Region:Middle East

Author(s):Rebecca

Product Code:KRAD2948

Pages:97

Published On:November 2025

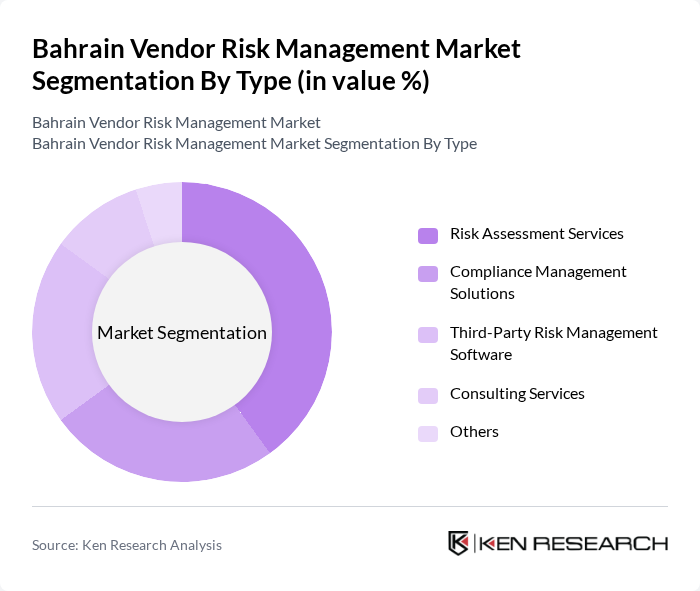

By Type:

The segmentation by type includes Risk Assessment Services, Compliance Management Solutions, Third-Party Risk Management Software, Consulting Services, and Others. Among these, Risk Assessment Services are currently dominating the market due to the increasing need for organizations to identify and mitigate potential risks associated with their vendors. This segment is driven by heightened awareness of cybersecurity threats and regulatory compliance requirements, leading businesses to prioritize risk assessments as a critical component of their vendor management strategies.

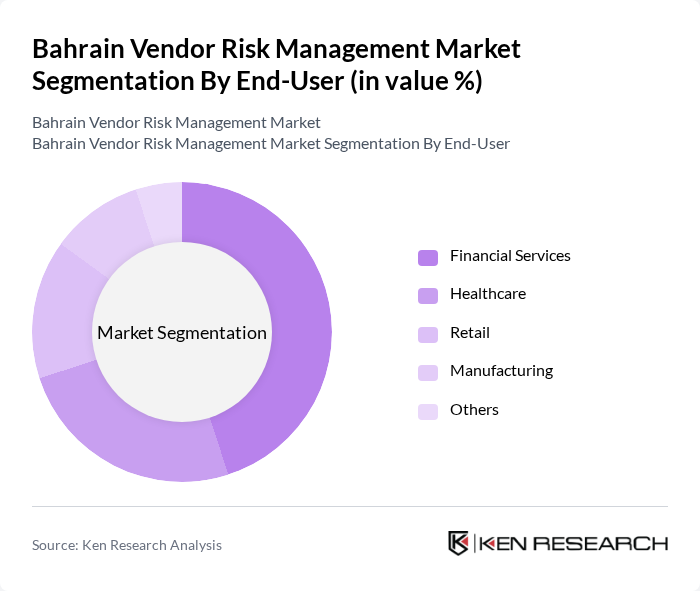

By End-User:

This segmentation includes Financial Services, Healthcare, Retail, Manufacturing, and Others. The Financial Services sector is leading the market, driven by stringent regulatory requirements and the critical need for data protection. Financial institutions are increasingly investing in vendor risk management solutions to ensure compliance with regulations and safeguard sensitive customer information, making this sector a key driver of growth in the vendor risk management market.

The Bahrain Vendor Risk Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte, PwC, KPMG, EY, RSA Security, RiskLens, LogicManager, MetricStream, Archer Technologies, SAI Global, CyberGRX, Prevalent, OneTrust, Trustwave, Venminder contribute to innovation, geographic expansion, and service delivery in this space.

As Bahrain continues to enhance its regulatory landscape and address cybersecurity threats, the vendor risk management market is poised for significant evolution. The integration of advanced technologies, such as AI and machine learning, will streamline risk assessments and improve decision-making processes. Additionally, the increasing collaboration among stakeholders will foster a more resilient vendor ecosystem, ensuring that organizations can effectively manage risks while capitalizing on digital transformation initiatives and sustainability efforts.

| Segment | Sub-Segments |

|---|---|

| By Type | Risk Assessment Services Compliance Management Solutions Third-Party Risk Management Software Consulting Services Others |

| By End-User | Financial Services Healthcare Retail Manufacturing Others |

| By Industry | Government Telecommunications Energy Transportation Others |

| By Service Model | On-Premises Solutions Cloud-Based Solutions Hybrid Solutions Others |

| By Deployment Type | Managed Services Professional Services Others |

| By Risk Type | Operational Risk Compliance Risk Financial Risk Strategic Risk Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Vendor Risk Management | 100 | Risk Managers, Compliance Officers |

| Insurance Industry Risk Assessment | 80 | Underwriters, Risk Analysts |

| Telecommunications Vendor Compliance | 70 | Procurement Managers, IT Security Officers |

| Healthcare Sector Vendor Oversight | 60 | Compliance Managers, Operations Directors |

| Government Procurement Risk Management | 50 | Public Sector Procurement Officers, Risk Assessors |

The Bahrain Vendor Risk Management Market is valued at approximately USD 150 million, reflecting a significant growth driven by increasing regulatory compliance requirements, rising cyber threats, and the need for effective management of third-party risks.