Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB1657

Pages:81

Published On:October 2025

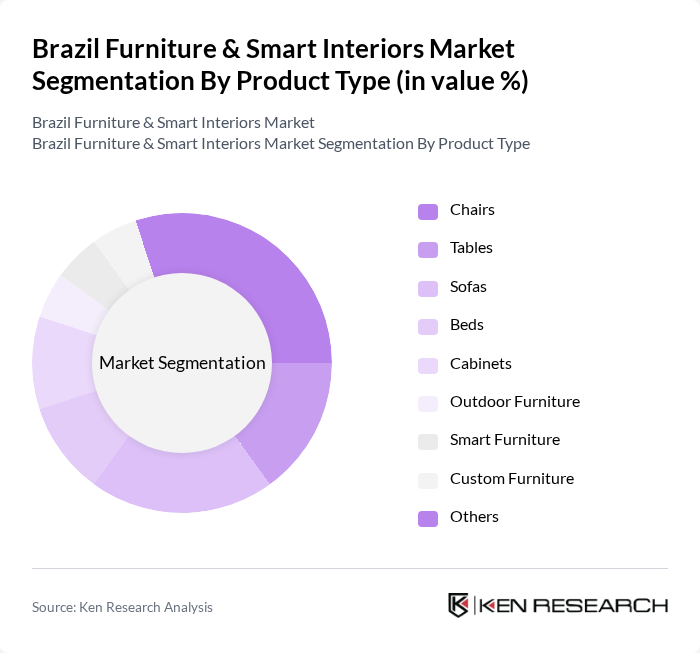

By Product Type:The product type segmentation includes various categories such as chairs, tables, sofas, beds, cabinets, outdoor furniture, smart furniture, custom furniture, and others. Among these, chairs and sofas remain the most popular due to their essential roles in both residential and commercial settings. The trend towards ergonomic, space-saving, and multifunctional furniture has led to a significant increase in demand for these products, with consumers prioritizing comfort, style, and adaptability. Smart furniture, featuring integrated technology and connectivity, is gaining traction among urban consumers seeking convenience and modern aesthetics .

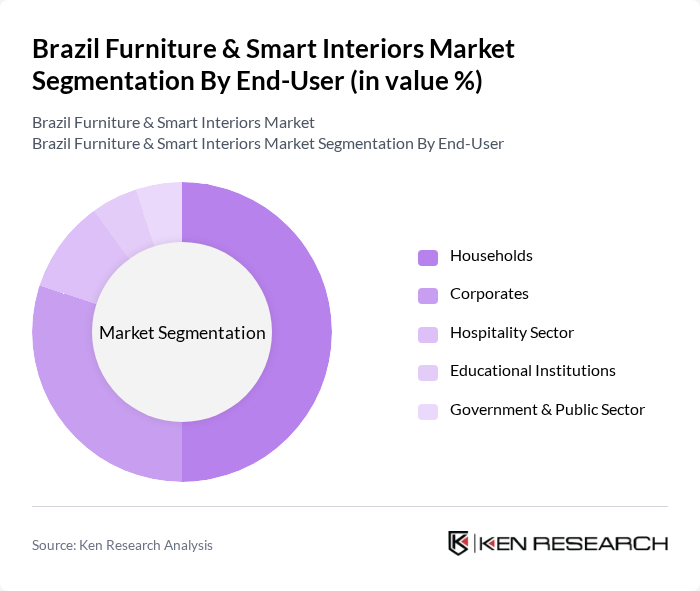

By End-User:The end-user segmentation encompasses residential, commercial (offices, hotels, restaurants, retail), hospitality, government, educational institutions, and others. The residential segment is the largest, driven by the increasing number of households, urban migration, and the trend towards home improvement and renovation. Commercial spaces, including offices and hospitality venues, are also seeing a rise in demand for stylish, functional, and technology-integrated furniture, particularly in urban areas where businesses are expanding and modernizing their interiors .

The Brazil Furniture & Smart Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tok&Stok, Etna, Mobly, Leroy Merlin Brasil, Casas Bahia, Magazine Luiza, MadeiraMadeira, Móveis Simonetti, Dalla Costa Móveis, Móveis Primavera, Artesano, Lojas Americanas, C&C Casa e Construção, Móveis São Marcos, Móveis Rimo contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil Furniture & Smart Interiors Market is poised for transformative growth driven by urbanization, rising incomes, and sustainability trends. As consumers increasingly prioritize smart home technologies and eco-friendly products, manufacturers will need to innovate continuously. The integration of IoT in furniture design will enhance user experience, while the expansion of e-commerce platforms will facilitate broader market access. Overall, the market is expected to adapt dynamically to evolving consumer preferences and technological advancements, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Chairs Tables Sofas Beds Cabinets Outdoor Furniture Smart Furniture Custom Furniture Others |

| By End-User | Residential Commercial (Offices, Hotels, Restaurants, Retail) Hospitality Government Educational Institutions Others |

| By Distribution Channel | Offline (Brick-and-Mortar Stores, Specialty Stores, Supermarkets & Hypermarkets) Online (E-commerce Platforms, Direct-to-Consumer) Wholesale Others |

| By Material | Wood Metal Plastic Leather Fabric/Upholstered Glass Composites Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Design Style | Modern Traditional Contemporary Rustic Minimalist Others |

| By Functionality | Multi-functional Space-saving Smart-enabled Standard Others |

| By Region | Southeast South Northeast North Central-West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 100 | Homeowners, Interior Designers |

| Commercial Furniture Sector | 60 | Office Managers, Facility Managers |

| Smart Home Technology Adoption | 50 | Tech-savvy Consumers, Home Automation Specialists |

| Eco-friendly Furniture Trends | 40 | Sustainability Advocates, Product Designers |

| Interior Design Preferences | 70 | Architects, Design Consultants |

The Brazil Furniture & Smart Interiors Market is valued at approximately USD 15 billion, driven by urbanization, rising disposable incomes, and a growing trend towards smart home solutions. This market reflects changing consumer preferences for innovative and multifunctional furniture.