Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA3721

Pages:84

Published On:September 2025

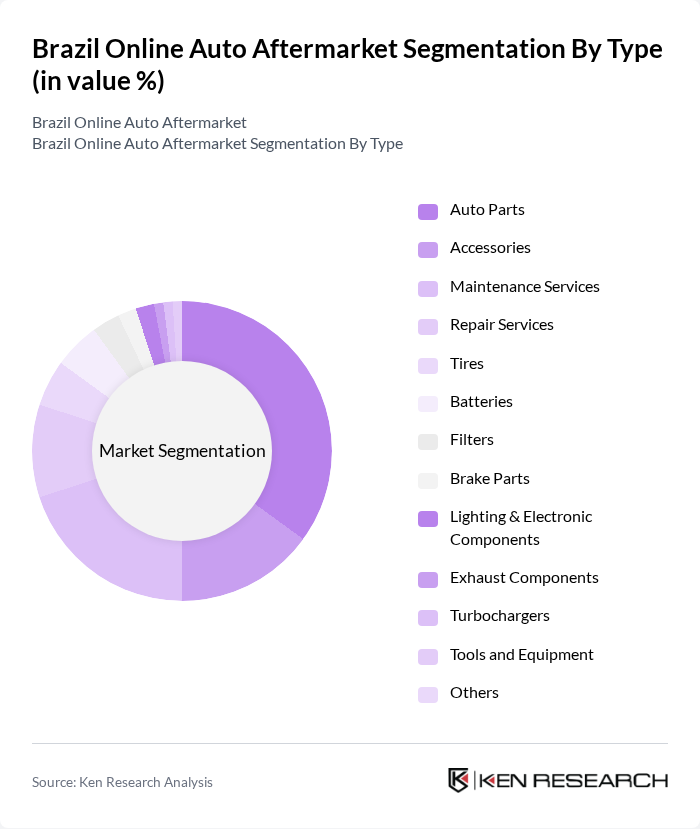

By Type:The online auto aftermarket in Brazil is segmented into various types, including Auto Parts, Accessories, Maintenance Services, Repair Services, Tires, Batteries, Filters, Brake Parts, Lighting & Electronic Components, Exhaust Components, Turbochargers, Tools and Equipment, and Others. Among these, Auto Parts and Maintenance Services are particularly significant due to the increasing demand for vehicle upkeep and repair, with transmission, steering, and lighting components showing notable growth.

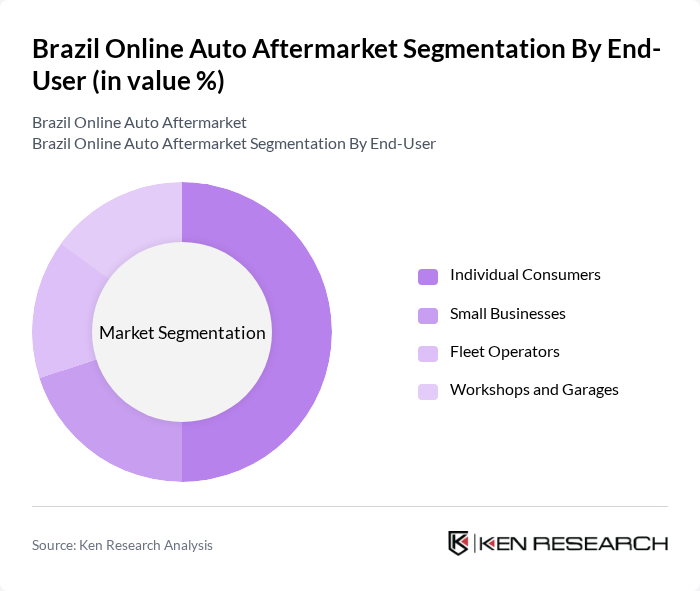

By End-User:The end-user segmentation of the online auto aftermarket includes Individual Consumers, Small Businesses, Fleet Operators, and Workshops and Garages. Individual Consumers represent the largest segment, driven by the increasing trend of DIY vehicle maintenance and repair, as well as the convenience of online shopping. Fleet operators and workshops are also increasing their online procurement for efficiency and cost savings.

The Brazil Online Auto Aftermarket market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Livre, OLX Brasil, AutoZone Brasil, Webmotors, iCarros, Amazon Brasil, Peça Rara, Connect Parts, AutoPecasOnline, AutoFácil, Trocafiltros, Mão na Roda, Carro na Rede, Peças e Acessórios, Rede PitStop contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's online auto aftermarket appears promising, driven by technological advancements and evolving consumer preferences. As mobile platforms gain traction, businesses are likely to invest in user-friendly applications to enhance customer experiences. Additionally, the integration of AI and machine learning will enable personalized marketing strategies, improving customer engagement. Sustainability will also play a crucial role, with increasing demand for eco-friendly products shaping the market landscape. These trends indicate a dynamic and responsive industry poised for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Auto Parts Accessories Maintenance Services Repair Services Tires Batteries Filters Brake Parts Lighting & Electronic Components Exhaust Components Turbochargers Tools and Equipment Others |

| By End-User | Individual Consumers Small Businesses Fleet Operators Workshops and Garages |

| By Sales Channel | Online Marketplaces Direct-to-Consumer (D2C) Platforms Third-Party E-commerce Platforms Retail Chains with Online Presence Distributors |

| By Product Category | OEM Parts Aftermarket Parts Performance Parts Remanufactured Parts |

| By Pricing Strategy | Premium Mid-range Budget |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| By Customer Demographics | Age Group Income Level Vehicle Type |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Auto Parts Retailers | 100 | eCommerce Managers, Marketing Directors |

| Automotive Repair Shops | 80 | Shop Owners, Service Managers |

| Consumer Preferences in Auto Parts | 120 | Car Owners, Automotive Enthusiasts |

| Distribution Channels Analysis | 60 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends and Innovations | 50 | Industry Experts, Product Development Managers |

The Brazil Online Auto Aftermarket is valued at approximately USD 1.5 billion, driven by increased e-commerce penetration, rising vehicle ownership, and a growing trend towards online shopping for auto parts and services.