Region:Middle East

Author(s):Dev

Product Code:KRAC3406

Pages:89

Published On:October 2025

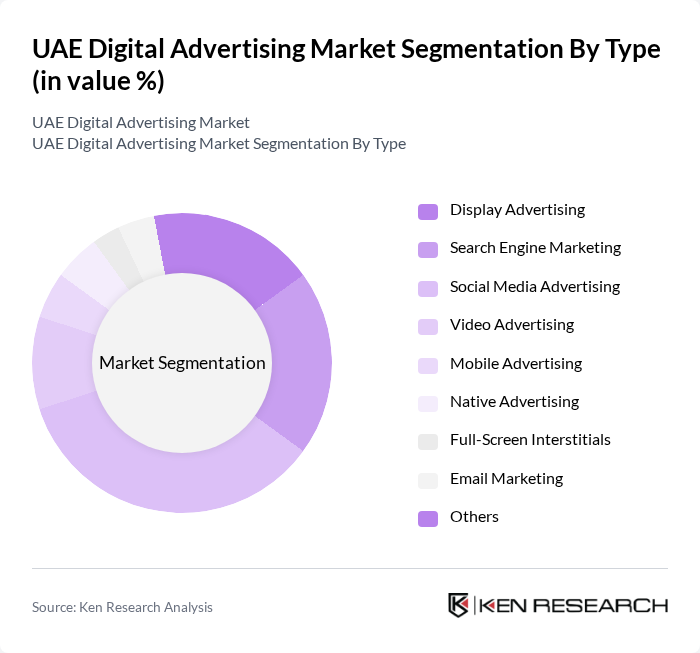

By Type:The digital advertising market can be segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Mobile Advertising, Native Advertising, Full-Screen Interstitials, Email Marketing, and Others. Among these, Social Media Advertising has emerged as the leading sub-segment due to the widespread use of platforms like Facebook, Instagram, TikTok, and LinkedIn, which allow businesses to target specific demographics effectively. The increasing engagement rates and 100% social media penetration in the UAE have made this type of advertising particularly attractive for brands looking to enhance their visibility and connect with consumers .

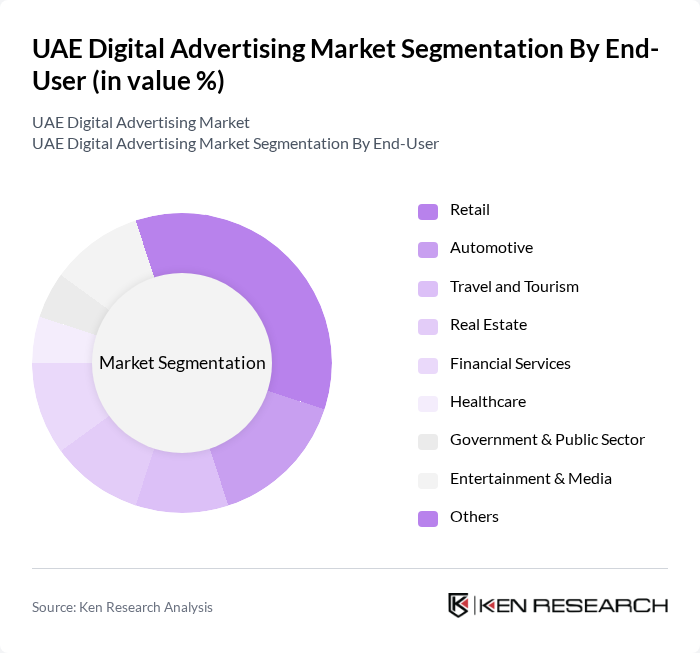

By End-User:The end-user segmentation of the digital advertising market includes Retail, Automotive, Travel and Tourism, Real Estate, Financial Services, Healthcare, Government & Public Sector, Entertainment & Media, and Others. The Retail sector is the dominant end-user, driven by the rapid growth of e-commerce and the need for brands to reach consumers through targeted digital campaigns. Retailers are increasingly leveraging digital advertising to promote their products, engage with customers, and drive online sales, making it a critical area for investment .

The UAE Digital Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Digital Marketing, AdFalcon, Socialize Agency, Nexa, Traffic Digital, Omnia Digital, WebTek Digital, The Media Lab, Blue Beetle, Qube Agency, The Online Project, Chain Reaction, Digital Farm, Grow Combine, Digital Gravity, Red Berries, Digital Nexa, McCollins Media, United SEO (USEO), Digital Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The UAE digital advertising market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As brands increasingly adopt artificial intelligence and machine learning for personalized advertising, the demand for innovative solutions will rise. Additionally, the integration of augmented reality in campaigns is expected to enhance user engagement. With a focus on sustainability, advertisers will likely prioritize eco-friendly practices, aligning with consumer values and regulatory expectations, shaping a more responsible advertising landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Mobile Advertising Native Advertising Full-Screen Interstitials Email Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Real Estate Financial Services Healthcare Government & Public Sector Entertainment & Media Others |

| By Platform | Social Media Platforms Search Engines Websites Mobile Apps Video Streaming Services Connected TV (CTV) & OTT Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Product Launch Campaigns Seasonal Promotions Influencer Marketing Campaigns Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Expat Communities Others |

| By Advertising Format | Text Ads Image Ads Video Ads Interactive Ads Rich Media Ads Others |

| By Budget Size | Small Budgets Medium Budgets Large Budgets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising Insights | 100 | Social Media Managers, Digital Marketing Strategists |

| Search Engine Marketing Effectiveness | 80 | SEO Specialists, PPC Campaign Managers |

| Display Advertising Performance | 60 | Brand Managers, Advertising Analysts |

| Consumer Engagement with Digital Ads | 90 | Market Researchers, Consumer Behavior Analysts |

| Emerging Digital Platforms Usage | 50 | Content Creators, Influencer Marketing Managers |

The UAE Digital Advertising Market is valued at approximately USD 3.3 billion, reflecting significant growth driven by increased internet and mobile device penetration, along with a shift in consumer behavior towards online platforms for shopping and information.