Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB5778

Pages:93

Published On:October 2025

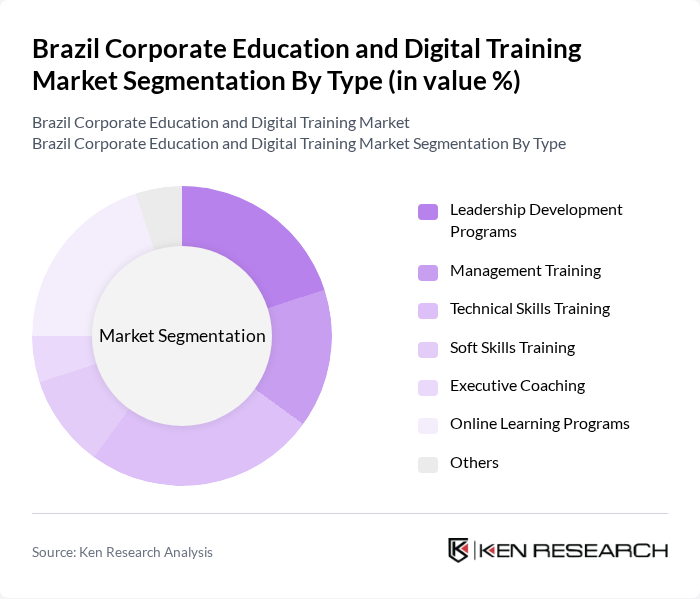

By Type:The market is segmented into various types of training programs, including Leadership Development Programs, Management Training, Technical Skills Training, Soft Skills Training, Executive Coaching, Online Learning Programs, and Others. Each of these sub-segments addresses specific organizational needs, with technical skills and online learning programs seeing especially strong demand due to digital transformation initiatives .

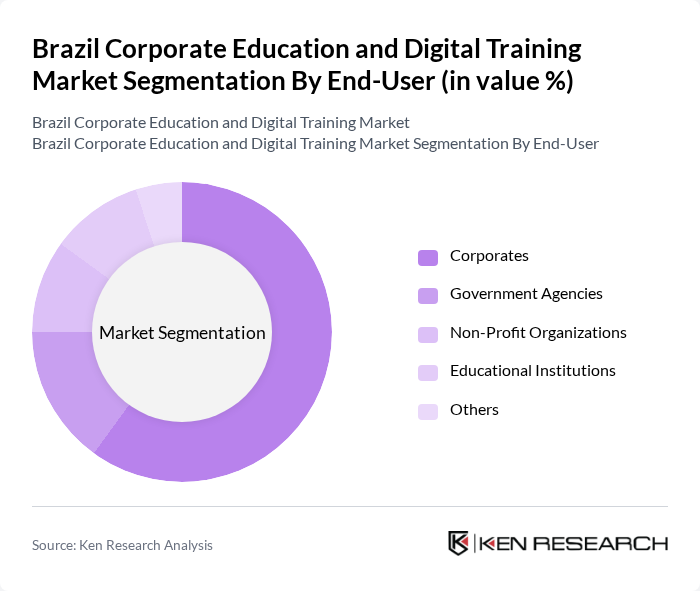

By End-User:The market is further segmented by end-users, which include Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, and Others. Corporates represent the largest share, reflecting the private sector’s strong investment in workforce development and digital upskilling. Government agencies and educational institutions are also increasing their adoption of digital training to meet evolving service and educational delivery needs .

The Brazil Corporate Education and Digital Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fundação Getulio Vargas (FGV), INSPER, Escola Superior de Propaganda e Marketing (ESPM), Fundação Dom Cabral, FIA Business School, Universidade de São Paulo (USP), Senac (Serviço Nacional de Aprendizagem Comercial), Sesi (Serviço Social da Indústria), Sebrae (Serviço Brasileiro de Apoio às Micro e Pequenas Empresas), Alura, Udemy for Business, LinkedIn Learning, Coursera for Business, SkillHub, and Veduca contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazilian corporate education and digital training market appears promising, driven by technological advancements and evolving workforce needs. As companies increasingly recognize the importance of continuous learning, the demand for innovative training solutions is expected to rise. Additionally, the integration of artificial intelligence and data analytics into training programs will enhance personalization and effectiveness, ensuring that employees acquire relevant skills. This trend will likely lead to a more agile workforce capable of adapting to rapid market changes and technological disruptions.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Programs Management Training Technical Skills Training Soft Skills Training Executive Coaching Online Learning Programs Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Delivery Mode | In-Person Training Online Training Hybrid Training On-Demand Learning Others |

| By Industry Focus | Finance Technology Healthcare Manufacturing Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-3 months) Long Courses (3-12 months) Others |

| By Certification Type | Professional Certifications Executive MBAs Diplomas Others |

| By Price Range | Low-End (Under $500) Mid-Range ($500 - $2000) High-End (Over $2000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 120 | HR Managers, Training Managers |

| Digital Learning Platforms | 60 | IT Managers, E-learning Specialists |

| Employee Skill Development | 50 | Learning and Development Managers, Team Leaders |

| Industry-Specific Training Initiatives | 40 | Sector Experts, Compliance Officers |

| Corporate Education Partnerships | 45 | Business Development Managers, Educational Consultants |

The Brazil Corporate Education and Digital Training Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by the demand for upskilling and reskilling in the workforce, particularly in response to technological advancements.