Region:Middle East

Author(s):Rebecca

Product Code:KRAC9700

Pages:93

Published On:November 2025

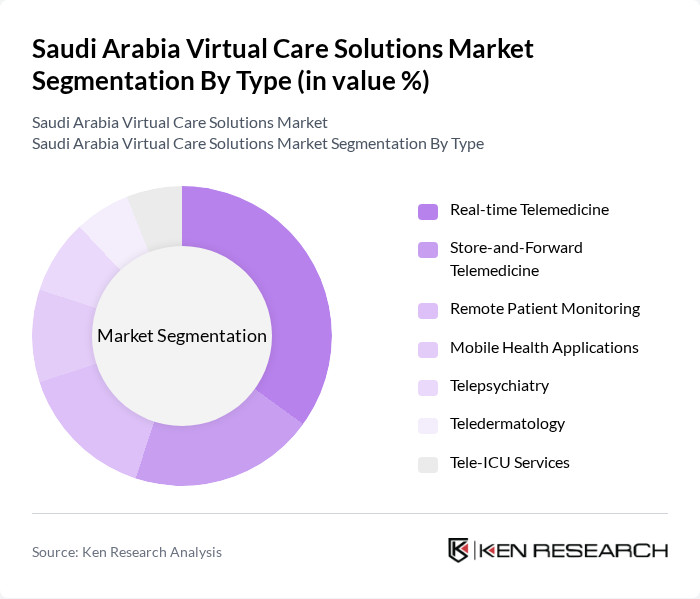

By Type:The market is segmented into various types of virtual care solutions, including Real-time Telemedicine, Store-and-Forward Telemedicine, Remote Patient Monitoring, Mobile Health Applications, Telepsychiatry, Teledermatology, and Tele-ICU Services. Among these, Real-time Telemedicine is the leading sub-segment, driven by the increasing demand for immediate medical consultations and the convenience of accessing healthcare services from home. The rise in smartphone usage and internet penetration has further facilitated the growth of this segment. Services such as virtual consultations, remote monitoring, and tele-ICU support represent the largest contributors to telehealth revenue, while software is emerging as the most dynamic segment, driven by demand for AI-powered diagnostics, electronic health records, and interoperable care platforms.

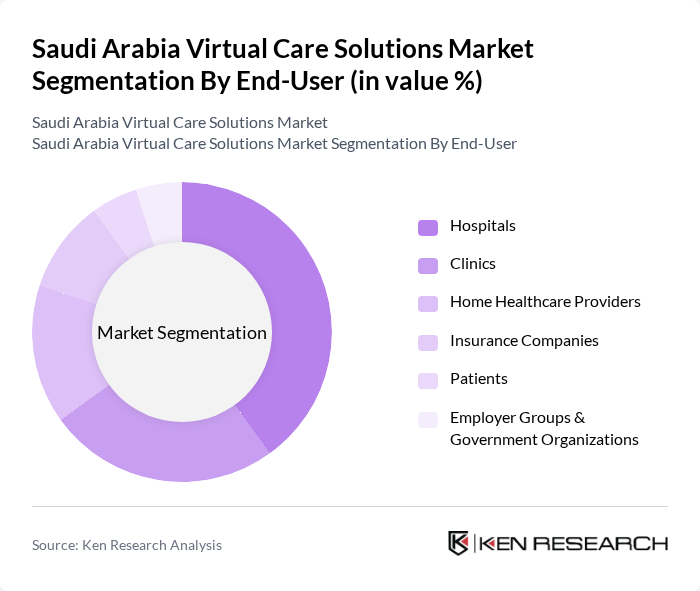

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare Providers, Insurance Companies, Patients, and Employer Groups & Government Organizations. Hospitals are the dominant end-user segment, as they increasingly adopt virtual care solutions to enhance patient management and reduce operational costs. The integration of telemedicine into hospital systems allows for better patient flow and improved healthcare delivery. The government's plans to privatize more than 290 hospitals and 2,300 healthcare facilities, raising private sector participation from 25% to 35% by 2030, is expected to further accelerate virtual care adoption across the healthcare ecosystem.

The Saudi Arabia Virtual Care Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Seha Virtual Hospital, DabaDoc, Vezeeta, Altibbi, Okadoc, Mawid, Meddy, Careem Health, Healthigo, Tibbiyah, Qaree, Doctor Anywhere contribute to innovation, geographic expansion, and service delivery in this space.

The future of the virtual care solutions market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer acceptance. As the government continues to invest in digital health infrastructure, the integration of AI and machine learning is expected to enhance service delivery. Additionally, the growing focus on mental health solutions will likely lead to the development of specialized telehealth platforms, catering to diverse patient needs and improving overall healthcare accessibility across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Real-time Telemedicine Store-and-Forward Telemedicine Remote Patient Monitoring Mobile Health Applications Telepsychiatry Teledermatology Tele-ICU Services |

| By End-User | Hospitals Clinics Home Healthcare Providers Insurance Companies Patients Employer Groups & Government Organizations |

| By Geographic Region | Northern and Central Region Western Region Eastern Region Southern Region |

| By Service Delivery Model | Synchronous (Real-time Consultations) Asynchronous (Store-and-forward) Hybrid Models Remote Monitoring Services |

| By Technology Platform | Video Conferencing Solutions Mobile Health Platforms Cloud-based Solutions AI-driven Telemedicine Solutions Electronic Health Records (EHR) Integration |

| By Payment Model | Subscription-based Services Pay-per-visit Model Insurance-covered Services Government-subsidized Programs |

| By Policy Support | Government Subsidies and Initiatives Tax Incentives for Providers Regulatory Support and Sandboxes Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 45 | Healthcare Administrators, Telehealth Coordinators |

| Patients Using Virtual Care | 120 | Patients, Caregivers, Health Insurance Holders |

| Healthcare Technology Developers | 35 | Product Managers, Software Engineers, UX Designers |

| Regulatory Bodies and Policymakers | 25 | Health Policy Analysts, Government Officials |

| Healthcare Consultants | 40 | Consultants, Market Analysts, Industry Experts |

The Saudi Arabia Virtual Care Solutions Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of digital health technologies and the need for improved access to medical services, particularly in remote areas.