Region:Global

Author(s):Rebecca

Product Code:KRAD0202

Pages:85

Published On:August 2025

By Solution Type:The solution type segmentation includes various subsegments such as Vendor Risk Assessment, Vendor Performance Management, Vendor Information Management, Compliance Management, Contract Management, Incident Management, and Others. Among these, Vendor Risk Assessment is currently the leading subsegment due to the increasing need for organizations to evaluate and mitigate risks associated with their vendors. This growing focus on risk assessment is driven by the rising number of data breaches, regulatory compliance requirements, and the adoption of AI-driven continuous monitoring solutions, prompting organizations to prioritize vendor evaluations to safeguard their operations .

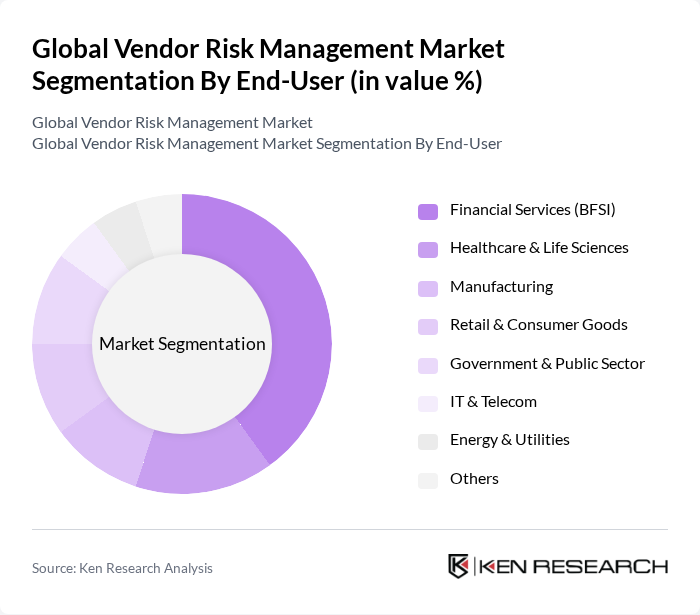

By End-User:The end-user segmentation encompasses various industries, including Financial Services (BFSI), Healthcare & Life Sciences, Manufacturing, Retail & Consumer Goods, Government & Public Sector, IT & Telecom, Energy & Utilities, and Others. The Financial Services sector is the dominant end-user, driven by stringent regulatory requirements, critical need for data protection, and heightened scrutiny of outsourcing risk by banking regulators. As financial institutions increasingly rely on third-party vendors for various services, the demand for effective vendor risk management solutions has surged, making this sector a key player in the market .

The Global Vendor Risk Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as RSA Security LLC, RiskLens Inc., LogicGate Inc., OneTrust LLC, MetricStream Inc., Prevalent Inc., Coupa Software Inc., Aravo Solutions Inc., Venminder Inc., SAI Global Pty Ltd., IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, Diligent Corporation, BitSight Technologies Inc., ProcessUnity Inc., NAVEX Global Inc., Quantivate LLC, Resolver Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of vendor risk management is poised for significant transformation, driven by technological advancements and evolving market dynamics. Organizations are increasingly adopting integrated risk management platforms that leverage AI and machine learning for predictive analytics. Additionally, the focus on sustainability and ethical sourcing will shape vendor selection criteria, compelling companies to prioritize responsible practices. As businesses navigate these changes, the demand for robust vendor risk management solutions will continue to grow, ensuring compliance and resilience in an ever-changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Vendor Risk Assessment Vendor Performance Management Vendor Information Management Compliance Management Contract Management Incident Management Others |

| By End-User | Financial Services (BFSI) Healthcare & Life Sciences Manufacturing Retail & Consumer Goods Government & Public Sector IT & Telecom Energy & Utilities Others |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Risk Assessment Methodology | Qualitative Assessment Quantitative Assessment Hybrid Assessment |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Vendor Risk Management | 100 | Risk Managers, Compliance Officers |

| Healthcare Vendor Compliance Strategies | 80 | IT Security Directors, Procurement Managers |

| Manufacturing Supply Chain Risk Assessment | 60 | Supply Chain Managers, Quality Assurance Leads |

| Technology Sector Vendor Risk Policies | 70 | Chief Information Officers, Vendor Management Specialists |

| Retail Vendor Risk Mitigation Practices | 50 | Operations Managers, Risk Assessment Analysts |

The Global Vendor Risk Management Market is valued at approximately USD 11.9 billion, reflecting a significant increase driven by the complexities of supply chains and the need for organizations to manage risks associated with third-party vendors.