India Hair Oil Market Overview

- The India Hair Oil Market is valued at approximately USD 1.8 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding hair care, the rising popularity of natural and organic products, and the influence of social media on beauty trends. The market has seen a significant shift towards premium and value-added products, catering to diverse consumer needs. Urban and tier-2 cities are witnessing heightened demand for Ayurvedic and herbal hair oils, as consumers seek chemical-free solutions and holistic wellness benefits. Additionally, the expansion of e-commerce and omnichannel retail has enabled brands to reach wider audiences and innovate with new product formats and ingredients .

- Key players in this market include major cities like Mumbai, Delhi, and Bengaluru, which dominate due to their large urban populations and higher disposable incomes. These cities serve as hubs for beauty and personal care products, with a concentration of retail outlets and e-commerce platforms that facilitate easy access to a wide range of hair oil products. Urban shoppers, especially millennials and Gen Z, favor lightweight, non-greasy, and multi-functional oils, contributing to the market’s evolution .

- The Drugs and Cosmetics Rules, 1945 (as amended by the Ministry of Health & Family Welfare, Government of India) regulate the use of herbal and Ayurvedic ingredients in personal care products, including hair oils. These rules mandate ingredient disclosure, safety assessment, and compliance with Ayurvedic standards for manufacturers, thereby supporting the market for natural hair care solutions and enhancing consumer safety .

India Hair Oil Market Segmentation

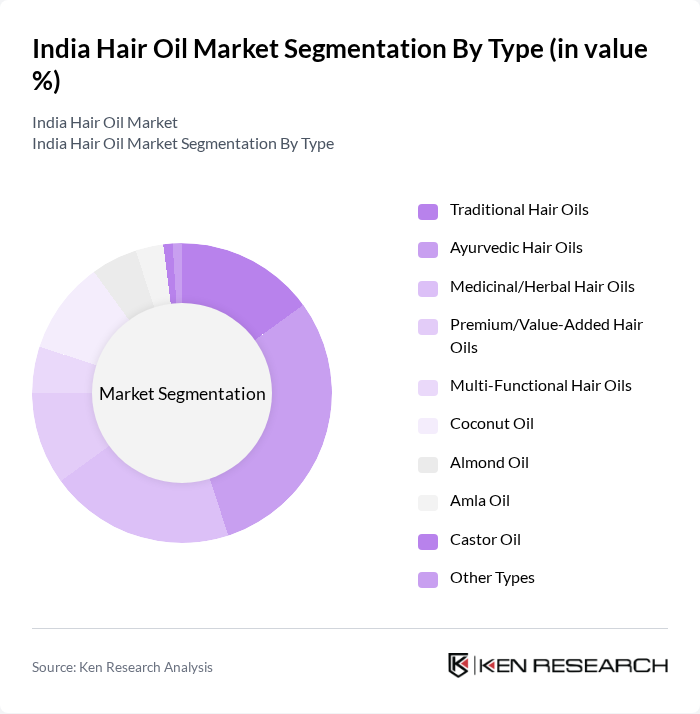

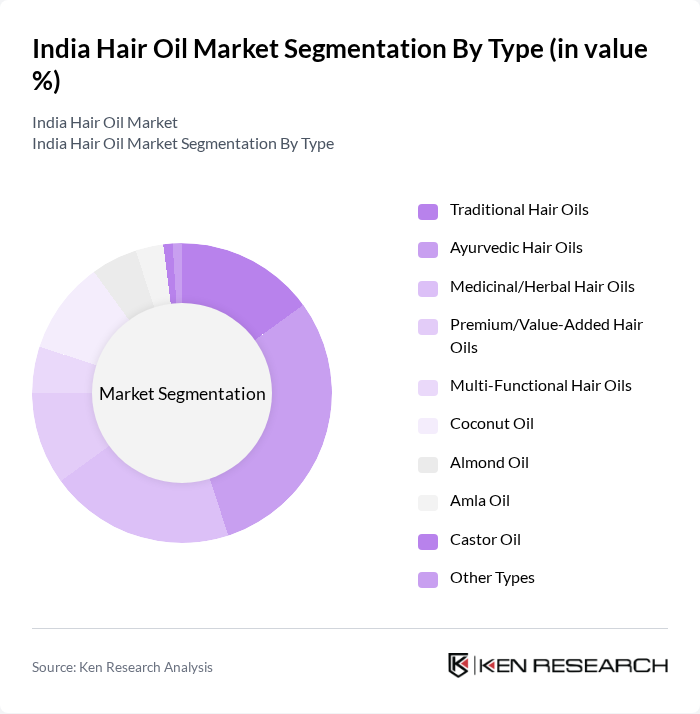

By Type:The market is segmented into various types of hair oils, including Traditional Hair Oils, Ayurvedic Hair Oils, Medicinal/Herbal Hair Oils, Premium/Value-Added Hair Oils, Multi-Functional Hair Oils, Coconut Oil, Almond Oil, Amla Oil, Castor Oil, and Other Types. Among these, Ayurvedic Hair Oils are gaining significant traction due to the increasing preference for natural and holistic beauty solutions. Consumers are increasingly inclined towards products that promise health benefits and are derived from traditional practices. The demand for coconut oil remains strong, especially in South India, while new product launches focus on blends with amla, bhringraj, argan, and almond oils to address specific hair concerns such as hair fall, scalp nourishment, and stress relief .

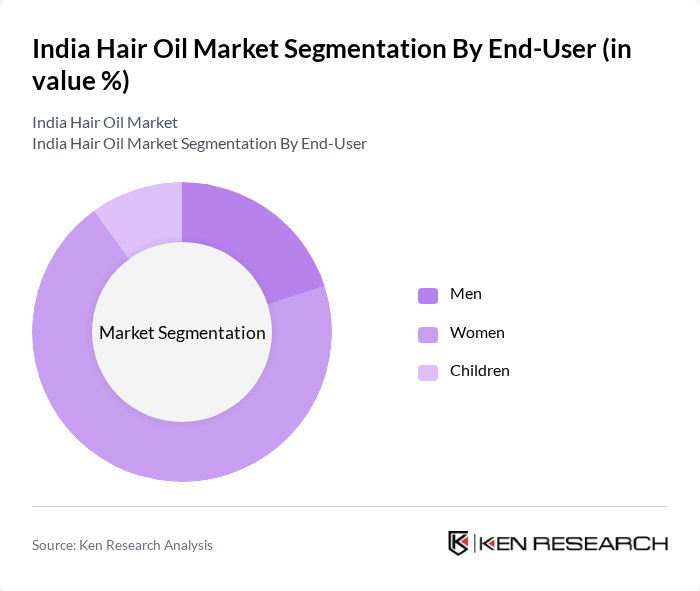

By End-User:The end-user segmentation includes Men, Women, and Children. Women represent the largest consumer base in the hair oil market, driven by their diverse hair care needs and preferences for various formulations. The increasing focus on hair health and beauty among women has led to a surge in demand for specialized products tailored to their specific requirements. Men are increasingly adopting hair oils for scalp nourishment and styling, while products for children emphasize gentle, natural ingredients .

India Hair Oil Market Competitive Landscape

The India Hair Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hindustan Unilever Limited, Dabur India Limited, Marico Limited, Godrej Consumer Products Limited, Emami Limited, Parachute (Marico), Biotique, Patanjali Ayurved Limited, Khadi Natural, Bajaj Consumer Care Limited, L'Oréal India, Procter & Gamble Hygiene and Health Care Limited, Revlon India, The Himalaya Wellness Company, WOW Skin Science contribute to innovation, geographic expansion, and service delivery in this space.

India Hair Oil Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness about Hair Care:The Indian hair oil market is witnessing a surge in consumer awareness regarding hair care, driven by the proliferation of information through social media and beauty blogs. In future, the hair care segment is projected to reach ?1,400 billion, with hair oils constituting a significant portion. This heightened awareness has led to a 30% increase in demand for specialized hair oils, particularly those targeting specific concerns like hair fall and dryness, reflecting a shift towards informed purchasing decisions.

- Rising Disposable Incomes:With India's GDP projected to grow by 6.5% in future, rising disposable incomes are significantly impacting consumer spending on personal care products. The average household income is expected to increase by ?60,000, allowing consumers to allocate more funds towards premium hair care products. This trend is evident as the premium segment of hair oils has seen a 25% growth, indicating that consumers are willing to invest in higher-quality products that promise better results.

- Growth of E-commerce Platforms:The expansion of e-commerce platforms has revolutionized the distribution of hair oils in India. In future, online sales are expected to account for 40% of total hair oil sales, driven by increased internet penetration, which reached 800 million users. This shift allows brands to reach a broader audience, particularly in tier-2 and tier-3 cities, where traditional retail presence is limited. The convenience of online shopping has led to a 40% increase in online hair oil purchases, enhancing market accessibility.

Market Challenges

- Intense Competition among Brands:The Indian hair oil market is characterized by fierce competition, with over 100 brands vying for market share. This saturation has led to aggressive pricing strategies, resulting in a 15% decline in average selling prices over the past year. Established brands face challenges from emerging players offering innovative products, making it difficult to maintain market position. The competitive landscape necessitates continuous innovation and marketing efforts to attract and retain consumers.

- Fluctuating Raw Material Prices:The hair oil industry is significantly affected by the volatility of raw material prices, particularly for key ingredients like coconut and almond oil. In future, the price of coconut oil is projected to rise by 20% due to supply chain disruptions and climatic factors. This fluctuation poses a challenge for manufacturers, as it impacts production costs and profit margins. Companies must navigate these challenges by optimizing supply chains and exploring alternative sourcing strategies to mitigate risks.

India Hair Oil Market Future Outlook

The future of the India hair oil market appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly seek personalized and effective hair care solutions, brands are likely to invest in research and development to create innovative products. Additionally, the trend towards sustainability will push companies to adopt eco-friendly practices, including biodegradable packaging. The integration of digital marketing strategies will further enhance brand visibility, allowing companies to engage with consumers more effectively and adapt to changing market dynamics.

Market Opportunities

- Growth in Organic and Natural Hair Oils:The demand for organic and natural hair oils is on the rise, with the segment expected to grow by 30% in future. Consumers are increasingly prioritizing products free from harmful chemicals, leading brands to innovate and expand their organic offerings. This trend presents a lucrative opportunity for companies to capture a health-conscious demographic seeking safer alternatives for hair care.

- Expansion into Rural Markets:Rural markets in India present significant growth potential, with over 65% of the population residing in these areas. As rural incomes rise, the demand for hair care products is expected to increase. Companies can leverage this opportunity by tailoring marketing strategies to local preferences and establishing distribution networks that cater to these underserved markets, potentially increasing their market share significantly.