Region:Middle East

Author(s):Rebecca

Product Code:KRAA9311

Pages:87

Published On:November 2025

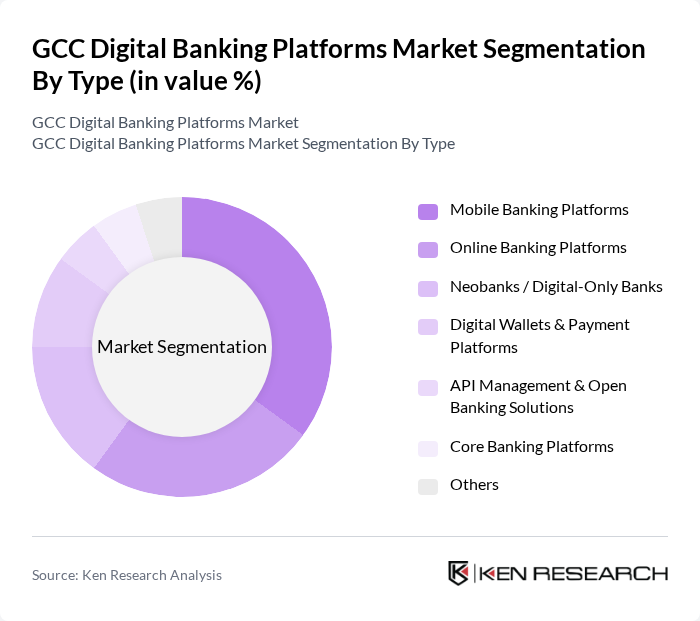

By Type:The market is segmented into various types, including Mobile Banking Platforms, Online Banking Platforms, Neobanks / Digital-Only Banks, Digital Wallets & Payment Platforms, API Management & Open Banking Solutions, Core Banking Platforms, and Others. Among these, Mobile Banking Platforms are gaining significant traction due to the increasing reliance on smartphones for financial transactions, supported by high mobile penetration and consumer preference for convenience.

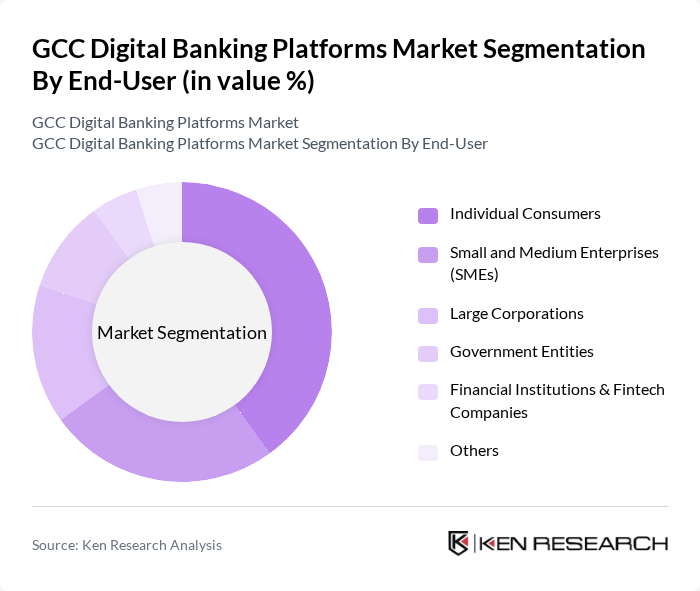

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, Financial Institutions & Fintech Companies, and Others. Individual Consumers are the largest segment, driven by the growing trend of personal banking through mobile applications and online platforms, as well as the increasing demand for instant, user-friendly digital services.

The GCC Digital Banking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Qatar National Bank (QNB), First Abu Dhabi Bank (FAB), Al Rajhi Bank, Gulf Bank, Abu Dhabi Commercial Bank (ADCB), Mashreq Bank, Bank of Bahrain and Kuwait (BBK), Saudi British Bank (SABB), Dubai Islamic Bank, Kuwait Finance House (KFH), Arab National Bank (ANB), Bank Al Jazira, Oman Arab Bank, Liv. by Emirates NBD, STC Pay, ila Bank (Bahrain), Boubyan Bank, Alinma Bank, ADCB Hayyak contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC digital banking platforms market appears promising, driven by technological advancements and evolving consumer preferences. As mobile-first banking solutions gain traction, banks are expected to invest in enhancing their digital interfaces and customer engagement strategies. Additionally, the integration of AI and machine learning will likely streamline operations and improve customer service. The focus on sustainability and ethical banking practices will also shape the market, aligning with global trends towards responsible finance.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Platforms Online Banking Platforms Neobanks / Digital-Only Banks Digital Wallets & Payment Platforms API Management & Open Banking Solutions Core Banking Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Financial Institutions & Fintech Companies Others |

| By Customer Segment | Retail Customers Business Customers High Net-Worth Individuals (HNWIs) Corporate & Institutional Clients Others |

| By Service Offered | Personal Banking Services Business Banking Services Investment & Wealth Management Services Payment & Money Transfer Services Lending & Credit Services Others |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments & Digital Wallets Direct Debit & Standing Orders Others |

| By Geographic Presence | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Technology Used | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Artificial Intelligence & Machine Learning Blockchain & Distributed Ledger Technology API & Open Banking Infrastructure Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Digital Services | 100 | Product Managers, Digital Strategy Leads |

| Fintech Innovations and Trends | 80 | Founders, CTOs of Fintech Startups |

| Consumer Adoption of Digital Banking | 150 | End-users, Banking Customers |

| Regulatory Impact on Digital Banking | 60 | Compliance Officers, Regulatory Affairs Managers |

| Mobile Payment Solutions | 90 | Marketing Managers, Payment Solution Architects |

The GCC Digital Banking Platforms Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and fintech innovations in the region.