Region:Central and South America

Author(s):Shubham

Product Code:KRAB5608

Pages:90

Published On:October 2025

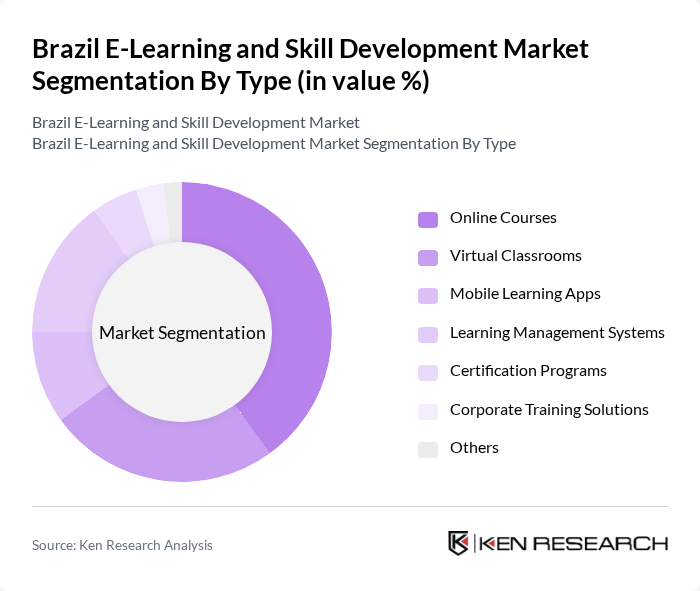

By Type:

The market is segmented into various types, including Online Courses, Virtual Classrooms, Mobile Learning Apps, Learning Management Systems, Certification Programs, Corporate Training Solutions, and Others. Among these, Online Courses have emerged as the dominant sub-segment, driven by their flexibility and accessibility. The increasing preference for self-paced learning and the availability of diverse course offerings have made online courses particularly appealing to both individuals and organizations. Virtual Classrooms and Learning Management Systems also play significant roles, especially in corporate training and educational institutions, where structured learning environments are essential.

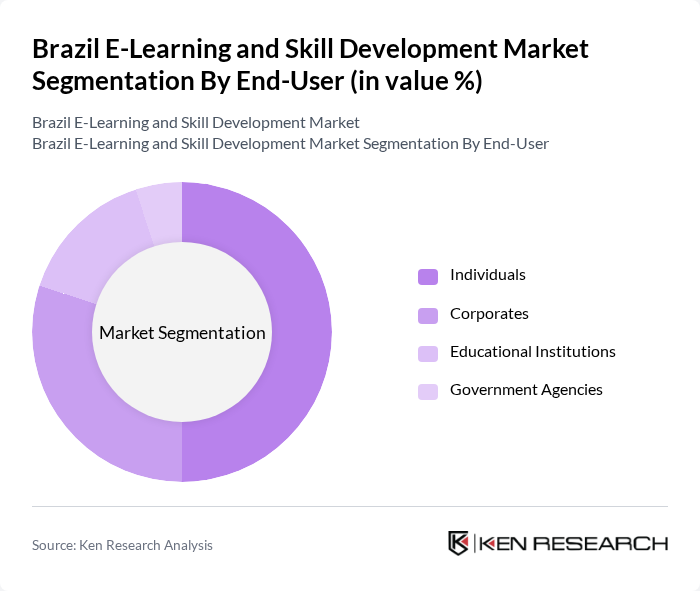

By End-User:

This market is also segmented by end-users, including Individuals, Corporates, Educational Institutions, and Government Agencies. The Individual segment is the largest, as many Brazilians seek to enhance their skills and knowledge through e-learning platforms. Corporates are increasingly investing in e-learning solutions for employee training and development, while Educational Institutions are adopting these technologies to complement traditional teaching methods. Government Agencies are also leveraging e-learning to improve public service training and education accessibility.

The Brazil E-Learning and Skill Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Educacional Estácio S.A., Kroton Educacional S.A., Arco Educação S.A., Veduca, Alura, Udemy, Coursera, Senai, Skillshare, Descomplica, Eduqo, EAD Plataforma, FGV Online, PUC Online, Univesp contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil e-learning and skill development market appears promising, driven by technological advancements and increasing demand for flexible learning solutions. As organizations and educational institutions embrace hybrid learning models, the integration of artificial intelligence and personalized learning experiences will likely enhance engagement and effectiveness. Furthermore, the focus on soft skills development will continue to shape training programs, ensuring that learners are equipped with the necessary competencies to thrive in a rapidly evolving job market.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Mobile Learning Apps Learning Management Systems Certification Programs Corporate Training Solutions Others |

| By End-User | Individuals Corporates Educational Institutions Government Agencies |

| By Application | Professional Development Academic Learning Vocational Training Language Learning |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium |

| By Content Type | Video-Based Content Text-Based Content Interactive Content |

| By Region | North Brazil South Brazil East Brazil West Brazil |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Platforms | 150 | School Administrators, Teachers, Parents |

| Corporate Training Solutions | 100 | HR Managers, Training Coordinators, Learning & Development Specialists |

| Higher Education Online Courses | 80 | University Professors, Educational Technologists, Students |

| Skill Development Programs | 70 | Program Directors, Vocational Trainers, Industry Experts |

| EdTech Startups | 60 | Founders, Product Managers, Investors |

The Brazil E-Learning and Skill Development Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by the demand for flexible learning solutions and the rise of digital literacy among the population.