Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5964

Pages:86

Published On:October 2025

By Type:The mattress market is segmented into various types, including Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Hybrid Mattresses, Adjustable Beds, Smart Mattresses, and Others. Among these, Memory Foam Mattresses are currently leading the market due to their popularity for providing comfort and support. Consumers increasingly prefer these mattresses for their ability to conform to body shapes, which enhances sleep quality. The trend towards personalized sleep solutions has further propelled the demand for Memory Foam options.

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, and Healthcare sectors. The Residential segment dominates the market, driven by increasing consumer spending on home comfort and wellness. As more individuals prioritize sleep quality, the demand for mattresses in residential settings has surged. Additionally, the rise in e-commerce has made it easier for consumers to purchase mattresses online, further boosting this segment's growth.

The Brazil Mattress and Smart Sleep Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Simmons Brasil, Orthocrin, Zissou, Castor, Sleep Number Corporation, Emma Sleep, Móveis Brasil, Colchões Anjos, D'Colchão, Americanflex, Hellenic, Colchões Ortobom, Colchões Castor, Sleeptech contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil mattress and smart sleep retail market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As smart sleep technology becomes more integrated into daily life, consumers are likely to seek products that enhance sleep quality through data-driven insights. Additionally, the growing emphasis on sustainability will push manufacturers to innovate eco-friendly materials and practices, aligning with consumer demand for environmentally responsible products. This dynamic landscape presents both challenges and opportunities for brands aiming to capture market share in a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Adjustable Beds Smart Mattresses Others |

| By End-User | Residential Commercial Hospitality Healthcare |

| By Sales Channel | Online Retail Offline Retail Direct Sales Wholesale |

| By Price Range | Budget Mid-Range Premium |

| By Material | Foam Fabric Metal Wood |

| By Brand Positioning | Luxury Brands Value Brands Mass Market Brands |

| By Distribution Mode | Direct-to-Consumer Retail Partnerships E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mattress Retailers | 150 | Store Managers, Sales Executives |

| Smart Sleep Technology Providers | 100 | Product Development Managers, Marketing Directors |

| Consumer Insights on Sleep Products | 200 | End-users, Sleep Health Advocates |

| Distribution Channel Analysis | 80 | Logistics Managers, Supply Chain Analysts |

| Market Trends and Innovations | 70 | Industry Analysts, Research Scholars |

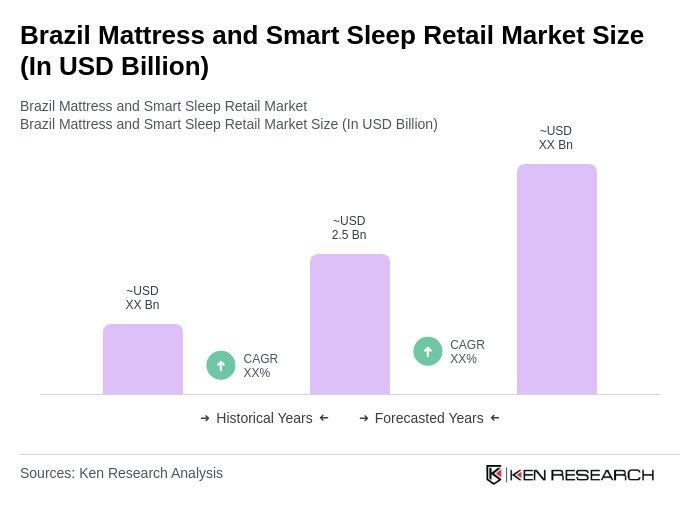

The Brazil Mattress and Smart Sleep Retail Market is valued at approximately USD 2.5 billion, reflecting a robust growth driven by increased consumer awareness of sleep health, rising disposable incomes, and the adoption of smart home technologies.