Region:Central and South America

Author(s):Rebecca

Product Code:KRAB1692

Pages:97

Published On:October 2025

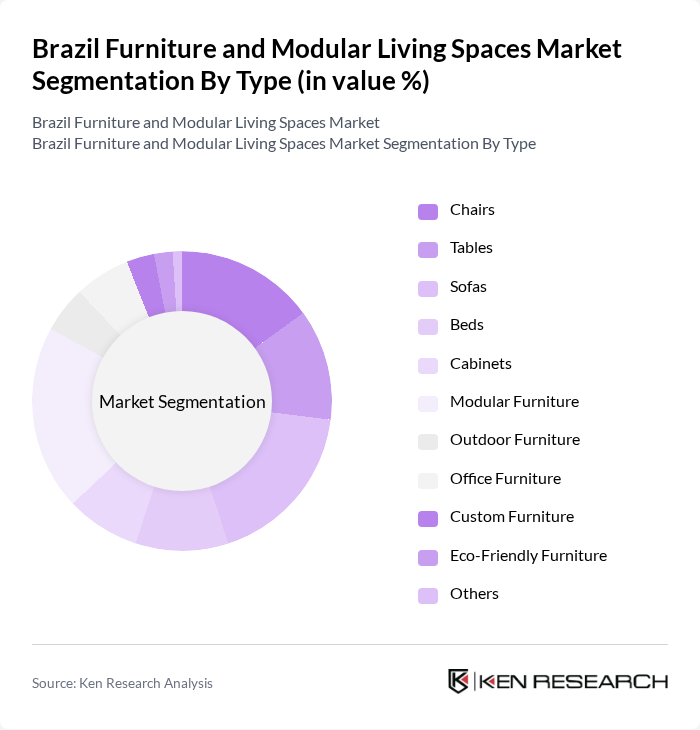

By Type:The furniture market is segmented into various types, including chairs, tables, sofas, beds, cabinets, modular furniture, outdoor furniture, office furniture, custom furniture, eco-friendly furniture, and others. Among these, modular furniture is gaining significant traction due to its versatility and space-saving features, appealing to urban dwellers. The demand for eco-friendly furniture is also on the rise as consumers become more environmentally conscious, with manufacturers increasingly adopting sustainable materials and production processes to meet this demand.

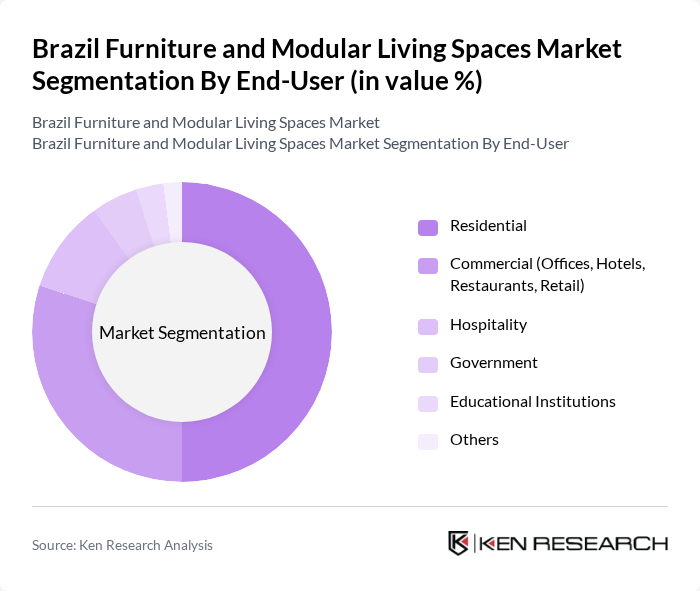

By End-User:The market is segmented by end-user into residential, commercial (offices, hotels, restaurants, retail), hospitality, government, educational institutions, and others. The residential segment is the largest, driven by increasing home ownership, renovation activities, and the rise of remote work, which has boosted demand for home office furniture. The commercial segment is also significant, fueled by the growth of the hospitality industry and the expansion of retail spaces, with hotels and restaurants investing in both functional and stylish furniture to enhance guest experiences.

The Brazil Furniture and Modular Living Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tok&Stok, Etna, Mobly, Leroy Merlin, Casas Bahia, Magazine Luiza, Artefacto, Lider Interiores, Todeschini, Florense, Dell Anno, Bartzen, Dalla Costa, Móveis Simonetto, Móveis Carraro contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil furniture and modular living spaces market is poised for transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture will rise. Additionally, the integration of smart technology into furniture design is expected to enhance user experience. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge, positioning themselves favorably in a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Chairs Tables Sofas Beds Cabinets Modular Furniture Outdoor Furniture Office Furniture Custom Furniture Eco-Friendly Furniture Others |

| By End-User | Residential Commercial (Offices, Hotels, Restaurants, Retail) Hospitality Government Educational Institutions Others |

| By Distribution Channel | Offline Retail (Brick-and-Mortar Stores) Online Retail (E-commerce Platforms) Direct Sales Wholesale Others |

| By Material | Wood Metal Plastic Leather Fabric Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Design Style | Contemporary Traditional Rustic Industrial Others |

| By Functionality | Multi-Functional Single-Function Space-Saving Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Modular Furniture Buyers | 100 | Homeowners, Interior Designers |

| Commercial Modular Living Space Developers | 60 | Project Managers, Real Estate Developers |

| Furniture Retailers and Distributors | 50 | Store Managers, Sales Executives |

| Architects and Designers in Modular Spaces | 40 | Architects, Design Consultants |

| Consumers Interested in Modular Living Solutions | 80 | Young Professionals, Families |

The Brazil Furniture and Modular Living Spaces Market is valued at approximately USD 15 billion, driven by urbanization, rising disposable incomes, and a growing preference for modular living solutions that address space constraints in urban areas.