various types of operating room equipment, including surgical tables, surgical lights, anesthesia machines, electrosurgical devices, patient monitors, surgical instruments, endoscopes, surgical imaging systems, integrated operating room systems, and others. Each of these sub-segments plays a crucial role in enhancing surgical efficiency and patient safety. Integrated operating room systems are gaining traction due to their ability to streamline workflows and improve surgical precision through advanced visualization and connectivity solutions .

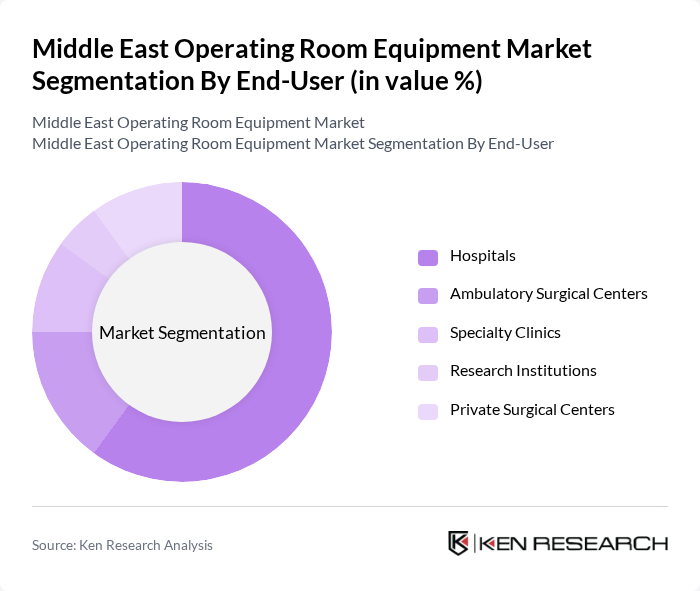

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers, specialty clinics, research institutions, and private surgical centers. Hospitals are the primary end-users, driven by the increasing number of surgical procedures and the need for advanced medical technologies. Ambulatory surgical centers are also witnessing growth due to the rising preference for minimally invasive surgeries and outpatient procedures .

The Middle East Operating Room Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE HealthCare, Philips Healthcare, Stryker Corporation, Medtronic PLC, Johnson & Johnson (Ethicon), B. Braun Melsungen AG, Baxter International Inc., Getinge AB, Steris PLC, Hillrom (now part of Baxter), Mindray Medical International Limited, Drägerwerk AG & Co. KGaA, Skytron LLC, Karl Storz SE & Co. KG, Olympus Corporation, Conmed Corporation, Terumo Corporation, Canon Medical Systems, Fujifilm Holdings Corporation, RAIN Technology ME LTD, Affera, Inc. (Medtronic) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East operating room equipment market appears promising, driven by technological advancements and increasing healthcare investments. As countries enhance their healthcare infrastructure, the demand for innovative surgical solutions is expected to rise. Additionally, the integration of artificial intelligence and robotic systems will likely transform surgical practices, improving patient outcomes. The focus on patient safety and efficiency will further propel the market, creating a dynamic environment for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Tables Surgical Lights Anesthesia Machines Electrosurgical Devices Patient Monitors Surgical Instruments Endoscopes Surgical Imaging Systems Integrated Operating Room Systems Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Research Institutions Private Surgical Centers |

| By Application | General Surgery Orthopedic Surgery Cardiovascular Surgery Neurosurgery Obstetrics & Gynecology Surgery Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Sales |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Jordan, Lebanon, Syria, Iraq, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Turkey |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment |

| By Policy Support | Government Subsidies Tax Incentives Grants for Healthcare Facilities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Operating Room Equipment | 100 | Hospital Administrators, Procurement Managers |

| Private Healthcare Facilities Equipment Needs | 80 | Clinical Directors, Equipment Buyers |

| Surgeon Preferences for Surgical Instruments | 60 | Surgeons, Operating Room Coordinators |

| Market Trends in Anesthesia Equipment | 50 | Anesthesiologists, Medical Equipment Specialists |

| Emerging Technologies in Operating Rooms | 40 | Healthcare Innovators, Technology Officers |

The Middle East Operating Room Equipment Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by advancements in surgical technologies, increased healthcare expenditure, and the expansion of healthcare infrastructure in the region.