Region:Central and South America

Author(s):Dev

Product Code:KRAB4885

Pages:98

Published On:October 2025

By Type:The furniture market is segmented into various types, including Living Room Furniture, Bedroom Furniture, Kitchen & Dining Furniture, Office Furniture, Outdoor Furniture, Smart Furniture, Custom & Modular Furniture, Vintage & Handcrafted Furniture, and Others. Among these, Living Room Furniture is the most dominant segment, driven by consumer preferences for stylish and functional designs that enhance home aesthetics. The increasing trend of home renovation and interior design has further propelled the demand for living room furniture, making it a key focus for manufacturers.

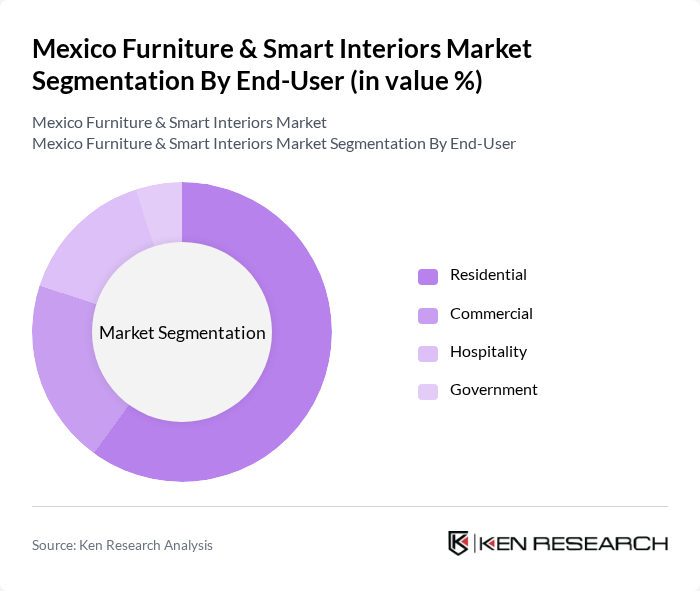

By End-User:The market is segmented by end-user into Residential, Commercial, Hospitality, and Government. The Residential segment leads the market, driven by the increasing trend of home improvement and the growing number of households. Consumers are investing in quality furniture that enhances their living spaces, reflecting personal style and comfort. The rise in disposable income and changing lifestyles have further contributed to the growth of this segment.

The Mexico Furniture & Smart Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Muebles Dico S.A. de C.V., IKEA México, Grupo Coppel S.A. de C.V., Liverpool S.A.B. de C.V., Sears Operadora México, S.A. de C.V., Casa Palacio, Walmart de México y Centroamérica, The Home Depot México, Office Depot de México, S.A. de C.V., Amazon México, Muebles América S.A. de C.V., Muebles Jalisco S.A. de C.V., Muebles para el Hogar S.A. de C.V., Muebles y Accesorios S.A. de C.V., Muebles Troncoso S.A. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico furniture and smart interiors market appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues, the demand for innovative and space-saving furniture solutions will likely increase. Additionally, the integration of sustainable practices and materials will become essential as consumers prioritize eco-friendly options. Companies that embrace these trends and invest in smart technologies will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Kitchen & Dining Furniture Office Furniture Outdoor Furniture Smart Furniture Custom & Modular Furniture Vintage & Handcrafted Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Online Retail Offline Retail (Specialty Stores, Hypermarkets, Department Stores) Direct Sales Wholesale |

| By Material | Wood Metal Plastic Fabric & Upholstery Others (Glass, Stone, Composite) |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Design Style | Modern Traditional Contemporary Rustic Minimalist |

| By Functionality | Multi-functional Space-saving Smart-enabled Standard |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 100 | Office Managers, Facility Coordinators |

| Smart Furniture Adoption | 80 | Tech-savvy Consumers, Smart Home Enthusiasts |

| Trends in Sustainable Furniture | 70 | Sustainability Advocates, Eco-conscious Consumers |

| Market Insights from Retailers | 90 | Store Managers, Sales Representatives |

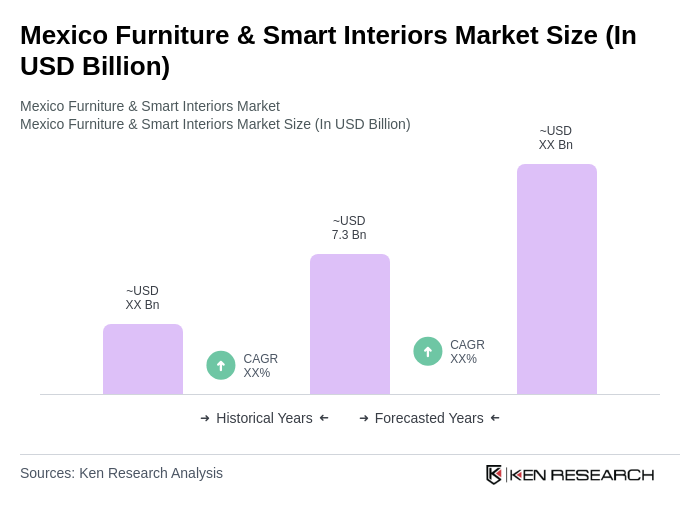

The Mexico Furniture & Smart Interiors Market is valued at approximately USD 7.3 billion, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and a preference for smart and sustainable living solutions.