Region:Asia

Author(s):Dev

Product Code:KRAC0356

Pages:100

Published On:August 2025

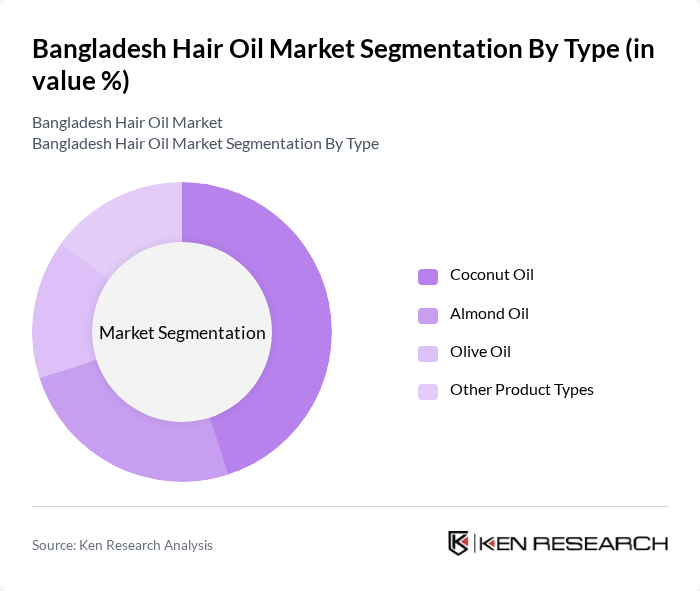

By Type:The hair oil market can be segmented into various types, includingCoconut Oil, Almond Oil, Olive Oil, and Other Product Types. Among these, Coconut Oil is the most dominant segment due to its traditional use in Bangladeshi households and its perceived health benefits for hair. The increasing trend of using natural oils has also bolstered the demand for Coconut Oil, making it a staple in many households. Almond Oil and Olive Oil are gaining traction, particularly among health-conscious consumers, but Coconut Oil remains the leader in this segment .

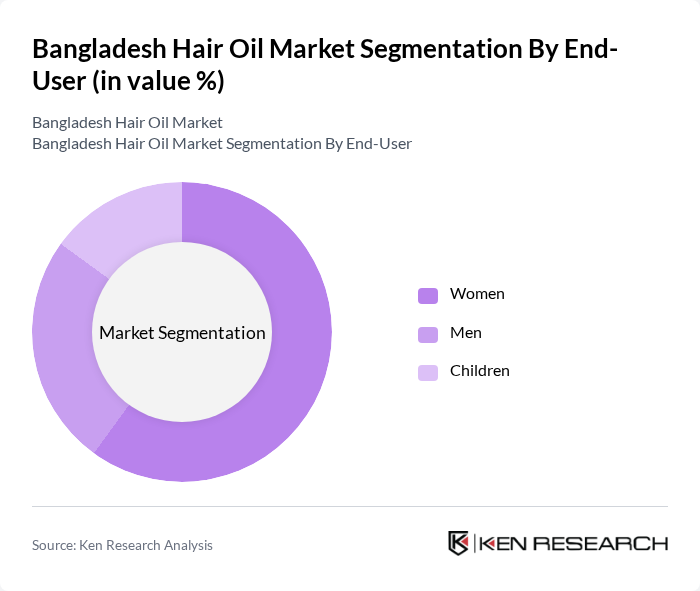

By End-User:The market can also be segmented based on end-users, which includeWomen, Men, and Children. Women represent the largest segment, driven by their higher spending on personal care products and a growing interest in hair health. The increasing awareness of hair care among men is also contributing to the growth of the men's segment, while the children's segment is primarily driven by parents' concerns for their children's hair health. Overall, the women's segment remains the most significant contributor to market growth .

The Bangladesh Hair Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever Bangladesh Limited, Marico Bangladesh Limited, Square Toiletries Limited, ACI Limited, Parachute (Marico), Dabur Bangladesh Limited, Kazi Farms Group, ACI Godrej Agrovet Pvt. Ltd., SQUARE Group, Kesh King (Emami Bangladesh), Herbal Essences (Procter & Gamble Bangladesh), Biotique Bangladesh, Keya Cosmetics Ltd., Kohinoor Chemical Company (Bangladesh) Ltd., Tibet (Square Toiletries) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bangladesh hair oil market appears promising, driven by evolving consumer preferences and increasing health consciousness. As the demand for natural and organic products continues to rise, brands that innovate with eco-friendly formulations and sustainable practices are likely to thrive. Additionally, the integration of technology in marketing and distribution will enhance consumer engagement, making personalized hair care solutions more accessible. This dynamic environment presents opportunities for growth and differentiation in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Coconut Oil Almond Oil Olive Oil Other Product Types |

| By End-User | Women Men Children |

| By Distribution Channel | Hypermarkets/Supermarkets Convenience Stores Online Retail Stores Other Distribution Channels |

| By Price Range | Low Price Mid Price Premium Price |

| By Packaging Type | Bottles Jars Pouches |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers |

| By Product Formulation | Natural Synthetic Mixed |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Hair Oil Sales | 100 | Store Managers, Retail Buyers |

| Consumer Preferences in Hair Care | 120 | End Consumers, Beauty Enthusiasts |

| Distribution Channel Insights | 80 | Distributors, Wholesalers |

| Salon Product Usage | 60 | Salon Owners, Hair Stylists |

| Market Trends and Innovations | 50 | Product Development Managers, Brand Strategists |

The Bangladesh Hair Oil Market is valued at approximately USD 280 million, reflecting a significant growth trend driven by increasing consumer awareness about hair care and a shift towards premium and herbal products.