Region:Middle East

Author(s):Shubham

Product Code:KRAC2172

Pages:98

Published On:October 2025

Market.png)

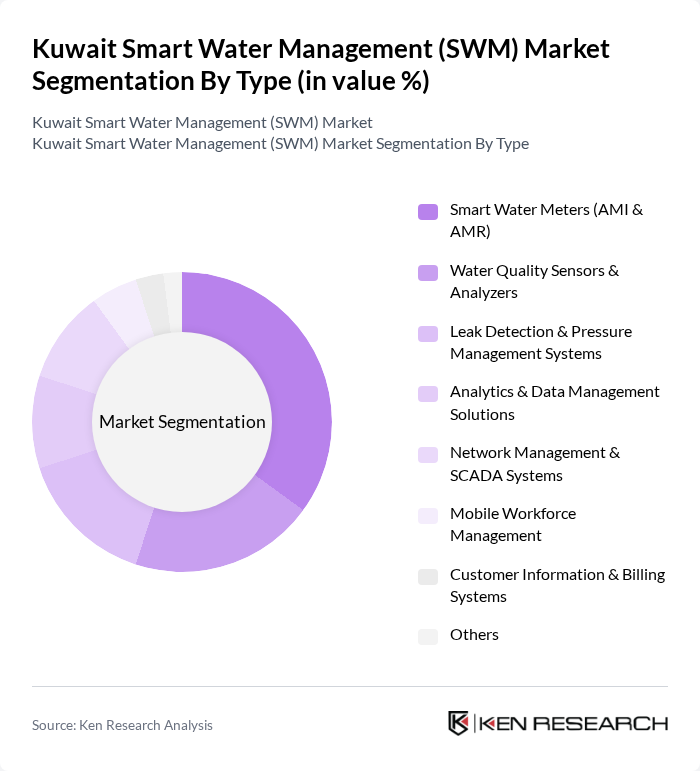

By Type:The Smart Water Management market can be segmented into various types, including Smart Water Meters (AMI & AMR), Water Quality Sensors & Analyzers, Leak Detection & Pressure Management Systems, Analytics & Data Management Solutions, Network Management & SCADA Systems, Mobile Workforce Management, Customer Information & Billing Systems, and Others. Among these, Smart Water Meters are leading the market due to their ability to provide real-time data and enhance billing accuracy, which is crucial for both consumers and utility providers.

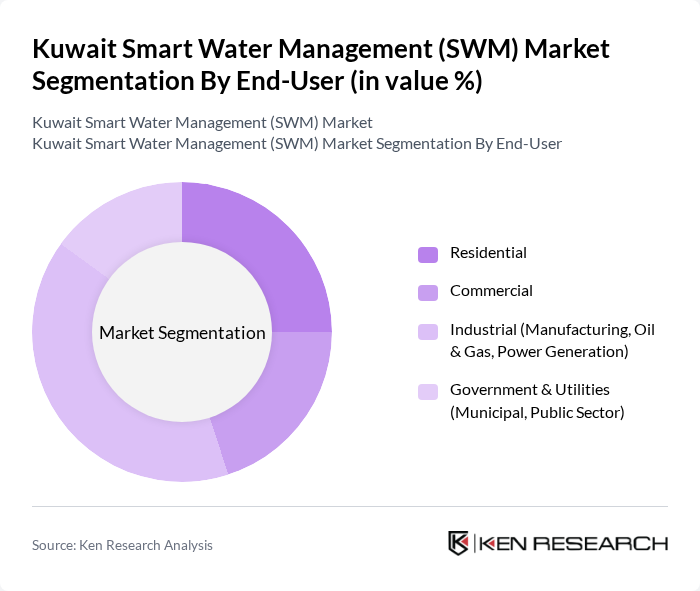

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial (Manufacturing, Oil & Gas, Power Generation), and Government & Utilities (Municipal, Public Sector). The Industrial segment is currently dominating the market due to the high water consumption rates in manufacturing and oil & gas sectors, which necessitate advanced water management solutions to optimize usage and reduce costs.

The Kuwait Smart Water Management market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Water Technologies, SUEZ Water Technologies & Solutions, Xylem Inc., Siemens AG, ABB Ltd., Honeywell International Inc., Schneider Electric SE, Itron, Inc., Trimble Inc., Aqualia, AquaVenture Holdings, IDE Technologies, Black & Veatch, Ecolab Inc., Aquatech International, Kuwait Integrated Petroleum Industries Company (KIPIC), Kuwait National Petroleum Company (KNPC), Kuwait Institute for Scientific Research (KISR), Alghanim International, Gulf Engineering Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Smart Water Management market appears promising, driven by increasing governmental support and technological advancements. In future, the integration of IoT and AI technologies is expected to enhance operational efficiencies significantly. Additionally, rising public awareness regarding water conservation will likely lead to greater adoption of smart solutions. As the government continues to invest in infrastructure, the market is poised for growth, fostering innovation and sustainability in water management practices across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Water Meters (AMI & AMR) Water Quality Sensors & Analyzers Leak Detection & Pressure Management Systems Analytics & Data Management Solutions Network Management & SCADA Systems Mobile Workforce Management Customer Information & Billing Systems Others |

| By End-User | Residential Commercial Industrial (Manufacturing, Oil & Gas, Power Generation) Government & Utilities (Municipal, Public Sector) |

| By Application | Water Distribution Management Wastewater & Sewage Management Irrigation & Agricultural Water Management Desalination Plant Monitoring Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Management | 100 | Water Utility Managers, City Planners |

| Smart Water Technology Providers | 60 | Product Managers, Technology Developers |

| Environmental Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Academic Institutions Researching Water Management | 40 | Researchers, Professors in Environmental Science |

| Private Sector Water Consumers | 70 | Facility Managers, Sustainability Officers |

The Kuwait Smart Water Management market is valued at approximately USD 420 million, driven by urbanization, efficient water resource management needs, and government initiatives focused on enhancing water sustainability.