Region:Middle East

Author(s):Rebecca

Product Code:KRAC2523

Pages:97

Published On:October 2025

By Type:The waste recycling services market can be segmented into various types, including Paper & Paperboard Recycling, Plastic Recycling, Metal Recycling, Glass Recycling, Electronic Waste (E-Waste) Recycling, Organic/Food Waste Recycling, Construction & Demolition (C&D) Waste Recycling, Bulbs, Batteries & Electronics Recycling, and Other Products. Each of these subsegments plays a crucial role in the overall market dynamics, driven by specific consumer needs and regulatory frameworks. In 2024, Paper & Paperboard was the largest revenue-generating segment.

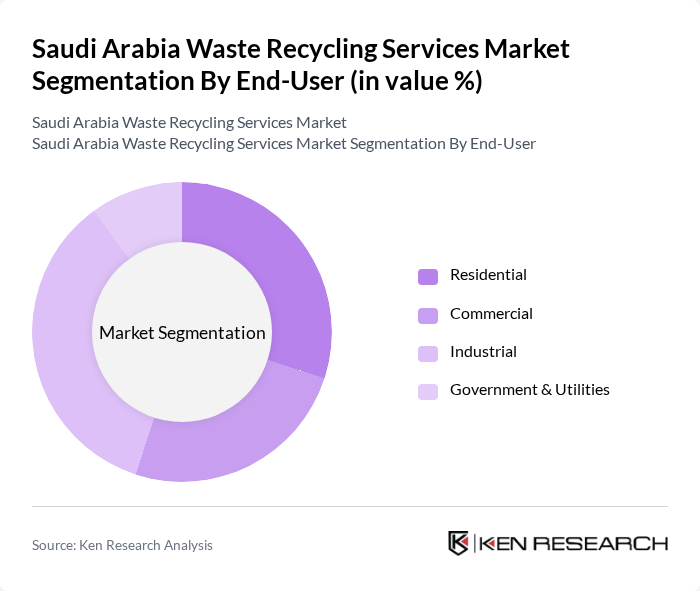

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. Each segment has distinct waste management needs and recycling practices, influenced by the volume and type of waste generated. The industrial sector, in particular, is a significant contributor to the recycling market due to its high waste output and regulatory compliance requirements.

The Saudi Arabia Waste Recycling Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Investment Recycling Company (SIRC), SEPCO Environment, Averda, Veolia Middle East, SUEZ Middle East Recycling, National Waste Management Center (NWMC), Tadweer Environmental Services, Green Planet Recycling, Al-Qaryan Group, Al-Muhaidib Group, Al-Babtain Contracting Company, Al-Suwaidi Industrial Services, Recyclean, Naqaa Solutions, WASCO (Waste Collection and Recycling Co. Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the waste recycling services market in Saudi Arabia appears promising, driven by increasing government support and public engagement. As urbanization accelerates, the demand for efficient waste management solutions will rise, prompting further investments in recycling technologies. Additionally, the integration of smart waste management systems is expected to enhance operational efficiency. In future, the market is likely to witness a significant transformation, with a focus on sustainable practices and innovative recycling methods becoming mainstream.

| Segment | Sub-Segments |

|---|---|

| By Type | Paper & Paperboard Recycling Plastic Recycling Metal Recycling Glass Recycling Electronic Waste (E-Waste) Recycling Organic/Food Waste Recycling Construction & Demolition (C&D) Waste Recycling Bulbs, Batteries & Electronics Recycling Other Products |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Waste-to-Energy Material Recovery Facilities Composting Landfill Diversion |

| By Collection Method | Curbside Collection Drop-off Centers Buy-back Centers |

| By Processing Method | Mechanical Recycling Chemical Recycling Biological Recycling |

| By Material Type | Ferrous Metals Non-Ferrous Metals Plastics Paper |

| By Policy Support | Subsidies Tax Exemptions Grants for Recycling Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 100 | City Waste Managers, Environmental Officers |

| Commercial Recycling Services | 60 | Facility Managers, Sustainability Managers |

| Construction and Demolition Waste | 50 | Project Managers, Site Supervisors |

| Plastic Waste Recycling | 40 | Recycling Plant Operators, Procurement Managers |

| Electronic Waste Management | 45 | IT Asset Managers, Compliance Officers |

The Saudi Arabia Waste Recycling Services Market is valued at approximately USD 1,160 million, reflecting a significant growth driven by increasing environmental awareness, government initiatives, and rising waste generation in urban areas.