Region:North America

Author(s):Shubham

Product Code:KRAA5496

Pages:92

Published On:September 2025

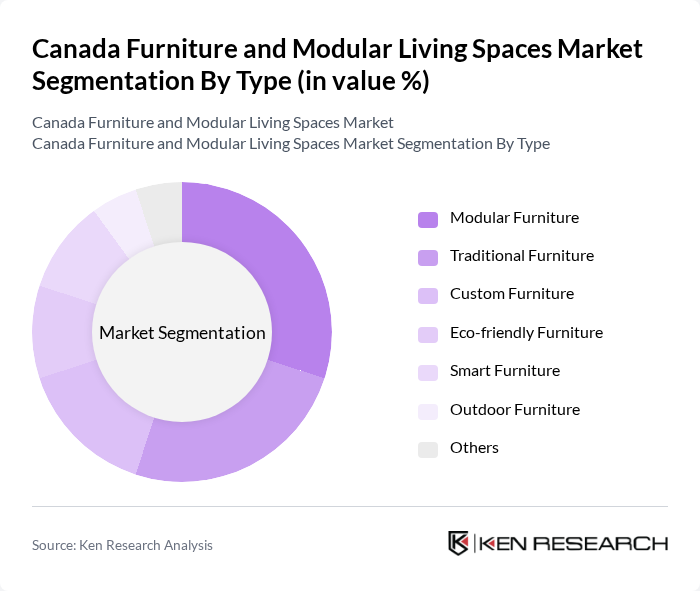

By Type:The furniture market is segmented into various types, including Modular Furniture, Traditional Furniture, Custom Furniture, Eco-friendly Furniture, Smart Furniture, Outdoor Furniture, and Others. Among these, Modular Furniture is gaining significant traction due to its versatility and space-saving features, appealing to urban dwellers. Traditional Furniture remains popular for its classic appeal, while Eco-friendly Furniture is increasingly favored by environmentally conscious consumers. Smart Furniture is also emerging as a trend, integrating technology into design for enhanced functionality.

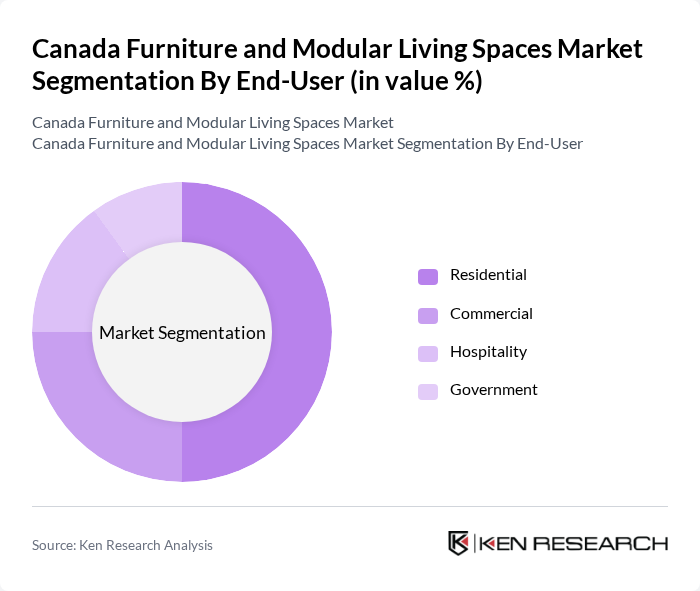

By End-User:The market is segmented by end-users into Residential, Commercial, Hospitality, and Government sectors. The Residential segment is the largest, driven by the increasing demand for home furnishings as more people invest in their living spaces. The Commercial segment is also significant, fueled by the growth of office spaces and retail environments. The Hospitality sector is recovering post-pandemic, leading to renewed investments in furniture for hotels and restaurants, while the Government segment focuses on public spaces and facilities.

The Canada Furniture and Modular Living Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Canada, Structube, Leon's Furniture, The Brick, EQ3, Wayfair Canada, Ashley HomeStore Canada, Dufresne Group, Urban Barn, Canadian Tire, Home Depot Canada, Rona, Bouclair, JYSK Canada, Palliser Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada furniture and modular living spaces market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture will likely rise. Additionally, the integration of smart technology into furniture design is expected to enhance user experience, making products more appealing. Companies that embrace sustainability and innovation will be well-positioned to capture market share and meet the needs of environmentally conscious consumers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Modular Furniture Traditional Furniture Custom Furniture Eco-friendly Furniture Smart Furniture Outdoor Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-range Premium |

| By Material | Wood Metal Plastic Fabric |

| By Design Style | Modern Traditional Contemporary Rustic |

| By Functionality | Multi-functional Space-saving Standard Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Modular Furniture Buyers | 150 | Homeowners, Renters, Interior Designers |

| Commercial Modular Living Space Providers | 100 | Business Owners, Facility Managers, Architects |

| Furniture Retailers and Distributors | 80 | Retail Managers, Sales Directors, Product Buyers |

| Urban Development Planners | 70 | City Planners, Real Estate Developers, Policy Makers |

| Consumer Insights on Modular Living | 90 | General Consumers, Young Professionals, Families |

The Canada Furniture and Modular Living Spaces Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and a preference for modular and customizable living solutions.