Region:Central and South America

Author(s):Dev

Product Code:KRAB4207

Pages:88

Published On:October 2025

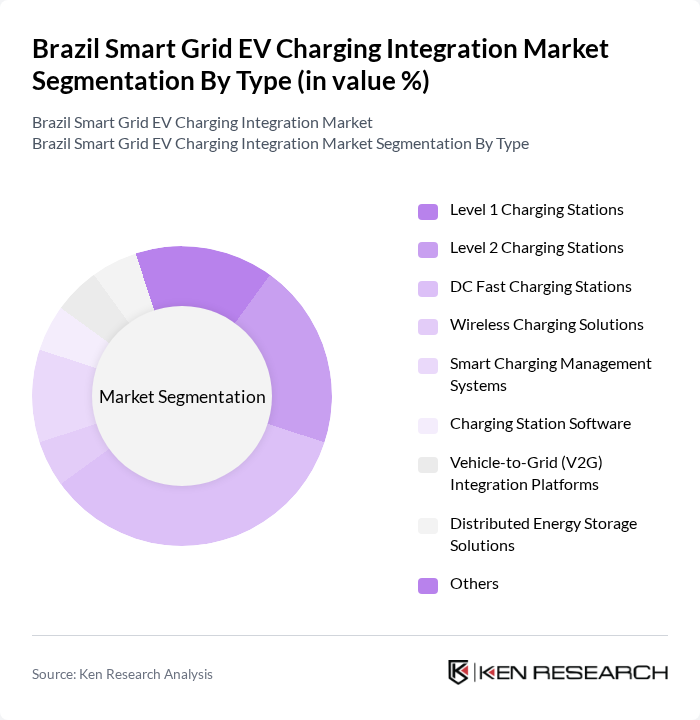

By Type:The market is segmented into various types of charging solutions, including Level 1 Charging Stations, Level 2 Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Smart Charging Management Systems, Charging Station Software, Vehicle-to-Grid (V2G) Integration Platforms, Distributed Energy Storage Solutions, and Others. Among these, DC Fast Charging Stations are gaining traction due to their ability to deliver rapid charging, addressing the growing demand for efficient EV charging in urban and intercity corridors. The adoption of smart charging management systems and V2G platforms is also rising, driven by the need for grid flexibility and integration of distributed renewables .

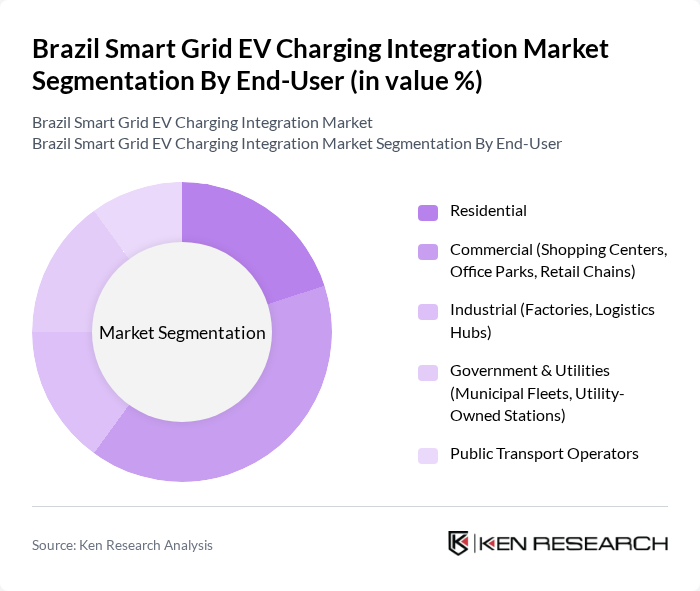

By End-User:The market is segmented by end-users, including Residential, Commercial (Shopping Centers, Office Parks, Retail Chains), Industrial (Factories, Logistics Hubs), Government & Utilities (Municipal Fleets, Utility-Owned Stations), and Public Transport Operators. The Commercial segment leads due to the increasing installation of charging stations in shopping centers, office parks, and retail chains, driven by the need for convenient charging solutions for employees, customers, and fleet vehicles. Industrial and government segments are also expanding, supported by fleet electrification and utility-led infrastructure projects .

The Brazil Smart Grid EV Charging Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eletrobras, Enel Brasil, CPFL Energia, Engie Brasil, Light S.A., Neoenergia, Equatorial Energia, AES Brasil, Siemens Brasil, Schneider Electric Brasil, ABB Brasil, BYD Brasil, Volvo Car Brasil, WEG S.A., NeoCharge, Tupinambá Energia, Electric Mobility Brasil, Zletric, BMW Group Brasil, Nissan do Brasil, Volkswagen do Brasil, Porsche Brasil, Shell Recharge Brasil, Raízen, Ipiranga contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil Smart Grid EV Charging Integration Market appears promising, driven by increasing electric vehicle adoption and supportive government policies. As the country aims to enhance its EV infrastructure, the integration of smart grid technologies will play a pivotal role in optimizing energy distribution and charging efficiency. Furthermore, the collaboration between public and private sectors is expected to accelerate the development of innovative charging solutions, paving the way for a more sustainable transportation ecosystem in Brazil.

| Segment | Sub-Segments |

|---|---|

| By Type | Level 1 Charging Stations Level 2 Charging Stations DC Fast Charging Stations Wireless Charging Solutions Smart Charging Management Systems Charging Station Software Vehicle-to-Grid (V2G) Integration Platforms Distributed Energy Storage Solutions Others |

| By End-User | Residential Commercial (Shopping Centers, Office Parks, Retail Chains) Industrial (Factories, Logistics Hubs) Government & Utilities (Municipal Fleets, Utility-Owned Stations) Public Transport Operators |

| By Region | Southeast Brazil South Brazil North Brazil Central-West Brazil Northeast Brazil |

| By Technology | Smart Meters Energy Management Systems Communication Technologies (OCPP, IoT, 5G) Data Analytics Tools Renewable Energy Integration Systems |

| By Application | Fleet Charging Public Charging Workplace Charging Home Charging Highway Corridor Charging |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Utility-Led Investments |

| By Policy Support | Subsidies for Charging Infrastructure Tax Incentives for EV Purchases Renewable Energy Certificates (RECs) Grants for Research and Development National Electric Mobility Plan Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies' Smart Grid Initiatives | 60 | Energy Managers, Project Directors |

| EV Charging Station Operators | 50 | Operations Managers, Business Development Executives |

| Government Policy Makers | 40 | Regulatory Affairs Specialists, Urban Planners |

| Automotive Manufacturers' EV Strategies | 45 | Product Managers, R&D Directors |

| Consumer Insights on EV Usage | 100 | EV Owners, Potential EV Buyers |

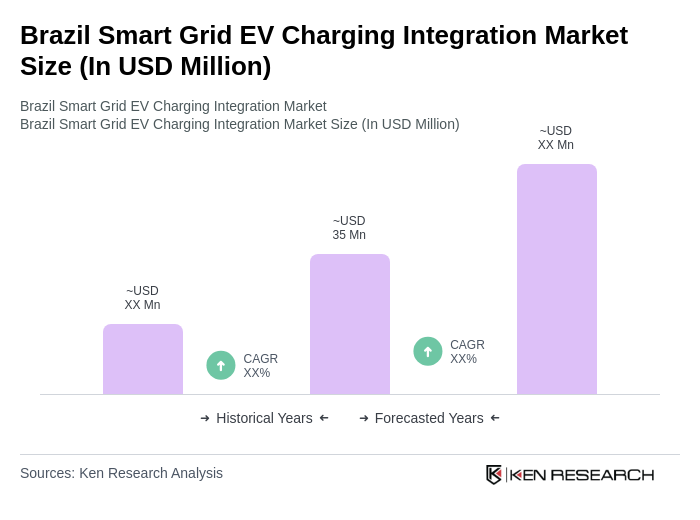

The Brazil Smart Grid EV Charging Integration Market is valued at approximately USD 35 million, driven by the rapid adoption of electric vehicles, government incentives for sustainable energy, and advancements in smart grid technologies.