Region:Asia

Author(s):Shubham

Product Code:KRAA1848

Pages:87

Published On:August 2025

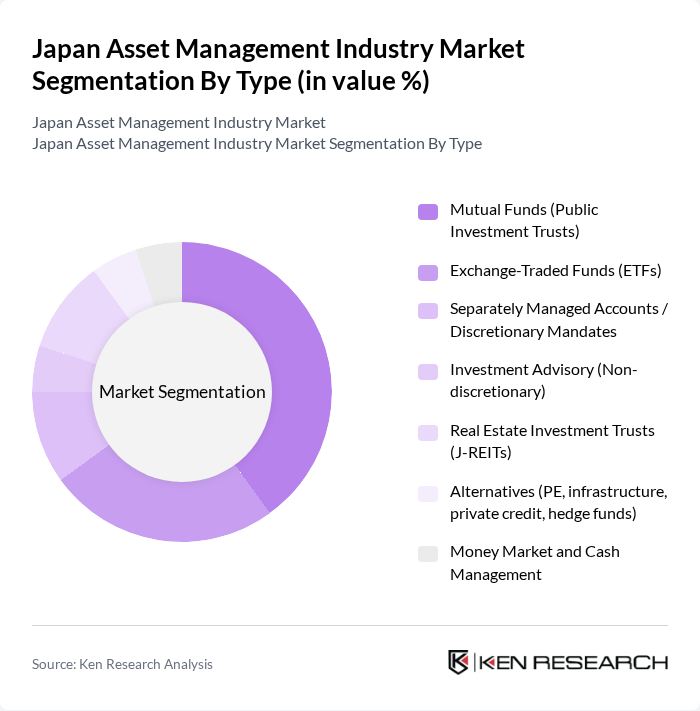

By Type:The asset management market in Japan is segmented into various types, including Mutual Funds (Public Investment Trusts), Exchange-Traded Funds (ETFs), Separately Managed Accounts / Discretionary Mandates, Investment Advisory (Non-discretionary), Real Estate Investment Trusts (J-REITs), Alternatives (PE, infrastructure, private credit, hedge funds), and Money Market and Cash Management. Among these, Mutual Funds and ETFs are particularly dominant due to their accessibility and popularity among retail investors.

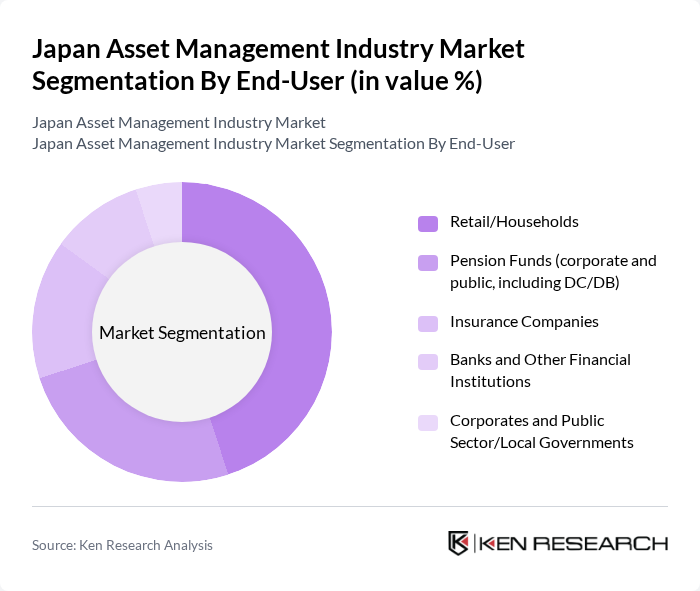

By End-User:The end-user segmentation of the asset management market includes Retail/Households, Pension Funds (corporate and public, including DC/DB), Insurance Companies, Banks and Other Financial Institutions, and Corporates and Public Sector/Local Governments. Retail clients are the largest segment, driven by increasing financial literacy, tax-advantaged programs for individuals, and the growing trend of individual investment through mutual funds and ETFs.

The Japan Asset Management Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nomura Asset Management Co., Ltd., Dai-ichi Life Asset Management Co., Ltd., Sumitomo Mitsui Trust Asset Management Co., Ltd., Mitsubishi UFJ Trust and Banking Corporation, Resona Asset Management Co., Ltd., Japan Post Investment Corporation, SBI Asset Management Co., Ltd., Tokio Marine Asset Management Co., Ltd., Manulife Investment Management (Japan) Limited, Aizawa Asset Management Co., Ltd., ORIX Asset Management Corporation, Mizuho Trust & Banking Co., Ltd., Nikko Asset Management Co., Ltd., Franklin Templeton Investments Japan Limited, BlackRock Japan Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Japan asset management industry is poised for significant transformation as it adapts to demographic shifts and technological advancements. By future, the focus on sustainable investing and ESG principles will likely reshape investment strategies, with ESG assets projected to exceed ¥30 trillion ($270 billion). Additionally, the rise of digital platforms and robo-advisors will enhance accessibility and client engagement, driving growth. Firms that embrace innovation and prioritize client-centric approaches will be well-positioned to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mutual Funds (Public Investment Trusts) Exchange-Traded Funds (ETFs) Separately Managed Accounts / Discretionary Mandates Investment Advisory (Non-discretionary) Real Estate Investment Trusts (J-REITs) Alternatives (PE, infrastructure, private credit, hedge funds) Money Market and Cash Management |

| By End-User | Retail/Households Pension Funds (corporate and public, including DC/DB) Insurance Companies Banks and Other Financial Institutions Corporates and Public Sector/Local Governments |

| By Investment Strategy | Active Management Passive/Index Management Quantitative/Systematic Strategies Multi-Asset (Tactical and Strategic Asset Allocation) ESG/Sustainable and Thematic Strategies |

| By Asset Class | Equity Fixed Income Cash/Money Market Alternatives (PE, real assets, hedge funds, private credit) Multi-Asset/Balanced |

| By Distribution Channel | Banks (megabanks, regional banks) Securities Brokers/IFA Online/Brokerage Platforms and Robo-Advisors Direct/Institutional Mandates |

| By Client Type | Retail Clients High Net Worth Individuals (HNWIs) and Family Offices Corporate Pensions (DB/DC) Public Pensions (e.g., GPIF) Financial Institutions and Insurance General Accounts |

| By Regulatory Framework | Financial Instruments and Exchange Act (FIEA) Investment Trusts and Investment Corporations Act (ITICA) Stewardship Code and Corporate Governance Code Tax Regimes (NISA, iDeCo, fund taxation) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Asset Management | 120 | Portfolio Managers, Chief Investment Officers |

| Retail Investment Products | 100 | Financial Advisors, Wealth Managers |

| Alternative Investments | 80 | Hedge Fund Managers, Private Equity Executives |

| Pension Fund Management | 70 | Pension Fund Administrators, Risk Managers |

| Regulatory Compliance in Asset Management | 60 | Compliance Officers, Legal Advisors |

The Japan Asset Management Industry Market is valued at approximately USD 6.87.2 trillion, reflecting around one thousand trillion yen in assets under management (AUM) by asset management companies, driven by increasing investor interest and digital platforms.