Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9551

Pages:91

Published On:November 2025

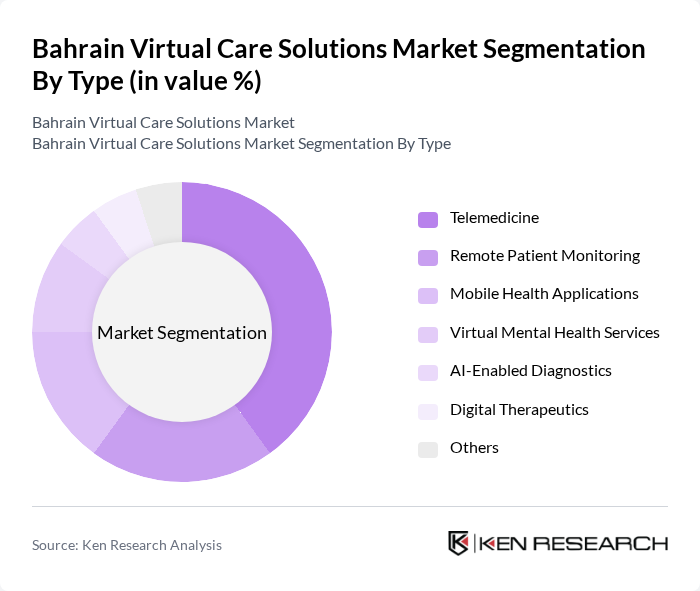

By Type:The market is segmented into various types, including Telemedicine, Remote Patient Monitoring, Mobile Health Applications, Virtual Mental Health Services, AI-Enabled Diagnostics, Digital Therapeutics, and Others. Among these, Telemedicine is the leading sub-segment, driven by its ability to provide immediate access to healthcare professionals and reduce the need for in-person visits. The increasing acceptance of telehealth services by both patients and providers, coupled with the integration of AI-powered diagnostic and workflow tools, has significantly contributed to its dominance in the market .

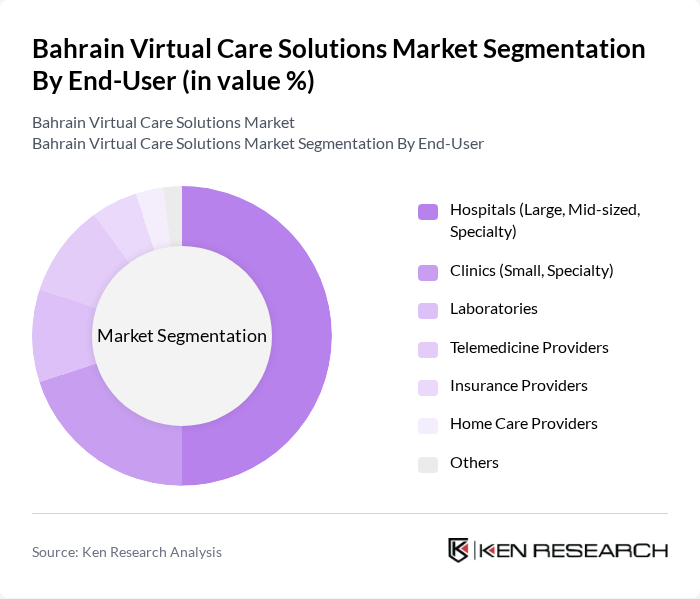

By End-User:The end-user segmentation includes Hospitals (Large, Mid-sized, Specialty), Clinics (Small, Specialty), Laboratories, Telemedicine Providers, Insurance Providers, Home Care Providers, and Others. Hospitals are the dominant end-user segment, as they increasingly adopt virtual care solutions to enhance patient management and streamline operations. The integration of virtual care into hospital systems allows for better resource allocation and improved patient outcomes. Laboratories and telemedicine providers are also experiencing rapid growth due to the expansion of remote monitoring and digital diagnostics .

The Bahrain Virtual Care Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE HealthCare, Philips Healthcare, Siemens Healthineers, InterSystems (TrakCare), Amazon Web Services (AWS) Bahrain, Doctori, Healthigo, Meddy, Seha, Aster DM Healthcare, Al Hilal Hospital, Bahrain Specialist Hospital, Royal Bahrain Hospital, American Mission Hospital, Bahrain Telemedicine Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of Bahrain's virtual care solutions market appears promising, driven by ongoing technological advancements and a growing emphasis on patient-centered care. As healthcare providers increasingly adopt telehealth services, the integration of artificial intelligence and machine learning will enhance diagnostic accuracy and patient engagement. Furthermore, the rising interest in mental health services is expected to catalyze the development of specialized virtual care platforms, ensuring comprehensive healthcare solutions that cater to diverse patient needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Remote Patient Monitoring Mobile Health Applications Virtual Mental Health Services AI-Enabled Diagnostics Digital Therapeutics Others |

| By End-User | Hospitals (Large, Mid-sized, Specialty) Clinics (Small, Specialty) Laboratories Telemedicine Providers Insurance Providers Home Care Providers Others |

| By Service Model | B2B Services B2C Services C2C Services Government Contracts Others |

| By Technology | Video Conferencing Mobile Applications Cloud Computing AI and Machine Learning IoT & Connected Devices Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Services Imaging & Diagnostics Administrative Workflow Assistance Others |

| By Payment Model | Subscription-Based Pay-Per-Use Insurance Reimbursement Licensing Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Development Data Residency Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 60 | CEOs, Product Managers, Technology Officers |

| Healthcare Institutions Utilizing Virtual Care | 50 | Hospital Administrators, IT Managers, Clinical Directors |

| Patients Engaged in Telehealth Services | 120 | Patients across various demographics, including age and health conditions |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Health Inspectors, Regulatory Analysts |

| Technology Developers in Virtual Care | 50 | Software Engineers, Product Developers, UX Designers |

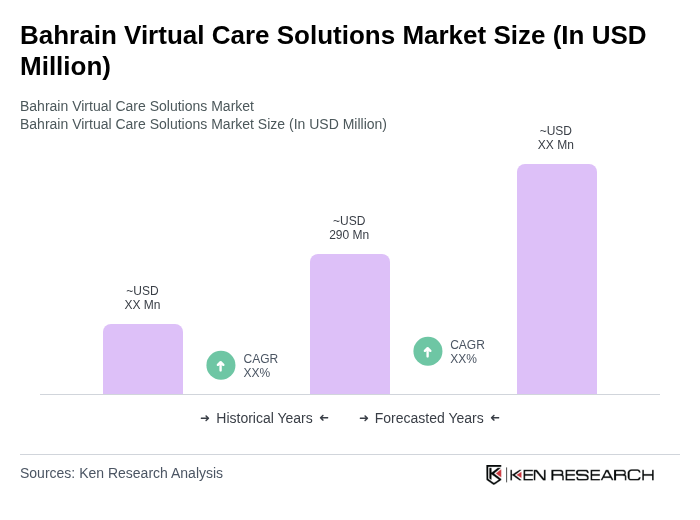

The Bahrain Virtual Care Solutions Market is valued at approximately USD 290 million, reflecting significant growth driven by the adoption of digital health technologies and the demand for remote healthcare services, particularly accelerated by the COVID-19 pandemic.