Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5957

Pages:91

Published On:October 2025

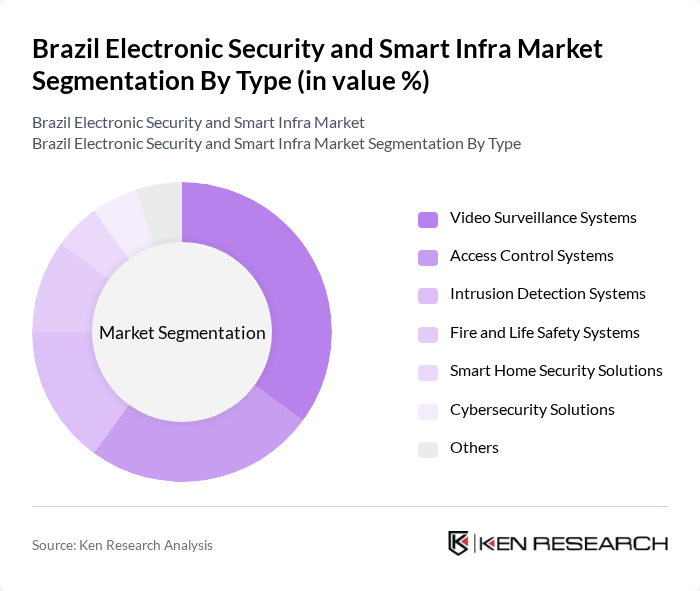

By Type:The market can be segmented into various types of electronic security and smart infrastructure solutions. The primary subsegments include Video Surveillance Systems, Access Control Systems, Intrusion Detection Systems, Fire and Life Safety Systems, Smart Home Security Solutions, Cybersecurity Solutions, and Others. Among these, Video Surveillance Systems are leading the market due to their widespread adoption in both residential and commercial sectors, driven by the need for enhanced security and monitoring capabilities.

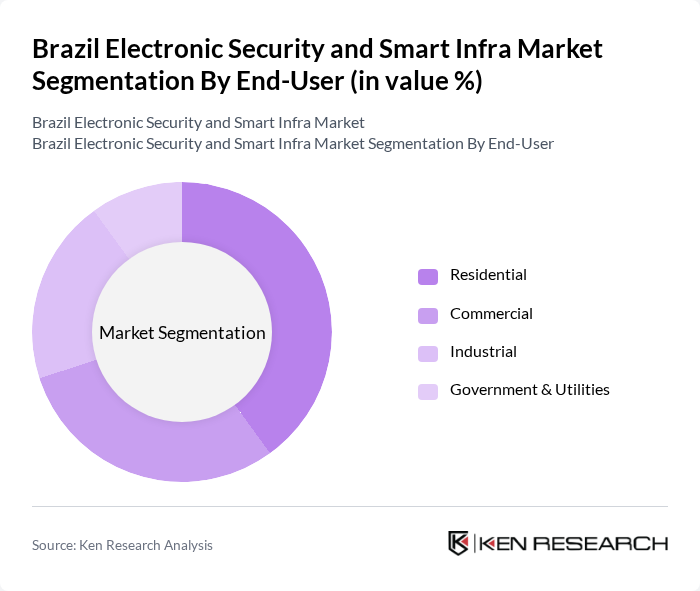

By End-User:The market is segmented by end-users, which include Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently the largest, driven by increasing consumer awareness regarding home security and the growing trend of smart home technologies. The demand for integrated security solutions in residential areas is significantly influencing market dynamics.

The Brazil Electronic Security and Smart Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as ADT Security Services, Grupo Protege, G4S Secure Solutions, Intelbras S.A., Hikvision Digital Technology, Axis Communications, Tyco Integrated Security, Securitas AB, Johnson Controls International, Bosch Security Systems, Siemens AG, Honeywell International Inc., Dahua Technology, Genetec Inc., Milestone Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's electronic security and smart infrastructure market appears promising, driven by technological advancements and increasing urbanization. As cities continue to grow, the integration of AI and IoT in security solutions will become more prevalent, enhancing efficiency and effectiveness. Additionally, government support for smart city initiatives will likely foster innovation and investment in security technologies. The market is expected to evolve rapidly, adapting to emerging threats and consumer demands, ultimately leading to a safer urban environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Surveillance Systems Access Control Systems Intrusion Detection Systems Fire and Life Safety Systems Smart Home Security Solutions Cybersecurity Solutions Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Retail Security Banking and Financial Services Transportation and Logistics Healthcare Facilities Educational Institutions Critical Infrastructure Others |

| By Distribution Channel | Direct Sales Online Sales Distributors and Resellers Retail Outlets |

| By Region | Southeast Brazil South Brazil North Brazil Central-West Brazil |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants and Schemes |

| By Policy Support | Subsidies for Smart Infrastructure Tax Incentives for Security Solutions Regulatory Compliance Support Training and Certification Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronic Security Systems in Retail | 100 | Security Managers, IT Directors |

| Smart Infrastructure Projects in Urban Areas | 80 | City Planners, Project Managers |

| Banking Sector Security Solutions | 70 | Risk Management Officers, Operations Heads |

| Transportation Security Systems | 60 | Logistics Coordinators, Safety Managers |

| Home Automation and Security | 90 | Homeowners, Technology Enthusiasts |

The Brazil Electronic Security and Smart Infra Market is valued at approximately USD 5 billion, driven by urbanization, rising crime rates, and the demand for smart infrastructure solutions. This growth reflects a significant increase in investments in security technologies across various sectors.