Region:Middle East

Author(s):Dev

Product Code:KRAD7743

Pages:83

Published On:December 2025

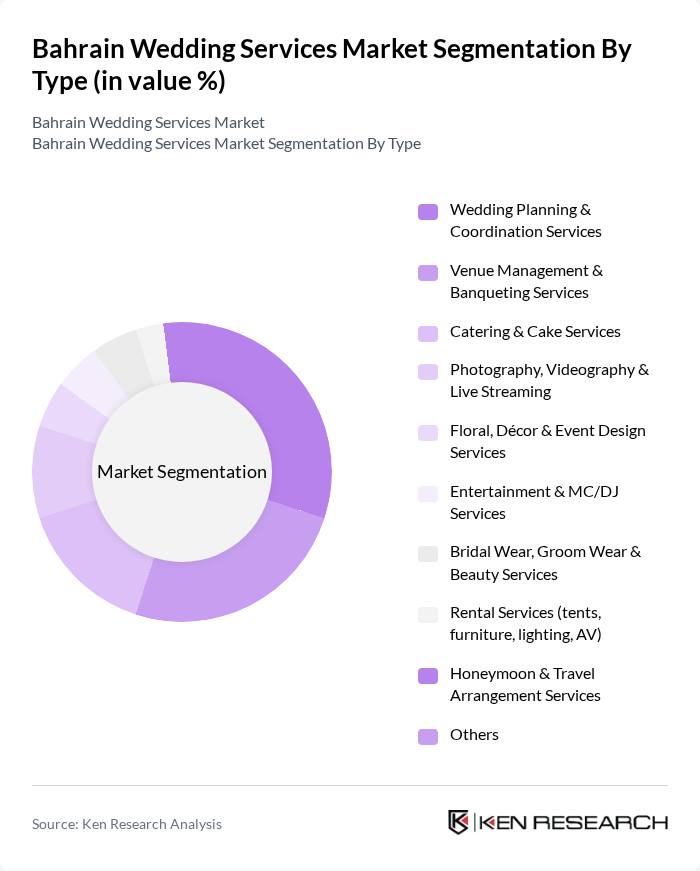

By Type:The market is segmented into various types of services that cater to different aspects of wedding planning and execution. The primary subsegments include Wedding Planning & Coordination Services, Venue Management & Banqueting Services, Catering & Cake Services, Photography, Videography & Live Streaming, Floral, Décor & Event Design Services, Entertainment & MC/DJ Services, Bridal Wear, Groom Wear & Beauty Services, Rental Services (tents, furniture, lighting, AV), Honeymoon & Travel Arrangement Services, and Others. Among these, Wedding Planning & Coordination Services is the leading subsegment, supported by the rising complexity of multi?day wedding events, demand for end?to?end professional management, and strong preference among affluent Bahraini and expatriate households for customized, theme?based celebrations. Venue Management & Banqueting and Catering & Cake Services also account for a substantial share, reflecting the importance of luxury hotel ballrooms, beach resorts, and high?quality culinary offerings in GCC wedding culture.

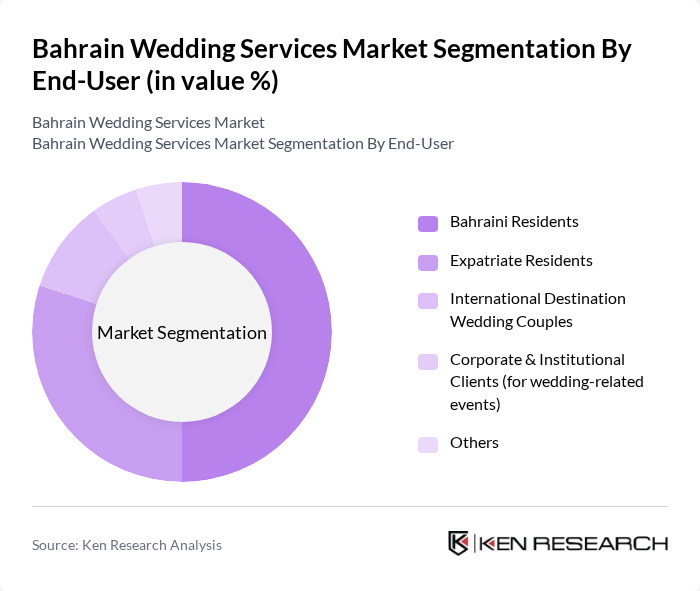

By End-User:The end-user segmentation includes Bahraini Residents, Expatriate Residents, International Destination Wedding Couples, Corporate & Institutional Clients (for wedding-related events), and Others. The Bahraini Residents segment dominates the market, as local couples typically host large, multi?guest ceremonies that reflect cultural values and customs, with high spending on venues, attire, catering, and décor. Expatriate Residents, especially from other GCC and Asian markets, also represent a sizeable share, leveraging Bahrain’s luxury hotels and convenient connectivity for family?oriented weddings, while a smaller but growing share comes from international destination wedding couples attracted by Bahrain’s waterfront properties and integrated resort offerings.

The Bahrain Wedding Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain International Exhibition & Convention Centre (BIECC), The Ritz-Carlton, Bahrain, Four Seasons Hotel Bahrain Bay, The Gulf Hotel Bahrain, Convention & Spa, Sofitel Bahrain Zallaq Thalassa Sea & Spa, Wyndham Grand Manama, Bahrain Wedding Services by Alreem Events, Mashmoom Events & Weddings, Divine Events Bahrain, Elite Events Bahrain, Tarteb Weddings & Events, LalaBella Events Bahrain, Gulf Marquee & Tent Rentals, Flowers Bahrain (Floral & Wedding Décor), Moonlight Photography & Video Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain wedding services market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As disposable incomes rise, couples are increasingly willing to invest in unique and personalized experiences. Additionally, the integration of technology in planning and executing weddings is expected to streamline processes and enhance customer engagement. However, service providers must navigate challenges such as competition and economic fluctuations to capitalize on these trends effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Wedding Planning & Coordination Services Venue Management & Banqueting Services Catering & Cake Services Photography, Videography & Live Streaming Floral, Décor & Event Design Services Entertainment & MC/DJ Services Bridal Wear, Groom Wear & Beauty Services Rental Services (tents, furniture, lighting, AV) Honeymoon & Travel Arrangement Services Others |

| By End-User | Bahraini Residents Expatriate Residents International Destination Wedding Couples Corporate & Institutional Clients (for wedding-related events) Others |

| By Venue Type | Hotel Ballrooms & Banquet Halls Dedicated Wedding & Event Halls Beachfront & Outdoor Garden Venues Royal Mansions, Private Villas & Majlis Venues Destination & Resort Venues Others |

| By Service Package | Full-Service Wedding Planning Packages Partial Planning & Day-of Coordination Décor-Only / Single-Service Contracts Digital / Virtual Planning & Consultation Packages Others |

| By Budget Range | Below BHD 5,000 BHD 5,000 – 10,000 BHD 10,000 – 25,000 BHD 25,000 – 50,000 Above BHD 50,000 Others |

| By Seasonality | Winter & Early Spring Season (Nov–Mar) Summer & Late Spring Season (Apr–Sep) Religious & Festive Periods (incl. post-Ramadan, Eid, Muharram) Others |

| By Customer Demographics | Age Group Nationality (Bahraini vs Expatriate) Income Bracket Cultural & Religious Background Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wedding Planners | 100 | Event Coordinators, Wedding Consultants |

| Catering Services | 80 | Catering Managers, Chefs |

| Photography and Videography | 70 | Photographers, Videographers |

| Venue Providers | 60 | Venue Managers, Event Space Owners |

| Floral and Decoration Services | 50 | Florists, Decorators |

The Bahrain Wedding Services Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by increasing disposable income, rising wedding expenditures, and a trend towards personalized and experiential celebrations.