Region:Central and South America

Author(s):Dev

Product Code:KRAB5505

Pages:88

Published On:October 2025

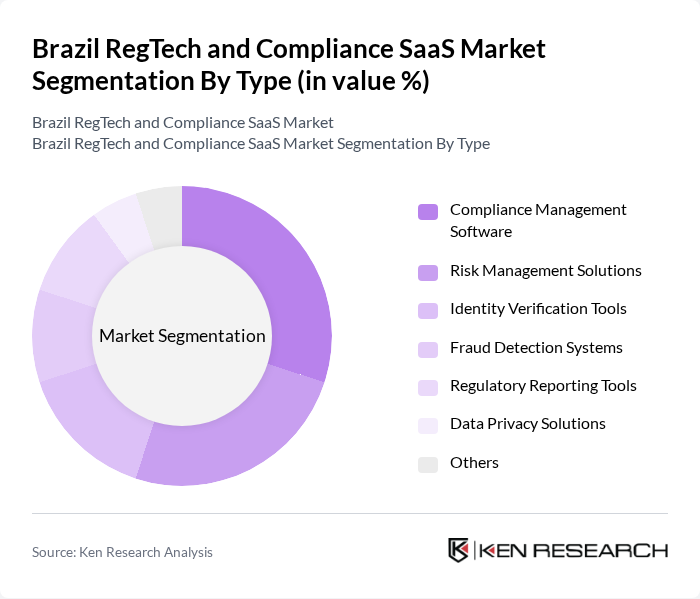

By Type:The market is segmented into various types of solutions that cater to different compliance needs. The primary subsegments include Compliance Management Software, Risk Management Solutions, Identity Verification Tools, Fraud Detection Systems, Regulatory Reporting Tools, Data Privacy Solutions, and Others. Each of these subsegments plays a crucial role in addressing specific regulatory challenges faced by organizations.

The Compliance Management Software subsegment is currently leading the market due to the increasing complexity of regulatory requirements and the need for organizations to streamline their compliance processes. Companies are increasingly adopting these solutions to automate compliance tasks, reduce manual errors, and ensure adherence to regulations. The demand for integrated compliance solutions that offer real-time monitoring and reporting capabilities is also on the rise, further solidifying the position of this subsegment in the market.

By End-User:The market is segmented based on the end-users of RegTech solutions, which include Financial Institutions, Insurance Companies, E-commerce Platforms, Healthcare Providers, Government Agencies, and Others. Each of these sectors has unique compliance requirements that drive the adoption of RegTech solutions.

Financial Institutions dominate the market due to their stringent regulatory requirements and the need for robust compliance frameworks. The increasing focus on anti-money laundering (AML) and know your customer (KYC) regulations has led to a surge in demand for RegTech solutions that can efficiently manage compliance processes. Additionally, the growing adoption of digital banking and fintech solutions has further accelerated the need for advanced compliance tools in this sector.

The Brazil RegTech and Compliance SaaS Market is characterized by a dynamic mix of regional and international players. Leading participants such as TOTVS S.A., Linx S.A., Sinqia S.A., Docket, KPMG Brazil, Deloitte Brazil, PwC Brazil, EY Brazil, B3 S.A., Grupo Boticário, Banco do Brasil S.A., Itaú Unibanco S.A., Bradesco S.A., XP Inc., StoneCo Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil RegTech and Compliance SaaS market is poised for significant evolution, driven by technological advancements and regulatory pressures. As organizations increasingly prioritize compliance and data security, the integration of artificial intelligence and machine learning into compliance solutions will become more prevalent. Additionally, the shift towards real-time reporting and customer-centric compliance strategies will reshape the landscape, enabling businesses to respond swiftly to regulatory changes and enhance operational efficiency in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Compliance Management Software Risk Management Solutions Identity Verification Tools Fraud Detection Systems Regulatory Reporting Tools Data Privacy Solutions Others |

| By End-User | Financial Institutions Insurance Companies E-commerce Platforms Healthcare Providers Government Agencies Others |

| By Deployment Model | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Compliance Area | Data Protection Compliance Financial Compliance Environmental Compliance Health and Safety Compliance |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Geographic Presence | Urban Areas Rural Areas Regional Markets |

| By Pricing Model | Subscription-Based Pricing Pay-Per-Use Pricing Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Compliance Solutions | 150 | Compliance Officers, Risk Managers |

| Insurance Industry RegTech Adoption | 100 | Regulatory Affairs Managers, IT Directors |

| FinTech Startups and Innovation | 80 | Founders, Product Managers |

| Data Protection and Privacy Compliance | 70 | Legal Advisors, Data Protection Officers |

| AML and KYC Solutions in Financial Services | 90 | AML Compliance Specialists, Operations Managers |

The Brazil RegTech and Compliance SaaS market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing regulatory requirements, the rise of digital financial services, and the need for enhanced compliance solutions to mitigate risks.