Region:Middle East

Author(s):Shubham

Product Code:KRAA8897

Pages:93

Published On:November 2025

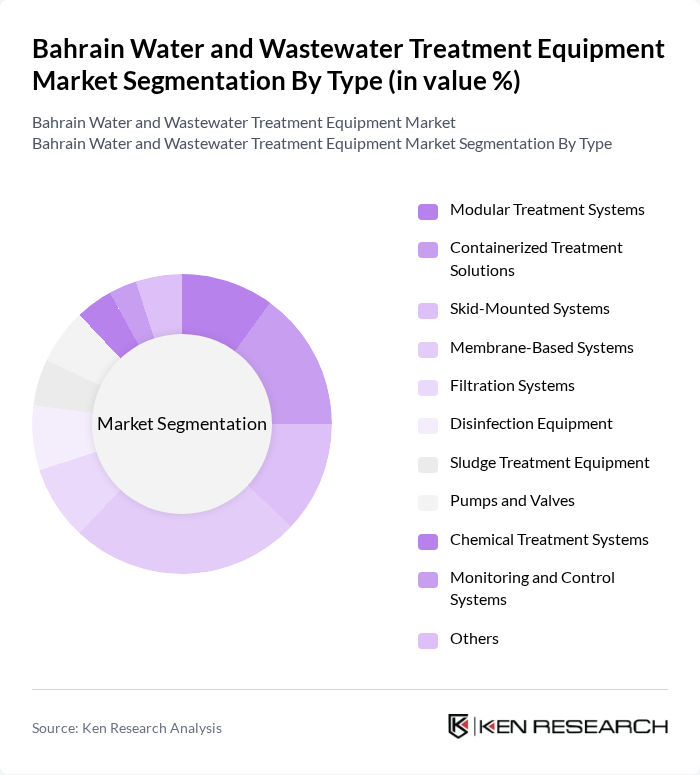

By Type:The market is segmented into various types of equipment used for water and wastewater treatment. The subsegments include Modular Treatment Systems, Containerized Treatment Solutions, Skid-Mounted Systems, Membrane-Based Systems, Filtration Systems, Disinfection Equipment, Sludge Treatment Equipment, Pumps and Valves, Chemical Treatment Systems, Monitoring and Control Systems, and Others. Among these, Membrane-Based Systems are currently dominating the market due to their efficiency in desalination and wastewater treatment processes, while Modular Treatment Systems are gaining traction for their flexibility and scalability in both residential and industrial applications .

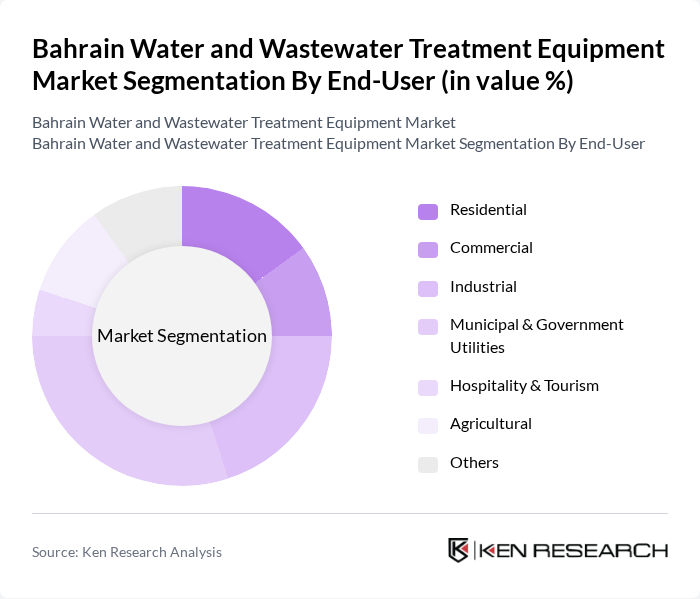

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Municipal & Government Utilities, Hospitality & Tourism, Agricultural, and Others. The Municipal & Government Utilities segment is leading the market, driven by the increasing need for efficient wastewater management and treatment solutions in urban areas. The Residential segment is also expanding rapidly due to new housing projects and heightened awareness of sustainable wastewater management among homeowners, while the Industrial segment is growing due to stricter discharge standards and the need for cost-effective treatment solutions .

The Bahrain Water and Wastewater Treatment Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Water Technologies, SUEZ Water Technologies & Solutions, Xylem Inc., Siemens AG (Water Technologies), Acciona Agua, Dow Water & Process Solutions (DuPont Water Solutions), Doosan Enerbility, Aquatech International, Toray Industries, Inc., IDE Technologies, Evoqua Water Technologies, H2O Innovation, Pentair plc, Kurita Water Industries Ltd., Metito (Overseas) Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain water and wastewater treatment equipment market is poised for significant transformation driven by technological advancements and increasing environmental awareness. As urbanization continues to rise, the demand for efficient treatment solutions will escalate, prompting investments in innovative technologies. Furthermore, the integration of smart water management systems is expected to enhance operational efficiency. These trends indicate a shift towards sustainable practices, positioning the market for growth as stakeholders prioritize resource conservation and environmental protection.

| Segment | Sub-Segments |

|---|---|

| By Type | Modular Treatment Systems Containerized Treatment Solutions Skid-Mounted Systems Membrane-Based Systems Filtration Systems Disinfection Equipment Sludge Treatment Equipment Pumps and Valves Chemical Treatment Systems Monitoring and Control Systems Others |

| By End-User | Residential Commercial Industrial Municipal & Government Utilities Hospitality & Tourism Agricultural Others |

| By Application | Municipal Wastewater Treatment Industrial Wastewater Treatment Desalination Pre-Treatment Drinking Water Treatment Reuse and Recycling Stormwater Management Others |

| By Technology | Reverse Osmosis Multi-Stage Flash (MSF) Distillation Multi-Effect Distillation (MED) Membrane Bioreactors Biological Treatment Chemical Treatment Physical Treatment Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies for Equipment Purchase Tax Exemptions for Green Technologies Regulatory Credits Grants for Research and Development Others |

| By Market Segment | Large Scale Projects Small Scale Projects Pilot Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Authorities | 45 | Water Resource Managers, Environmental Engineers |

| Wastewater Treatment Facilities | 38 | Facility Managers, Operations Supervisors |

| Private Sector Water Treatment Providers | 42 | Business Development Managers, Technical Directors |

| Regulatory Bodies | 18 | Policy Makers, Compliance Officers |

| Consultants in Water Management | 27 | Environmental Consultants, Project Managers |

The Bahrain Water and Wastewater Treatment Equipment Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by urbanization, environmental regulations, and the demand for sustainable water management solutions.