Region:Middle East

Author(s):Rebecca

Product Code:KRAC3300

Pages:91

Published On:October 2025

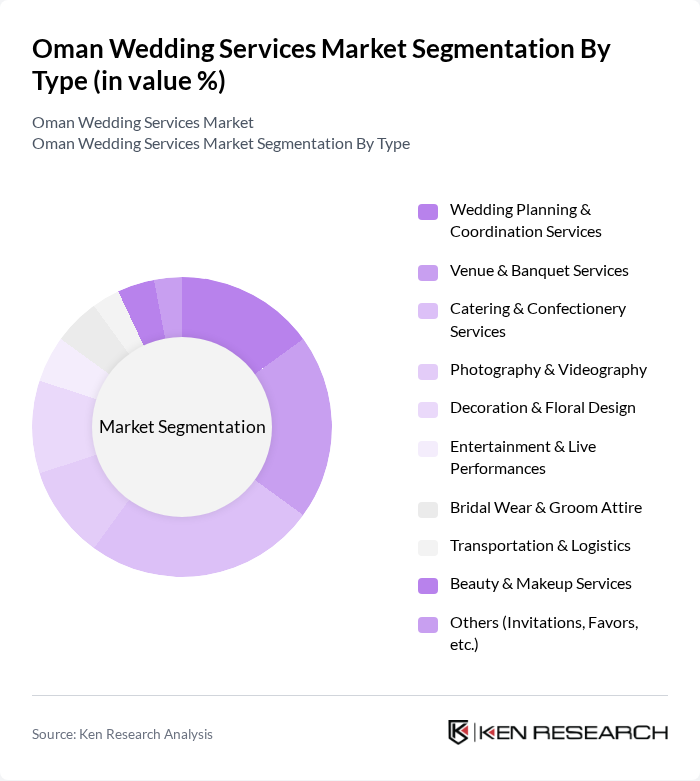

By Type:The market is segmented into various types of services that cater to the diverse needs of couples planning their weddings. The key subsegments include Wedding Planning & Coordination Services, Venue & Banquet Services, Catering & Confectionery Services, Photography & Videography, Decoration & Floral Design, Entertainment & Live Performances, Bridal Wear & Groom Attire, Transportation & Logistics, Beauty & Makeup Services, and Others (Invitations, Favors, etc.).

The Catering & Confectionery Services subsegment leads the market, reflecting the cultural emphasis on food during weddings, where elaborate feasts are a hallmark of Omani celebrations. Couples increasingly opt for customized catering options that reflect their tastes and preferences, driving demand for diverse culinary offerings. The market is further supported by a growing number of catering companies specializing in both traditional and modern cuisines, making this subsegment a key driver of wedding service growth .

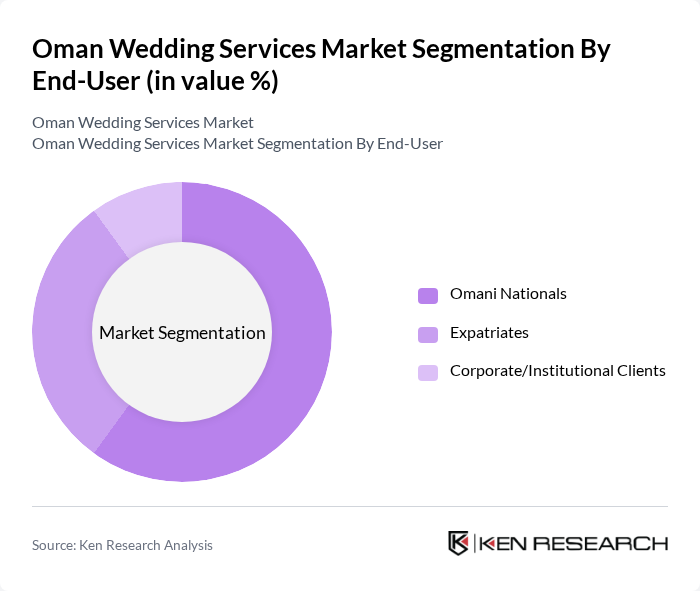

By End-User:The market is segmented based on the end-users, which include Omani Nationals, Expatriates, and Corporate/Institutional Clients. Each segment has unique preferences and requirements, influencing the types of services they seek for their wedding events.

The Omani Nationals segment is the largest, driven by cultural traditions that emphasize grand wedding celebrations. This demographic invests significantly in wedding services, seeking a blend of traditional and modern elements. Expatriates also contribute to market growth, often seeking customized services that reflect diverse cultural backgrounds. Corporate clients, though a smaller segment, are increasingly organizing events that require wedding services, further diversifying the market .

The Oman Wedding Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ahlam Wedding Services, Oman Wedding Planners, Muscat Wedding Services, Al Noor Events, Royal Weddings Oman, Elegant Weddings Oman, Oman Event Management, Dream Weddings Oman, Al Muna Events, Majestic Weddings, Oman Bridal Services, Golden Moments Weddings, Blissful Weddings Oman, Unique Weddings Oman, Oman Luxury Weddings, The Chedi Muscat (Hotel & Wedding Venue), Shangri-La Barr Al Jissah Resort & Spa, InterContinental Muscat, Grand Hyatt Muscat, Crowne Plaza Muscat contribute to innovation, geographic expansion, and service delivery in this space.

The Oman wedding services market is poised for growth, driven by increasing disposable incomes and a cultural emphasis on elaborate celebrations. As technology continues to influence planning processes, service providers are expected to adopt innovative solutions to enhance customer experiences. Additionally, the trend towards intimate weddings may reshape service offerings, allowing for more personalized and unique experiences. Overall, the market is likely to adapt to evolving consumer preferences while maintaining its cultural significance.

| Segment | Sub-Segments |

|---|---|

| By Type | Wedding Planning & Coordination Services Venue & Banquet Services Catering & Confectionery Services Photography & Videography Decoration & Floral Design Entertainment & Live Performances Bridal Wear & Groom Attire Transportation & Logistics Beauty & Makeup Services Others (Invitations, Favors, etc.) |

| By End-User | Omani Nationals Expatriates Corporate/Institutional Clients |

| By Service Package | Full-Service Wedding Packages Partial/Custom Packages A La Carte Services |

| By Budget Range | Luxury Weddings Mid-Range Weddings Budget Weddings |

| By Venue Type | Hotels & Resorts Wedding Halls Outdoor/Beach Venues Private Residences |

| By Geographic Location | Muscat Salalah Sohar Nizwa Other Regions |

| By Customer Demographics | Age Group Cultural Background Income Level |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wedding Planning Services | 100 | Wedding Planners, Event Coordinators |

| Catering Services | 70 | Caterers, Food Service Managers |

| Photography and Videography | 60 | Photographers, Videographers |

| Venue Management | 50 | Venue Managers, Event Space Owners |

| Floral and Decoration Services | 40 | Florists, Decorators |

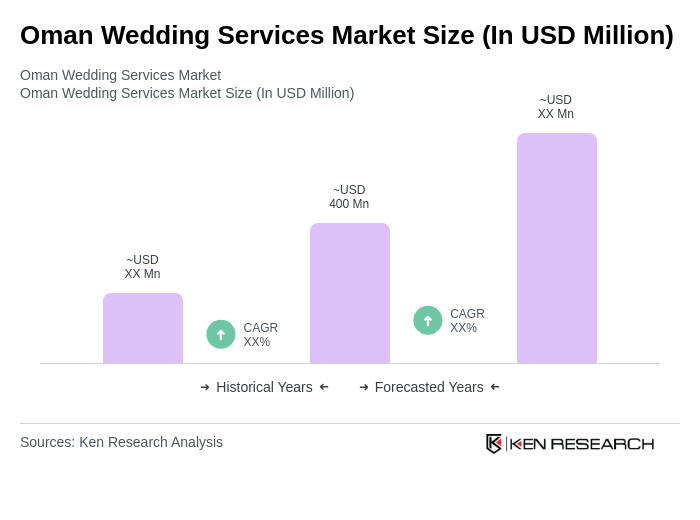

The Oman Wedding Services Market is valued at approximately USD 400 million, driven by an increase in weddings, cultural significance, and rising disposable incomes among both Omani nationals and expatriates.