Region:Central and South America

Author(s):Dev

Product Code:KRAA4669

Pages:95

Published On:September 2025

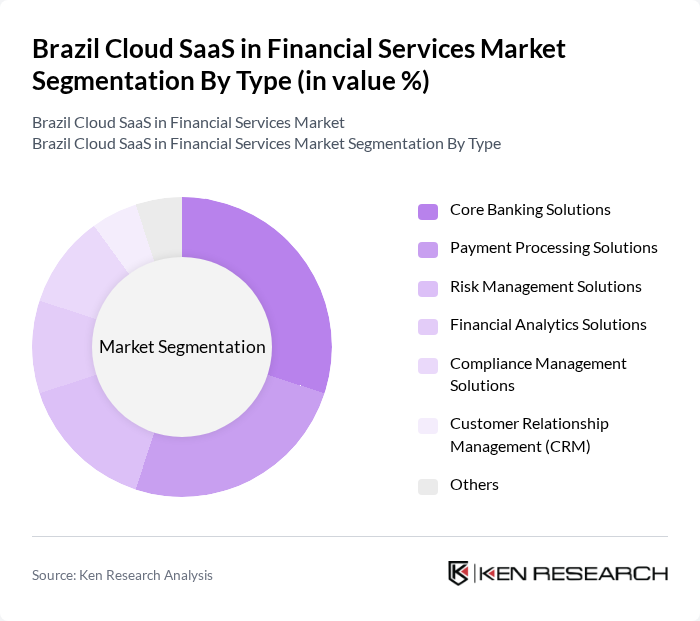

By Type:The market is segmented into various types, including Core Banking Solutions, Payment Processing Solutions, Risk Management Solutions, Financial Analytics Solutions, Compliance Management Solutions, Customer Relationship Management (CRM), and Others. Each of these segments plays a crucial role in addressing specific needs within the financial services sector.

The Core Banking Solutions segment is currently dominating the market due to the increasing need for financial institutions to modernize their operations and enhance customer service. These solutions enable banks to offer a seamless banking experience, integrate various services, and improve operational efficiency. The rise of digital banking and the demand for real-time transaction processing are driving the adoption of core banking solutions, making them essential for financial institutions aiming to stay competitive in a rapidly evolving market.

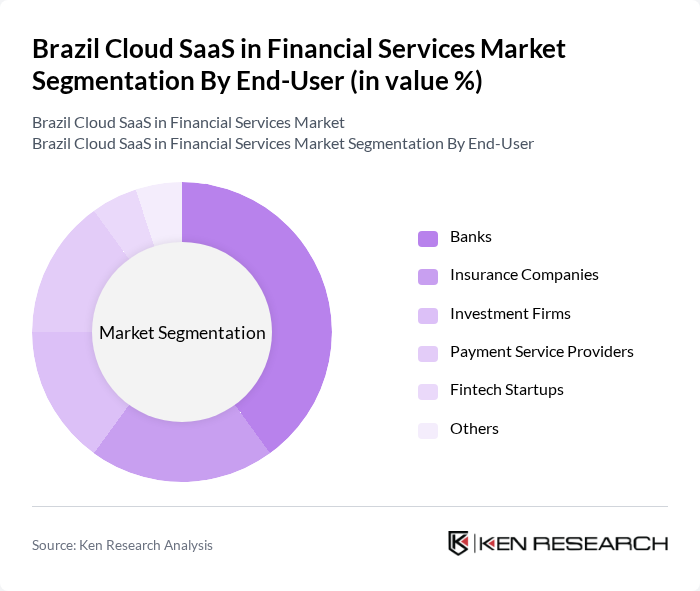

By End-User:The market is segmented by end-users, including Banks, Insurance Companies, Investment Firms, Payment Service Providers, Fintech Startups, and Others. Each segment has unique requirements and contributes to the overall growth of the market.

Banks are the leading end-users in the market, accounting for a significant share due to their extensive reliance on cloud-based solutions for core operations, customer management, and regulatory compliance. The increasing competition among banks to enhance customer experience and operational efficiency is driving the demand for cloud SaaS solutions. Additionally, the growing trend of digital transformation in the banking sector is further propelling the adoption of these solutions.

The Brazil Cloud SaaS in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as TOTVS S.A., Linx S.A., PagSeguro Digital Ltd., StoneCo Ltd., Banco Inter S.A., Nubank, C6 Bank, BTG Pactual, XP Inc., Banco do Brasil S.A., Bradesco S.A., Itaú Unibanco Holding S.A., Santander Brasil S.A., Oracle Corporation, SAP SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil Cloud SaaS in Financial Services market appears promising, driven by technological advancements and evolving consumer expectations. As financial institutions increasingly adopt AI and machine learning, the demand for sophisticated SaaS solutions will rise. Additionally, the trend towards open banking will foster collaboration among fintechs and traditional banks, enhancing service offerings. These developments are expected to create a dynamic environment for innovation and growth in the sector, positioning Brazil as a leader in cloud-based financial services.

| Segment | Sub-Segments |

|---|---|

| By Type | Core Banking Solutions Payment Processing Solutions Risk Management Solutions Financial Analytics Solutions Compliance Management Solutions Customer Relationship Management (CRM) Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Service Providers Fintech Startups Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Application | Financial Management Customer Engagement Fraud Detection Regulatory Compliance Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| By Region | Southeast Region South Region Northeast Region Central-West Region North Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector SaaS Adoption | 150 | IT Managers, Digital Transformation Leads |

| Insurance Industry SaaS Solutions | 100 | Product Managers, Compliance Officers |

| Investment Firms' SaaS Utilization | 80 | Portfolio Managers, Risk Analysts |

| Fintech Startups' Software Preferences | 70 | Founders, Technical Co-founders |

| Regulatory Compliance Software Users | 90 | Compliance Managers, Legal Advisors |

The Brazil Cloud SaaS in Financial Services Market is valued at approximately USD 3.5 billion, driven by the increasing adoption of digital banking solutions and the rise of fintech companies, enhancing customer experiences and operational efficiency.