Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5297

Pages:90

Published On:October 2025

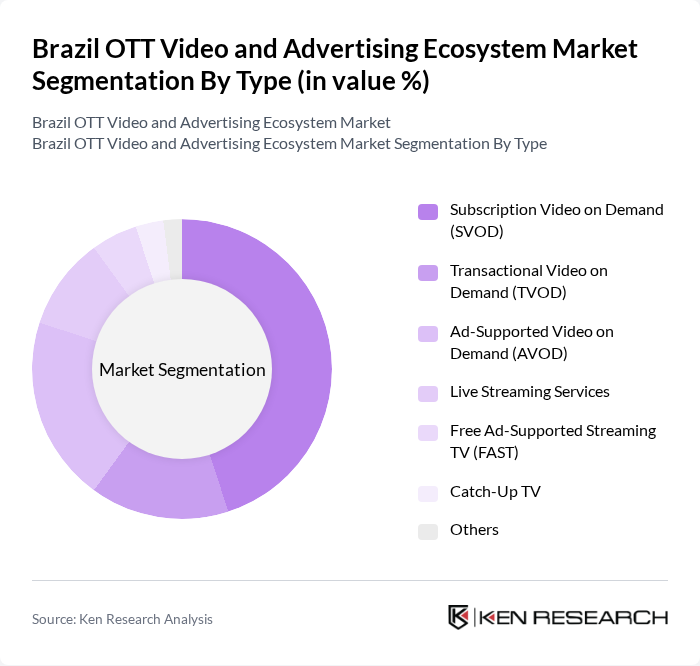

By Type:The market is segmented into Subscription Video on Demand (SVOD), Transactional Video on Demand (TVOD), Ad-Supported Video on Demand (AVOD), Live Streaming Services, Free Ad-Supported Streaming TV (FAST), Catch-Up TV, and Others. Among these, SVOD remains the leading segment, reflecting consumer preference for ad-free, premium content and exclusive series. The willingness of Brazilian consumers to pay for high-quality, on-demand entertainment has driven the sustained growth of this segment. AVOD and FAST services are also gaining traction, particularly among price-sensitive viewers seeking free or low-cost access to diverse content libraries .

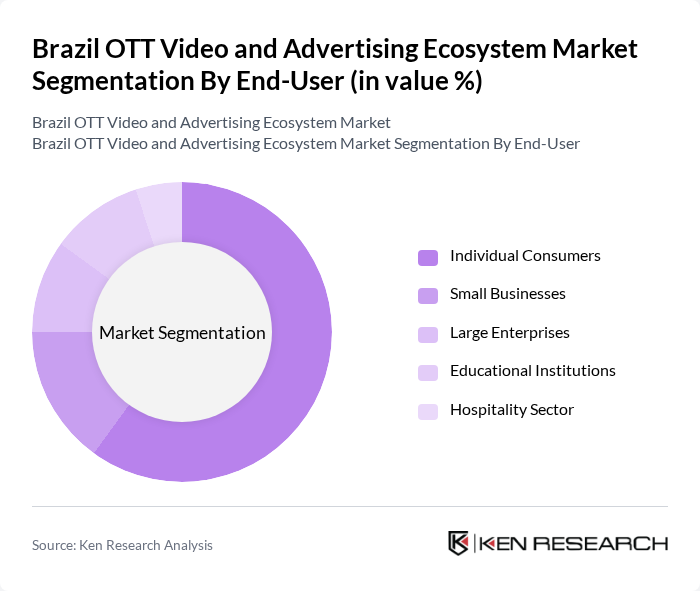

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Large Enterprises, Educational Institutions, and the Hospitality Sector. Individual Consumers represent the dominant segment, driven by the increasing adoption of OTT services for personal entertainment and the convenience of accessing a wide range of content across multiple devices. The growing availability of affordable mobile data plans and bundled OTT offerings has further accelerated uptake among individuals .

The Brazil OTT Video and Advertising Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, Inc., Amazon Prime Video, Globoplay (Grupo Globo), Disney+, HBO Max, Paramount+, YouTube (Google LLC), Star+ (The Walt Disney Company), Telecine (Grupo Globo), Claro Video (América Móvil), Apple TV+, Tubi (Fox Corporation), Pluto TV (Paramount Global), Samsung TV Plus, Facebook Watch (Meta Platforms, Inc.), +SBT (Sistema Brasileiro de Televisão), Vivo Play (Telefônica Brasil) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's OTT video and advertising ecosystem appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, more users will engage with OTT platforms, leading to increased content consumption. Innovations in advertising technology will enhance targeting capabilities, allowing advertisers to reach specific demographics effectively. Furthermore, the growth of local content production will cater to diverse audiences, fostering a more competitive landscape that encourages investment and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Subscription Video on Demand (SVOD) Transactional Video on Demand (TVOD) Ad-Supported Video on Demand (AVOD) Live Streaming Services Free Ad-Supported Streaming TV (FAST) Catch-Up TV Others |

| By End-User | Individual Consumers Small Businesses Large Enterprises Educational Institutions Hospitality Sector |

| By Content Genre | Movies TV Shows Documentaries Sports Kids Programming News & Current Affairs Others |

| By Distribution Channel | Direct-to-Consumer Platforms Third-Party Aggregators Telecom Partnerships Smart TV App Stores Retail Outlets |

| By Advertising Model | Programmatic Advertising Direct Sales Sponsored Content Affiliate Marketing Native Advertising |

| By Device Type | Smart TVs Mobile Devices Tablets Desktop Computers Streaming Media Players (e.g., Chromecast, Roku) |

| By Pricing Model | Subscription-Based Pay-Per-View Free with Ads Freemium Bundled with Telecom Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OTT Platform User Insights | 120 | Regular Users, Occasional Viewers |

| Advertising Spend Analysis | 60 | Media Buyers, Marketing Managers |

| Content Preference Surveys | 50 | Content Creators, Producers |

| Consumer Behavior Studies | 80 | General Audience, Niche Viewers |

| Market Trend Evaluations | 40 | Industry Analysts, Research Experts |

The Brazil OTT Video and Advertising Ecosystem Market is valued at approximately USD 2.3 billion, reflecting significant growth driven by increased internet access, smartphone adoption, and a shift towards on-demand content consumption.