Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB6315

Pages:87

Published On:October 2025

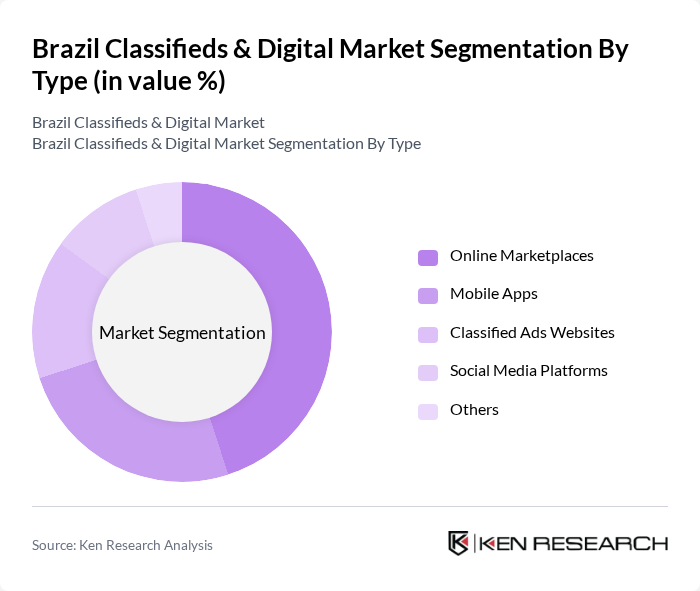

By Type:The market is segmented into various types, including Online Marketplaces, Mobile Apps, Classified Ads Websites, Social Media Platforms, and Others. Among these, Online Marketplaces are the most dominant due to their comprehensive offerings and user-friendly interfaces, which cater to a wide range of consumer needs. Mobile Apps are also gaining traction as they provide convenience and accessibility for users on the go. The increasing reliance on smartphones and mobile internet is driving the growth of these platforms.

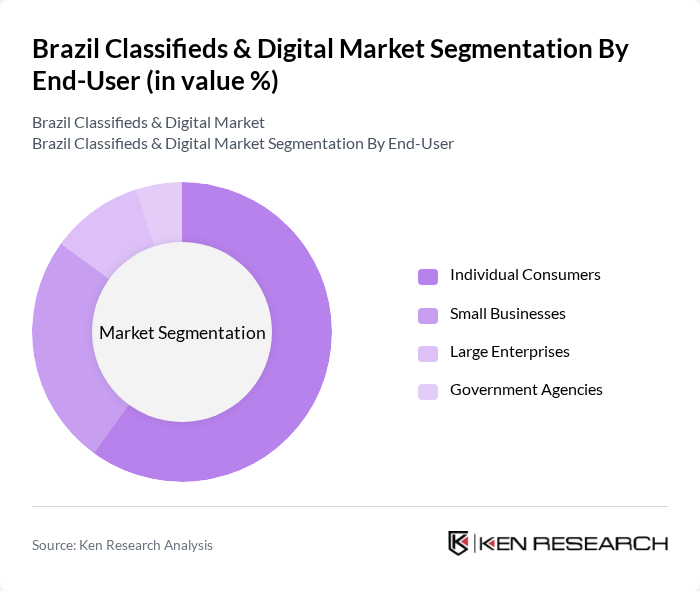

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Large Enterprises, and Government Agencies. Individual Consumers represent the largest segment, driven by the growing trend of online shopping and the convenience of accessing various products and services through digital platforms. Small Businesses are also significant contributors, utilizing classifieds to reach potential customers without the need for extensive marketing budgets. The increasing digital literacy among consumers is further propelling this segment.

The Brazil Classifieds & Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Brasil, Webmotors, Zap Imóveis, Mercado Livre, iCarros, VivaReal, Trovit, InfoJobs, Enjoei, OLX Autos, GetNinjas, 99Freelas, Olist, B2W Digital, Docket contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's classifieds and digital market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, businesses will increasingly leverage data analytics and AI to enhance user experiences. Additionally, the integration of innovative payment solutions will facilitate smoother transactions. Companies that prioritize security and user trust will likely thrive, while those that adapt to changing market dynamics will capture emerging opportunities in niche segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Marketplaces Mobile Apps Classified Ads Websites Social Media Platforms Others |

| By End-User | Individual Consumers Small Businesses Large Enterprises Government Agencies |

| By Category | Real Estate Automotive Jobs Services Others |

| By Sales Channel | Direct Sales Affiliate Marketing Partnerships Others |

| By Pricing Model | Free Listings Paid Listings Subscription-Based Others |

| By Geographic Focus | Urban Areas Rural Areas Regional Markets Others |

| By User Demographics | Age Groups Income Levels Education Levels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 150 | Real Estate Agents, Property Managers |

| Automotive Sales | 100 | Car Dealership Owners, Automotive Sales Managers |

| Job Listings | 120 | HR Managers, Recruitment Consultants |

| Consumer Goods Sales | 80 | Small Business Owners, E-commerce Managers |

| Service Providers | 90 | Freelancers, Service Business Owners |

The Brazil Classifieds & Digital Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online shopping and services.