Region:North America

Author(s):Geetanshi

Product Code:KRAD0134

Pages:100

Published On:August 2025

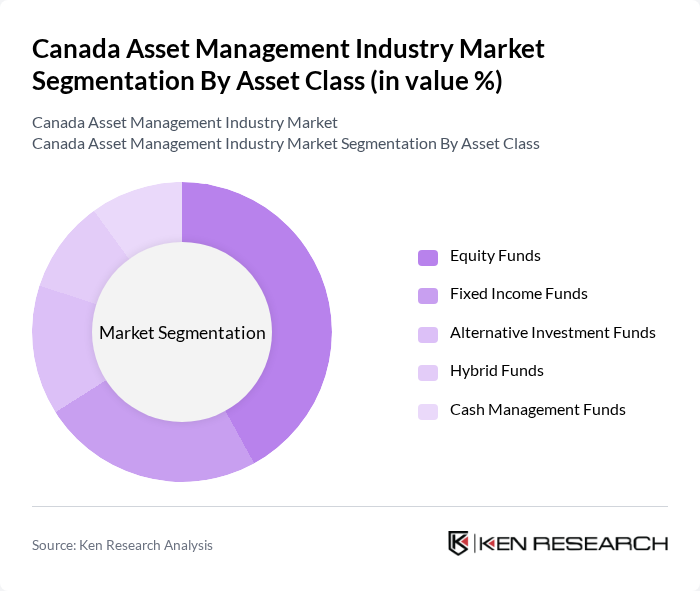

By Asset Class:The asset class segmentation includes various types of funds that cater to different investment strategies and risk profiles. The subsegments are Equity Funds, Fixed Income Funds, Alternative Investment Funds, Hybrid Funds, and Cash Management Funds. Among these, Equity Funds continue to dominate the market, commanding the largest share due to their potential for higher returns and strong performance in both retail and institutional portfolios. Cash Management Funds have also emerged as the fastest-growing segment, driven by increased demand for liquidity and low-risk investment options.

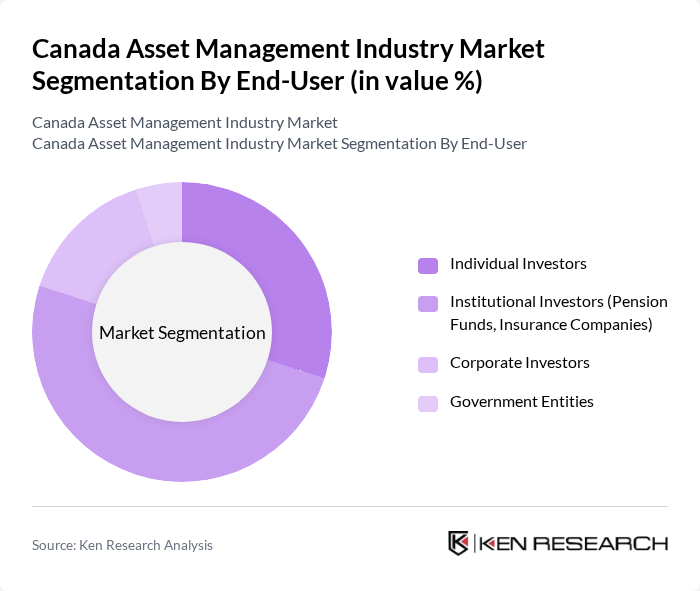

By End-User:The end-user segmentation encompasses various types of investors, including Individual Investors, Institutional Investors (Pension Funds, Insurance Companies), Corporate Investors, and Government Entities. Institutional Investors are the leading segment, driven by their substantial capital and the need for professional management of large portfolios, which often leads to higher allocations in asset management services.

The Canada Asset Management Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as RBC Global Asset Management, TD Asset Management, BMO Global Asset Management, CIBC Asset Management, Manulife Investment Management, Fidelity Investments Canada, Invesco Canada, Franklin Templeton Investments, BlackRock Canada, AGF Investments, Mackenzie Investments, CI Global Asset Management, Scotia Wealth Management, Desjardins Investments, Sun Life Global Investments contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian asset management industry appears promising, driven by evolving investor preferences and technological advancements. As the market adapts to the increasing demand for sustainable investments, firms are likely to enhance their ESG offerings. Additionally, the rise of digital asset management solutions will facilitate greater accessibility and efficiency, attracting a broader range of investors. These trends indicate a dynamic landscape where innovation and client-centric approaches will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Asset Class | Equity Funds Fixed Income Funds Alternative Investment Funds Hybrid Funds Cash Management Funds |

| By End-User | Individual Investors Institutional Investors (Pension Funds, Insurance Companies) Corporate Investors Government Entities |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Strategic Asset Allocation |

| By Fund Size | Small Cap Funds Mid Cap Funds Large Cap Funds Multi-Cap Funds |

| By Distribution Channel | Direct Sales Financial Advisors Online Platforms Institutional Sales |

| By Geographic Focus | Domestic Investments International Investments Emerging Markets Developed Markets |

| By Risk Profile | Conservative Funds Moderate Funds Aggressive Funds Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Equity Fund Managers | 60 | Portfolio Managers, Investment Analysts |

| Fixed Income Asset Managers | 50 | Bond Traders, Risk Management Officers |

| Alternative Investment Advisors | 40 | Hedge Fund Managers, Private Equity Executives |

| Institutional Investor Representatives | 55 | Pension Fund Managers, Endowment Fund Directors |

| Retail Investment Advisors | 45 | Financial Planners, Wealth Management Advisors |

The Canada Asset Management Industry Market is valued at approximately USD 2.0 trillion, driven by factors such as the increasing number of high-net-worth individuals and a growing interest in alternative investments.