Region:Global

Author(s):Rebecca

Product Code:KRAB4164

Pages:93

Published On:October 2025

Market.png)

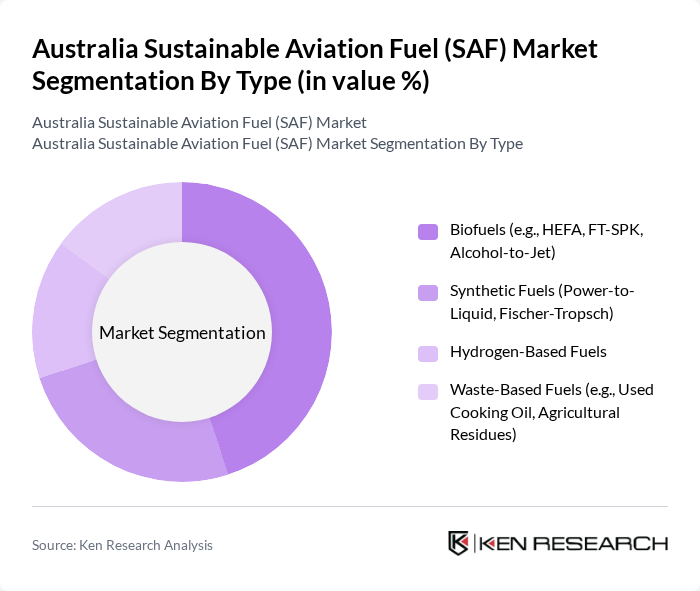

By Type:The market is segmented into biofuels, synthetic fuels, hydrogen-based fuels, and waste-based fuels. Each type offers distinct characteristics and applications, serving different aviation industry needs. Biofuels, particularly those produced from hydroprocessed esters and fatty acids (HEFA), dominate due to compatibility with existing jet engines and infrastructure. Synthetic fuels, including power-to-liquid and Fischer-Tropsch products, are gaining traction as technology matures. Hydrogen-based and waste-derived fuels represent emerging segments, with ongoing research to improve scalability and cost-effectiveness .

The biofuels segment leads the market, supported by the availability of feedstocks such as used cooking oil and agricultural residues, and by advancements in production technology. Airlines prefer biofuels for their ability to reduce greenhouse gas emissions and their drop-in compatibility with current aviation infrastructure. Ongoing research and investment are further enhancing the efficiency and cost-competitiveness of biofuels, making them the preferred option for airlines aiming to achieve sustainability targets .

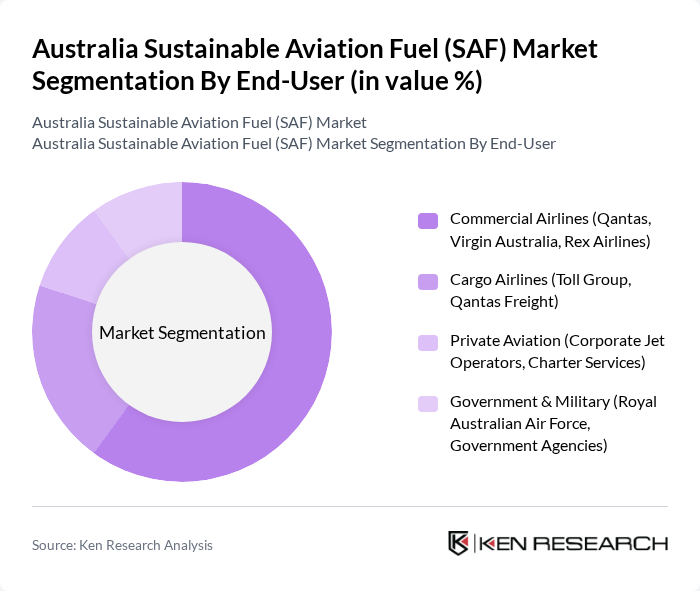

By End-User:End-user segments include commercial airlines, cargo airlines, private aviation, and government & military. Each segment has unique fuel requirements and sustainability objectives. Commercial airlines are the largest consumers of SAF, driven by regulatory compliance and corporate sustainability commitments. Cargo airlines are increasingly adopting SAF as supply chains and logistics operators prioritize emissions reduction. Private aviation and government/military sectors are also incorporating SAF, though at a smaller scale .

Commercial airlines are the primary end-users of sustainable aviation fuel, motivated by sustainability targets and regulatory requirements to reduce carbon emissions. Leading airlines such as Qantas and Virgin Australia have made significant investments in SAF procurement and partnerships. The cargo airline segment is expanding as logistics providers recognize the importance of decarbonizing their operations. Private aviation and government/military use of SAF is growing, supported by pilot programs and public sector commitments .

The Australia Sustainable Aviation Fuel (SAF) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qantas Airways Limited, Virgin Australia Airlines Pty Ltd, Rex Airlines Pty Ltd, Shell Australia Pty Ltd, BP Australia Pty Ltd, Ampol Limited, Viva Energy Australia Pty Ltd, LanzaJet Inc., Gevo, Inc., World Energy, LLC, Neste Oyj, Renewable Energy Group, Inc., Velocys plc, Aemetis, Inc., Licella Holdings Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Sustainable Aviation Fuel market appears promising, driven by increasing investments in technology and infrastructure. As airlines commit to sustainability goals, the demand for SAF is expected to rise significantly. By future, the Australian government aims to have established a comprehensive SAF supply chain, enhancing accessibility. Additionally, collaboration among stakeholders, including airlines, fuel producers, and government bodies, will be crucial in overcoming existing challenges and fostering a robust SAF ecosystem in the aviation sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Biofuels (e.g., HEFA, FT-SPK, Alcohol-to-Jet) Synthetic Fuels (Power-to-Liquid, Fischer-Tropsch) Hydrogen-Based Fuels Waste-Based Fuels (e.g., Used Cooking Oil, Agricultural Residues) |

| By End-User | Commercial Airlines (Qantas, Virgin Australia, Rex Airlines) Cargo Airlines (Toll Group, Qantas Freight) Private Aviation (Corporate Jet Operators, Charter Services) Government & Military (Royal Australian Air Force, Government Agencies) |

| By Application | Domestic Flights International Flights Charter Services Emergency & Humanitarian Flights |

| By Distribution Channel | Direct Sales (Producer to Airline) Partnerships with Airlines Fuel Suppliers (Viva Energy, Ampol) Airport Refueling Infrastructure |

| By Investment Source | Private Investments (Venture Capital, Corporate) Government Funding (ARENA, CEFC) International Grants (UN, ICAO, IATA) Strategic Joint Ventures |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Blending Mandates & Quotas |

| By Technology | Fischer-Tropsch Synthesis (FT-SPK) Hydroprocessed Esters and Fatty Acids (HEFA-SPK) Alcohol-to-Jet Technology (ATJ-SPK) Gasification & Pyrolysis |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline Fuel Procurement | 90 | Fuel Managers, Procurement Officers |

| Aviation Regulatory Bodies | 45 | Policy Makers, Regulatory Analysts |

| SAF Production Facilities | 60 | Plant Managers, Operations Directors |

| Environmental NGOs | 40 | Sustainability Advocates, Research Analysts |

| Airports and Ground Services | 55 | Airport Operations Managers, Ground Service Providers |

The Australia Sustainable Aviation Fuel (SAF) Market is valued at approximately USD 1.1 billion, driven by government initiatives, consumer demand for eco-friendly travel, and investments in SAF production technologies and infrastructure.