Region:Asia

Author(s):Shubham

Product Code:KRAB5595

Pages:90

Published On:October 2025

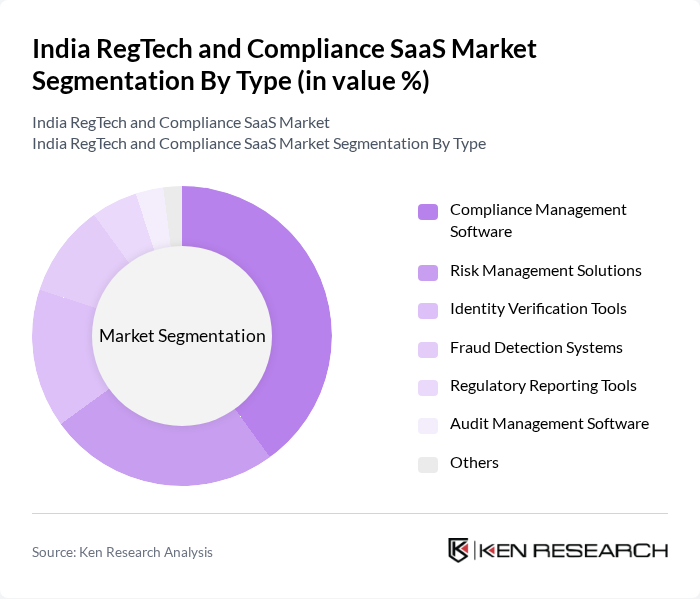

By Type:The market is segmented into various types of solutions that cater to different compliance needs. The primary subsegments include Compliance Management Software, Risk Management Solutions, Identity Verification Tools, Fraud Detection Systems, Regulatory Reporting Tools, Audit Management Software, and Others. Among these, Compliance Management Software is currently leading the market due to the increasing need for organizations to adhere to complex regulatory requirements and manage compliance risks effectively.

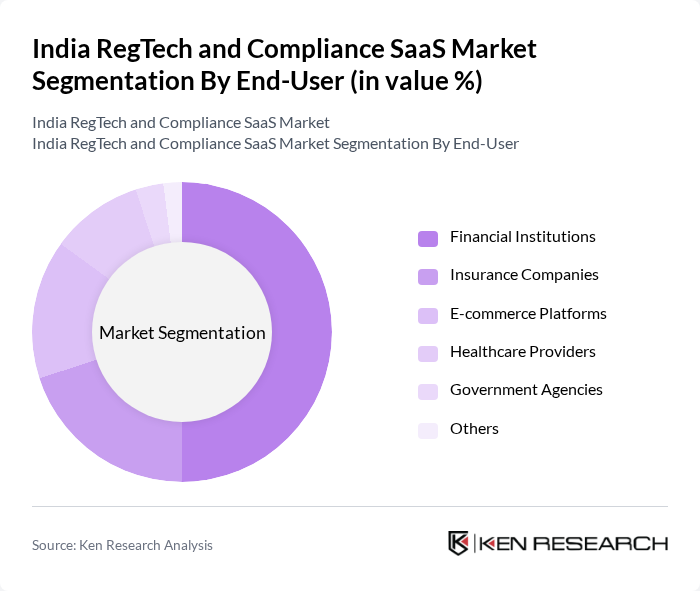

By End-User:The end-user segmentation includes Financial Institutions, Insurance Companies, E-commerce Platforms, Healthcare Providers, Government Agencies, and Others. Financial Institutions dominate this segment as they require robust compliance solutions to navigate the complex regulatory landscape and manage risks associated with financial transactions.

The India RegTech and Compliance SaaS Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoho Corporation, Freshworks Inc., Signzy Technologies, Razorpay, PayU India, FSS (Financial Software and Systems), ComplyAdvantage, Riskified, KYC Portal, Cygnet Infotech, Aujas Networks, InfrasoftTech, Intellect Design Arena, TCS (Tata Consultancy Services), Wipro Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India RegTech and Compliance SaaS market appears promising, driven by technological advancements and increasing regulatory scrutiny. As organizations prioritize compliance, the demand for innovative solutions will likely rise. The integration of artificial intelligence and machine learning into compliance tools is expected to enhance efficiency and accuracy. Furthermore, the ongoing digital transformation in financial services will create new opportunities for RegTech providers to offer tailored solutions that meet evolving regulatory requirements and customer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Compliance Management Software Risk Management Solutions Identity Verification Tools Fraud Detection Systems Regulatory Reporting Tools Audit Management Software Others |

| By End-User | Financial Institutions Insurance Companies E-commerce Platforms Healthcare Providers Government Agencies Others |

| By Industry Vertical | Banking Insurance Retail Telecommunications Energy and Utilities Others |

| By Deployment Model | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee |

| By Geographic Presence | North India South India East India West India |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Compliance Solutions | 100 | Compliance Officers, Risk Managers |

| Insurance Regulatory Technology | 80 | Underwriting Managers, Compliance Analysts |

| Financial Services SaaS Adoption | 90 | IT Managers, Chief Technology Officers |

| Investment Firms Compliance Practices | 70 | Compliance Directors, Legal Advisors |

| FinTech Regulatory Challenges | 85 | Founders, Regulatory Affairs Specialists |

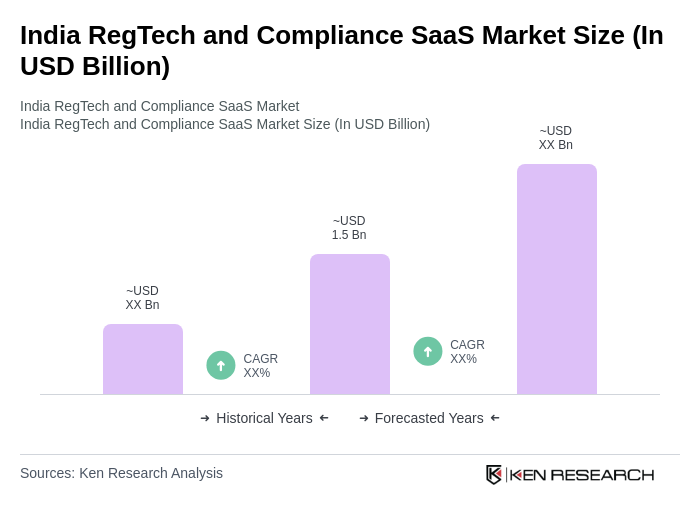

The India RegTech and Compliance SaaS Market is valued at approximately USD 1.5 billion, driven by increasing regulatory requirements, the rise of digital financial services, and the need for enhanced compliance solutions to mitigate risks associated with fraud and data breaches.