Region:Central and South America

Author(s):Shubham

Product Code:KRAB5659

Pages:80

Published On:October 2025

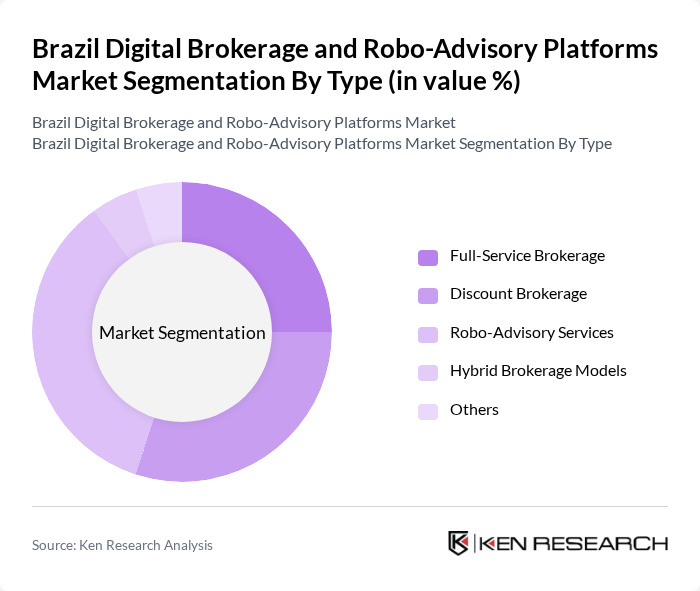

By Type:The market is segmented into various types, including Full-Service Brokerage, Discount Brokerage, Robo-Advisory Services, Hybrid Brokerage Models, and Others. Each of these segments caters to different investor needs and preferences, with Robo-Advisory Services gaining significant traction due to their cost-effectiveness and ease of use.

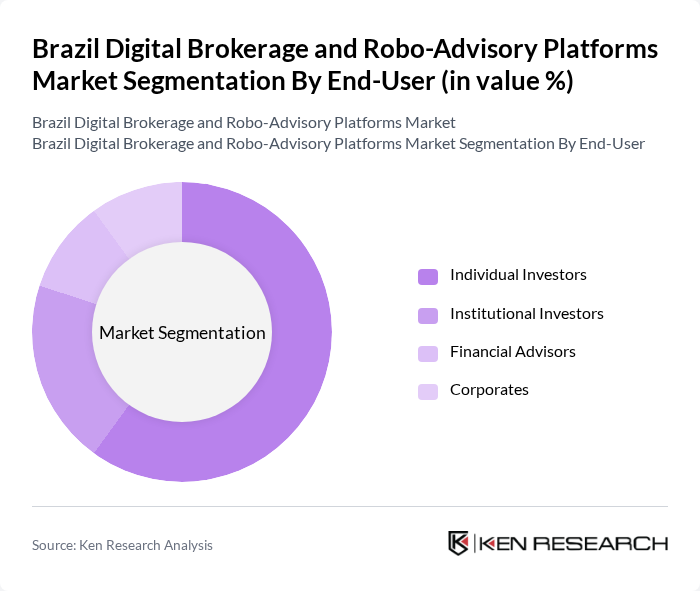

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Financial Advisors, and Corporates. Individual Investors are the largest segment, driven by the increasing number of retail investors entering the market, supported by user-friendly platforms and educational resources.

The Brazil Digital Brokerage and Robo-Advisory Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as XP Inc., Modalmais, Rico Investimentos, Easynvest, Clear Corretora, Banco Inter, BTG Pactual, Genial Investimentos, Órama, Ativa Investimentos, Guide Investimentos, Terra Investimentos, Banco do Brasil, Santander Brasil, Bradesco contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's digital brokerage and robo-advisory platforms appears promising, driven by technological advancements and evolving consumer preferences. As financial literacy improves, more individuals are expected to engage with these platforms. Additionally, the integration of AI and machine learning will enhance personalized investment strategies, making them more appealing. The market is likely to see increased partnerships with traditional financial institutions, further expanding access to underserved demographics and fostering innovation in investment solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Robo-Advisory Services Hybrid Brokerage Models Others |

| By End-User | Individual Investors Institutional Investors Financial Advisors Corporates |

| By Investment Type | Equities Fixed Income Mutual Funds ETFs Others |

| By Service Model | Automated Investment Platforms Managed Accounts Advisory Services Others |

| By Customer Segment | Millennials Gen X Baby Boomers High Net-Worth Individuals |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Others |

| By Pricing Model | Commission-Based Subscription-Based Performance-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Retail Clients |

| Institutional Brokerage Services | 100 | Institutional Investors, Fund Managers |

| Robo-Advisory User Experience | 80 | Robo-Advisory Clients, Financial Planners |

| Market Trends and Innovations | 70 | Fintech Innovators, Technology Officers |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

The Brazil Digital Brokerage and Robo-Advisory Platforms Market is valued at approximately USD 5 billion, reflecting significant growth driven by increased adoption of digital financial services and rising retail investor participation.