Region:Central and South America

Author(s):Dev

Product Code:KRAB5410

Pages:86

Published On:October 2025

Market.png)

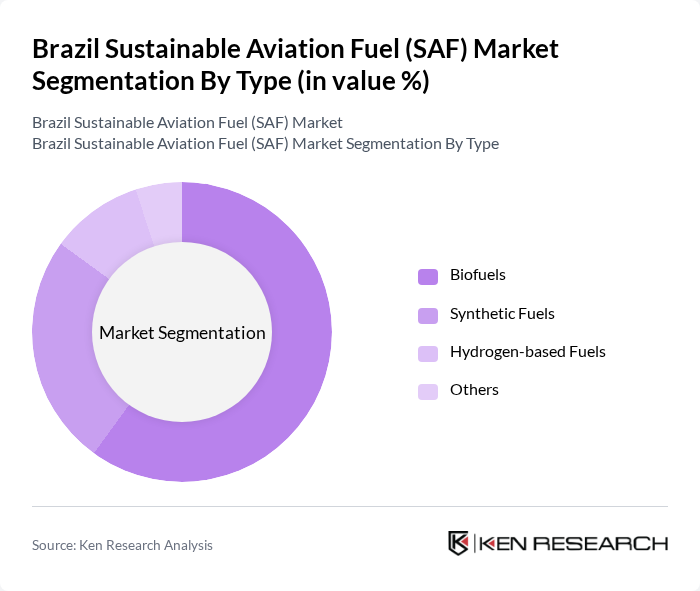

By Type:The market is segmented into various types of sustainable aviation fuels, including biofuels, synthetic fuels, hydrogen-based fuels, and others. Among these, biofuels are currently the most dominant segment due to their established production processes and compatibility with existing aviation infrastructure. The increasing focus on reducing carbon footprints and the availability of feedstock in Brazil further bolster the demand for biofuels. Synthetic fuels and hydrogen-based fuels are emerging but still face challenges in terms of production scalability and cost-effectiveness.

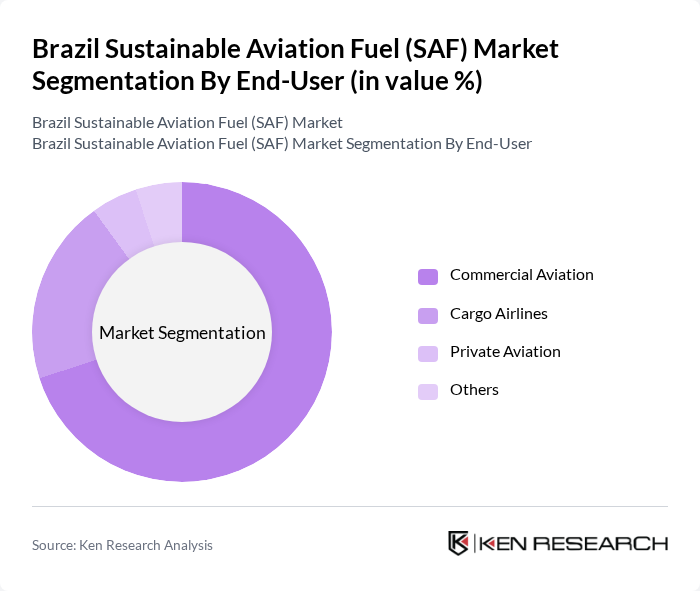

By End-User:The end-user segmentation includes commercial aviation, cargo airlines, private aviation, and others. Commercial aviation is the leading segment, driven by the high volume of passenger traffic and the increasing pressure on airlines to adopt sustainable practices. Cargo airlines are also significant users of SAF, as they seek to enhance their sustainability credentials. Private aviation, while smaller in volume, is growing as affluent consumers demand greener travel options.

The Brazil Sustainable Aviation Fuel (SAF) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Embraer S.A., Azul Linhas Aéreas Brasileiras S.A., Gol Linhas Aéreas Inteligentes S.A., LATAM Airlines Brasil S.A., Petrobras S.A., Raízen S.A., Granbio Investimentos S.A., Biocombustíveis do Brasil S.A., Acelen S.A., TotalEnergies S.A., Shell Brasil Ltda., Neste Corporation, Gevo, Inc., LanzaTech, Inc., World Energy Holdings LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazilian SAF market appears promising, driven by increasing regulatory support and a growing commitment to sustainability within the aviation sector. As airlines seek to meet carbon neutrality goals, investments in SAF production technologies are expected to rise. Additionally, collaborations between government and private sectors will likely enhance infrastructure development, facilitating broader SAF adoption. The market is poised for growth, with a focus on innovation and sustainable practices shaping its trajectory in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Biofuels Synthetic Fuels Hydrogen-based Fuels Others |

| By End-User | Commercial Aviation Cargo Airlines Private Aviation Others |

| By Application | Domestic Flights International Flights Charter Services Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Credits (RECs) Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline Sustainability Initiatives | 100 | Chief Sustainability Officers, Fleet Managers |

| Biofuel Production Insights | 80 | Production Managers, R&D Directors |

| Regulatory Framework Analysis | 60 | Policy Makers, Environmental Consultants |

| Market Demand for SAF | 90 | Airline Operations Managers, Fuel Procurement Officers |

| Technological Innovations in SAF | 70 | Technology Developers, Industry Analysts |

The Brazil Sustainable Aviation Fuel (SAF) Market is valued at approximately USD 1.2 billion, driven by increasing environmental regulations, rising fuel prices, and airlines' commitment to reducing carbon emissions. This market is expected to grow as Brazil enhances its renewable energy initiatives.