Region:Middle East

Author(s):Rebecca

Product Code:KRAC8414

Pages:82

Published On:November 2025

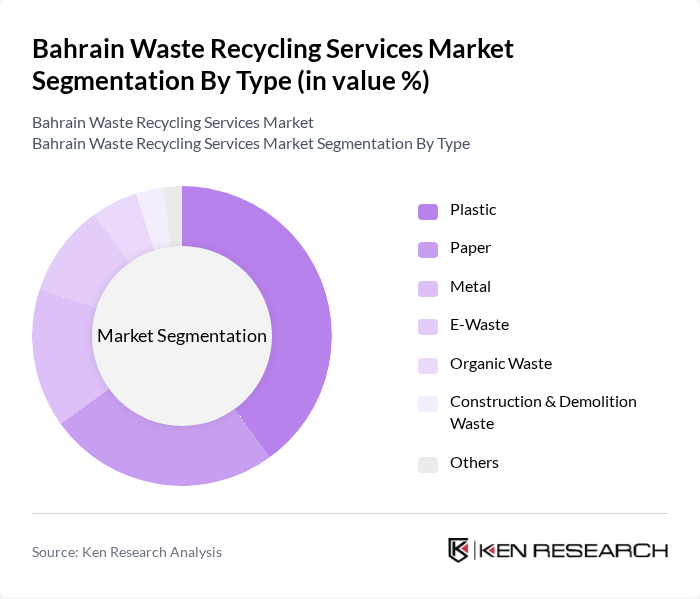

By Type:

The waste recycling services market is segmented by type into various categories, includingPlastic, Paper, Metal, E-Waste, Organic Waste, Construction & Demolition Waste, and Others. Among these,Plastic waste recyclingis currently the most dominant segment due to the increasing use of plastic products and the growing awareness of environmental issues related to plastic waste. The demand for recycled plastic is driven by consumer preferences for sustainable products and regulatory pressures to reduce plastic waste.Paper recyclingalso holds a significant share, supported by the ongoing shift towards digitalization and the need to manage packaging and office waste. Metal and E-Waste recycling are expanding, supported by industrial and electronics sector growth.

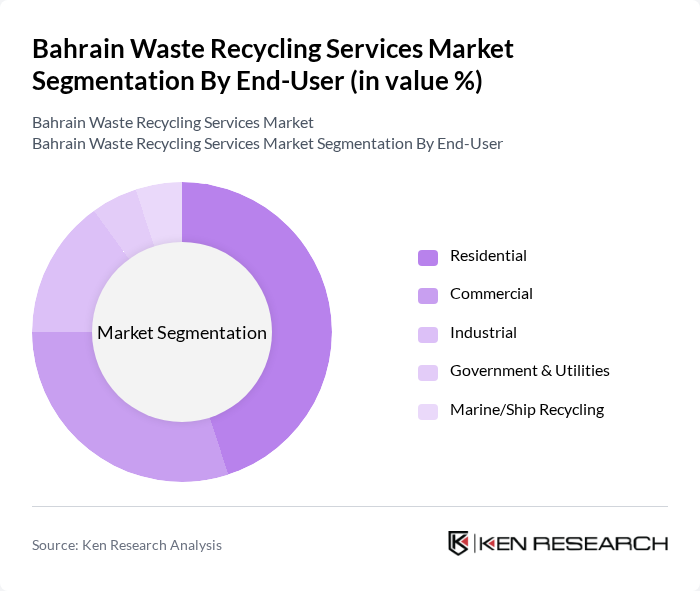

By End-User:

The end-user segmentation of the waste recycling services market includesResidential, Commercial, Industrial, Government & Utilities, and Marine/Ship Recycling. TheResidential segmentis the largest contributor, driven by increasing awareness of recycling practices among households and the implementation of municipal recycling programs. TheCommercial sectorfollows closely, as businesses are increasingly adopting sustainable practices and complying with regulations. TheIndustrial segmentis also significant, as industries generate substantial waste and are under pressure to recycle and manage waste effectively. Government & Utilities and Marine/Ship Recycling segments are supported by regulatory mandates and specialized waste streams.

The Bahrain Waste Recycling Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Recycling Plant, Gulf City Cleaning Company (GCCC), EnviroServe Bahrain, EcoWaste Bahrain, Green Wave Environmental Solutions, Recycling Consultancy W.L.L., Gulf Eco Recycling, Bahrain Waste Management Company, Alba (Aluminium Bahrain B.S.C.), Bahrain National Recycling Company, ASRY (Arab Shipbuilding & Repair Yard Company), Tamkeen Waste Management, EcoGreen Solutions, Waste Management Solutions, Bahrain Environmental Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain waste recycling services market appears promising, driven by increasing environmental awareness and government support. As public participation in recycling initiatives grows, the market is expected to see enhanced collaboration between public and private sectors. Additionally, technological advancements will likely streamline recycling processes, making them more efficient. With a focus on sustainable practices, Bahrain is poised to become a regional leader in waste management, fostering a circular economy that benefits both the environment and the economy.

| Segment | Sub-Segments |

|---|---|

| By Type (Plastic, Paper, Metal, E-Waste, Organic Waste, Construction & Demolition Waste, Others) | Plastic Paper Metal E-Waste Organic Waste Construction & Demolition Waste Others |

| By End-User (Residential, Commercial, Industrial, Government & Utilities, Marine/Ship Recycling) | Residential Commercial Industrial Government & Utilities Marine/Ship Recycling |

| By Collection Method (Curbside Collection, Drop-off Centers, Buy-back Centers, Industrial Collection, Shipyard Collection) | Curbside Collection Drop-off Centers Buy-back Centers Industrial Collection Shipyard Collection Others |

| By Processing Method (Mechanical Recycling, Chemical Recycling, Biological Recycling, Waste-to-Energy, Ship Dismantling) | Mechanical Recycling Chemical Recycling Biological Recycling Waste-to-Energy Ship Dismantling Others |

| By Material Recovery (Recyclable Materials, Non-Recyclable Materials) | Recyclable Materials Non-Recyclable Materials |

| By Geographic Coverage (Urban, Rural, Industrial Zones, Ports/Shipyards) | Urban Rural Industrial Zones Ports/Shipyards |

| By Policy Support (Subsidies, Tax Exemptions, Grants, PPP Initiatives) | Subsidies Tax Exemptions Grants PPP Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 100 | City Waste Managers, Environmental Officers |

| Commercial Recycling Services | 60 | Facility Managers, Sustainability Coordinators |

| Household Waste Recycling | 110 | Community Leaders, Local Residents |

| Industrial Waste Processing | 50 | Operations Managers, Compliance Officers |

| Plastic Waste Initiatives | 70 | Recycling Plant Managers, Policy Makers |

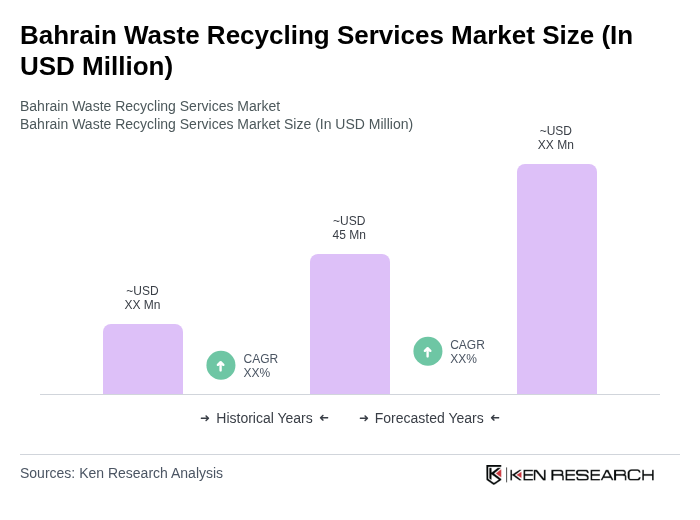

The Bahrain Waste Recycling Services Market is valued at approximately USD 45 million, reflecting a five-year historical analysis. This growth is driven by increased environmental awareness and government initiatives promoting recycling.