Region:Middle East

Author(s):Shubham

Product Code:KRAA8515

Pages:91

Published On:November 2025

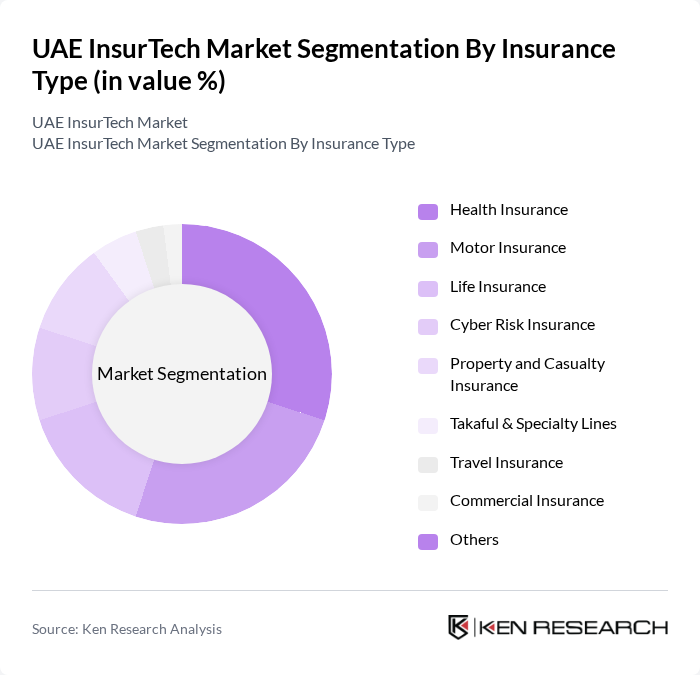

By Insurance Type:The InsurTech market is segmented into Health Insurance, Motor Insurance, Life Insurance, Cyber Risk Insurance, Property and Casualty Insurance, Takaful & Specialty Lines, Travel Insurance, Commercial Insurance, and Others.Health Insuranceleads the market, driven by mandatory health coverage for employees and dependents, a large expatriate population, and rising medical cost inflation.Motor Insuranceis also significant, supported by the UAE’s mature automotive sector and regulatory requirements. The growing prevalence of embedded and wellness-linked insurance, as well as increased demand for cyber and specialty lines, reflects evolving consumer needs and regulatory trends .

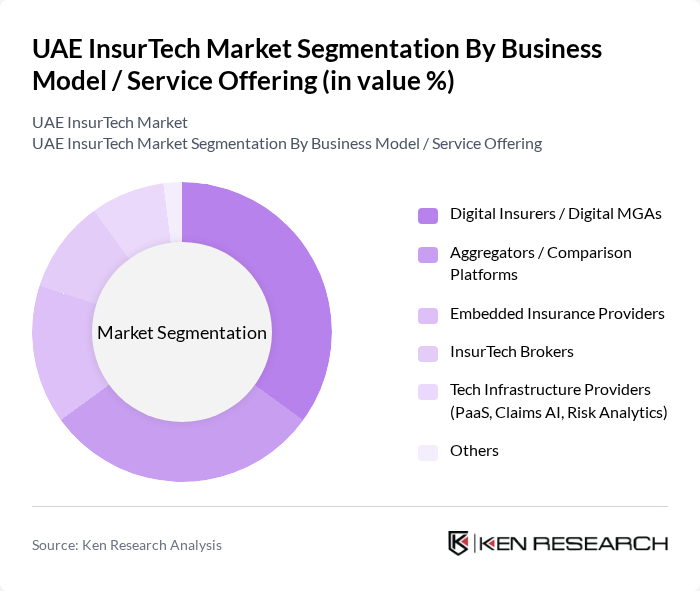

By Business Model / Service Offering:The InsurTech market is also segmented by business models, including Digital Insurers / Digital MGAs, Aggregators / Comparison Platforms, Embedded Insurance Providers, InsurTech Brokers, Tech Infrastructure Providers (PaaS, Claims AI, Risk Analytics), and Others.Digital Insurers and Digital MGAshold the largest share, as they directly issue policies and manage underwriting and customer engagement digitally, enabling rapid scaling and cost efficiency. Aggregators and comparison platforms are also prominent, facilitating consumer access to a wide range of products and competitive pricing. Embedded insurance and tech infrastructure providers are gaining traction as insurers seek to expand distribution and enhance operational efficiency .

The UAE InsurTech market is characterized by a dynamic mix of regional and international players. Leading participants such as Yallacompare, Aqeed, Souqalmal, Bayzat, Policybazaar UAE, Sehteq, Now Health International, Union Insurance Company, AXA Gulf (now GIG Gulf), Oman Insurance Company (Sukoon Insurance), Abu Dhabi National Insurance Company (ADNIC), Dubai Insurance Company, Noor Takaful, Emirates Insurance Company, and Al Ain Ahlia Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The UAE InsurTech market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The integration of AI and machine learning will enhance risk assessment and underwriting processes, improving efficiency. Additionally, the increasing focus on sustainability will prompt InsurTech companies to develop eco-friendly insurance products. As regulatory frameworks evolve to support innovation, collaboration between traditional insurers and InsurTech firms will likely foster a more dynamic and responsive insurance ecosystem in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Insurance Type | Health Insurance Motor Insurance Life Insurance Cyber Risk Insurance Property and Casualty Insurance Takaful & Specialty Lines Travel Insurance Commercial Insurance Others |

| By Business Model / Service Offering | Digital Insurers / Digital MGAs Aggregators / Comparison Platforms Embedded Insurance Providers InsurTech Brokers Tech Infrastructure Providers (PaaS, Claims AI, Risk Analytics) Others |

| By End-User | Individual / Retail Customers SMEs (Micro & Small Businesses) Large Corporates Public Sector / Government Organizations Freelancers and Gig Economy Others |

| By Distribution Channel | Direct-to-Customer (Web, App) Brokers and Agents Online Platforms Partnerships with Financial Institutions Embedded & API Channel Others |

| By Technology Integration | Artificial Intelligence & Machine Learning Big Data Analytics Blockchain Solutions Cloud Computing IoT Applications Others |

| By Customer Segment | Millennials Gen X Baby Boomers High Net-Worth Individuals Corporate Clients Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Others |

| By Risk Type | Low Risk Medium Risk High Risk Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Innovations | 60 | Product Managers, Health Insurance Executives |

| Digital Claims Processing | 50 | Claims Managers, IT Directors |

| Consumer Adoption of InsurTech | 100 | Policyholders, Potential Customers |

| Regulatory Impact on InsurTech | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Investment Trends in InsurTech | 40 | Venture Capitalists, Financial Analysts |

The UAE InsurTech market is valued at approximately USD 8.5 billion, driven by the adoption of digital technologies, fintech integration, and a growing demand for personalized insurance products.