Region:Asia

Author(s):Dev

Product Code:KRAD0437

Pages:89

Published On:August 2025

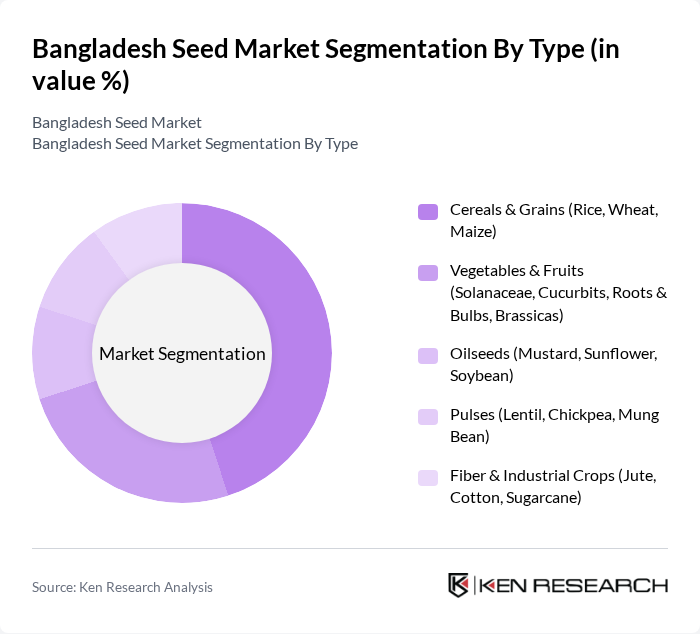

By Type:The seed market can be segmented into various types, including cereals & grains, vegetables & fruits, oilseeds, pulses, and fiber & industrial crops. Among these, cereals & grains—particularly rice—dominate due to rice’s staple status and continual replacement demand for improved and hybrid varieties; vegetables are a fast-growing segment driven by higher margins, intensive cultivation, and year-round peri-urban demand. The increasing population and urbanization have supported demand for rice, maize, and diversified vegetables, encouraging investment in breeding and quality seed systems.

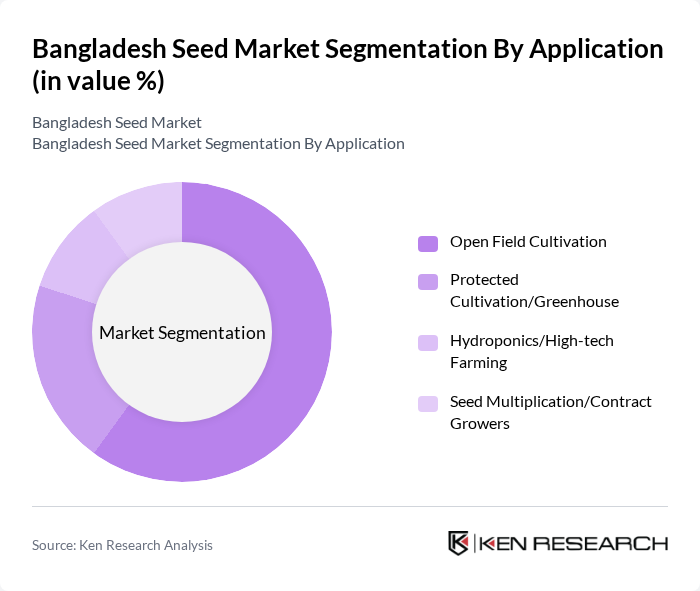

By Application:The seed market is also segmented by application, which includes open field cultivation, protected cultivation/greenhouse, hydroponics/high-tech farming, and seed multiplication/contract growers. Open field cultivation is the most prevalent method, as it aligns with traditional farming practices and is suitable for a wide range of crops, particularly in rural areas where most farming occurs.

The Bangladesh Seed Market is characterized by a dynamic mix of regional and international players. Leading participants such as BRAC Seed & Agro (BRAC), ACI Seed (ACI Agribusiness), Lal Teer Seed Limited (Multimode Group), Bayer Crop Science (Bangladesh), Syngenta Bangladesh Limited, East-West Seed (Bangladesh), Advanta Seeds (UPL Group) – Bangladesh, Supreme Seed Company Limited, Getco Agro Vision Ltd., Ispahani Agro Limited, Metal Agro Limited (Kazi Farms Group – Contract/Distribution for seeds), Haji Seeds (Haji Seed Company), Krishibid Seed Limited (KSL), Benipro Agro (Benimashito/Benipro Seeds Bangladesh), Bangladesh Agricultural Development Corporation (BADC) – Seed Wing contribute to innovation, geographic expansion, and service delivery in this space.

The Bangladesh seed market is poised for significant transformation, driven by increasing agricultural demands and technological innovations. As farmers increasingly adopt sustainable practices, the focus on climate-resilient seed varieties will intensify. Furthermore, the integration of e-commerce platforms for seed distribution is expected to enhance accessibility for farmers, particularly in rural areas. These trends indicate a dynamic market landscape, with opportunities for growth and development in the coming years, fostering a more resilient agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereals & Grains (Rice, Wheat, Maize) Vegetables & Fruits (Solanaceae, Cucurbits, Roots & Bulbs, Brassicas) Oilseeds (Mustard, Sunflower, Soybean) Pulses (Lentil, Chickpea, Mung Bean) Fiber & Industrial Crops (Jute, Cotton, Sugarcane) |

| By Application | Open Field Cultivation Protected Cultivation/Greenhouse Hydroponics/High-tech Farming Seed Multiplication/Contract Growers |

| By End-User | Smallholder Farmers Commercial Farms & Agribusinesses Government & Public Agencies (BADC, DAE, Research Institutes) NGOs & Development Programs/Projects |

| By Distribution Channel | Company Direct & Field Sales Force Agri-Dealers & Retail Outlets E-commerce/Online Platforms Government Schemes & Subsidy Channels |

| By Region | Dhaka Chattogram (Chittagong) Khulna Rajshahi & Rangpur Sylhet, Barishal & Mymensingh |

| By Price Range | Value/Low Price Mid Price Premium/High Price |

| By Certification Type | Certified Seeds Truthfully Labeled (TFL) / Quality Declared Seed (QDS) Uncertified/Informal Sector |

| By Product Technology | Open-Pollinated Varieties (OPVs) Non-transgenic Hybrids Transgenic/GM Traits (imported vegetable traits; field crops largely non-GM) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seed Retailers | 100 | Store Owners, Sales Representatives |

| Farmers (Rice Cultivation) | 140 | Smallholder Farmers, Large-scale Farmers |

| Seed Distributors | 80 | Distribution Managers, Logistics Coordinators |

| Agricultural Experts | 60 | Agronomists, Extension Workers |

| Government Officials | 50 | Policy Makers, Regulatory Authorities |

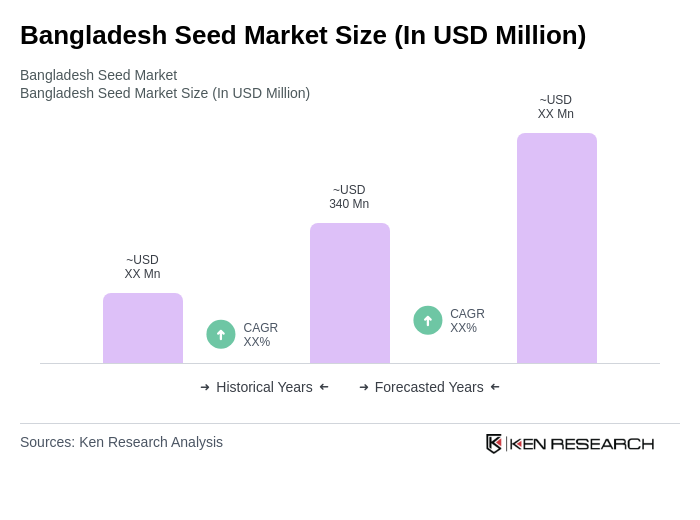

The Bangladesh Seed Market is valued at approximately USD 340 million, driven by the adoption of high-yielding and disease-resistant seed varieties, increased private-sector participation, and government initiatives focused on agricultural modernization and food security.