Region:North America

Author(s):Geetanshi

Product Code:KRAB3348

Pages:94

Published On:October 2025

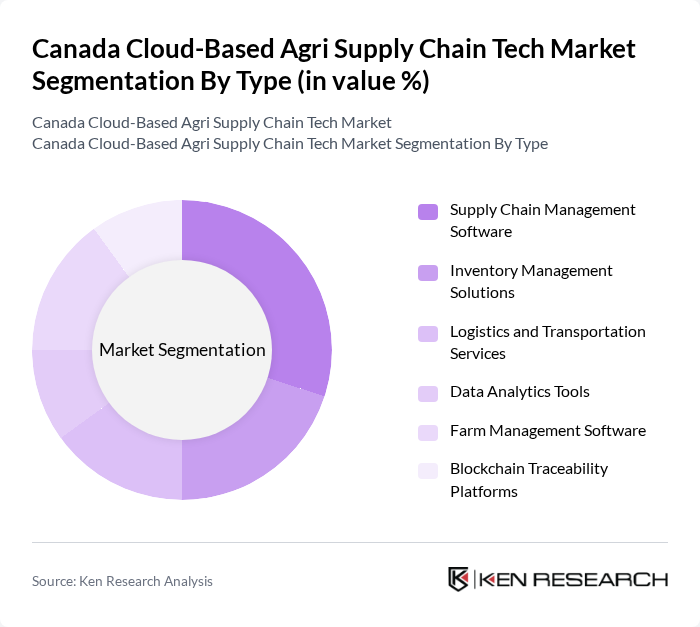

By Type:The market is segmented into Supply Chain Management Software, Inventory Management Solutions, Logistics and Transportation Services, Data Analytics Tools, Farm Management Software, and Blockchain Traceability Platforms. Each segment plays a critical role in driving operational efficiency, traceability, and transparency across the agricultural supply chain. Supply Chain Management Software and Data Analytics Tools are particularly important for enabling real-time monitoring, forecasting, and optimization of logistics and inventory, while Blockchain Traceability Platforms are increasingly adopted to ensure food safety and regulatory compliance .

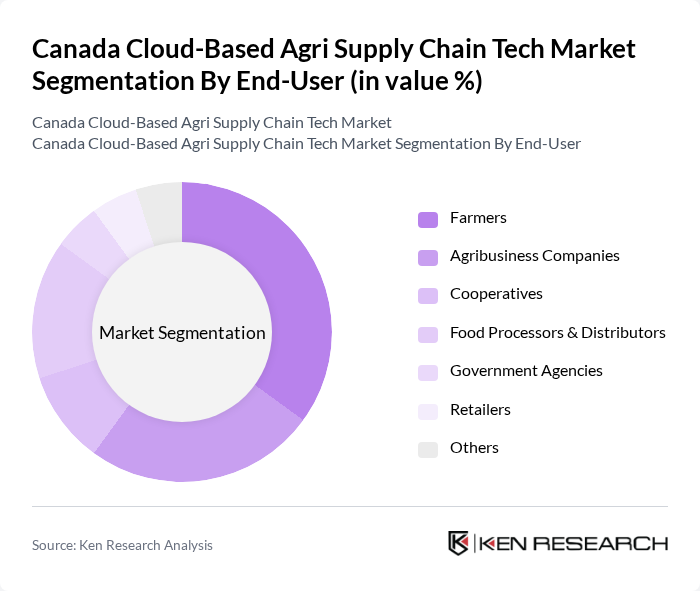

By End-User:The end-user segmentation includes Farmers, Agribusiness Companies, Cooperatives, Food Processors & Distributors, Government Agencies, Retailers, and Others. Farmers and agribusiness companies are the primary adopters, leveraging cloud-based solutions for resource optimization, yield forecasting, and regulatory compliance. Food processors and distributors utilize these technologies to enhance traceability and ensure product quality, while government agencies focus on supply chain transparency and food safety standards .

The Canada Cloud-Based Agri Supply Chain Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Farmonaut, TELUS Agriculture & Consumer Goods, Farmers Edge, Bayer Crop Science (Climate FieldView), BASF Digital Farming, Ukko Agro, Miraterra Soil, Precision AI, AgriWebb, Trimble Ag Software, Ceres Global Ag Corp, Nutrien, John Deere, Syngenta, Raven Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada Cloud-Based Agri Supply Chain Tech market appears promising, driven by technological advancements and increasing consumer demand for transparency in food sourcing. In future, the integration of AI and machine learning is expected to enhance predictive analytics capabilities, allowing farmers to make informed decisions. Additionally, the rise of collaborative platforms will facilitate better communication among stakeholders, fostering innovation and efficiency in the supply chain, ultimately benefiting the entire agricultural ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Supply Chain Management Software Inventory Management Solutions Logistics and Transportation Services Data Analytics Tools Farm Management Software Blockchain Traceability Platforms |

| By End-User | Farmers Agribusiness Companies Cooperatives Food Processors & Distributors Government Agencies Retailers Others |

| By Application | Crop Management Livestock Management Supply Chain Optimization Market Access and Distribution Regulatory Compliance & Reporting Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors and Resellers System Integrators Others |

| By Region | Western Canada Central Canada Eastern Canada Northern Canada Others |

| By Business Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Investment Source | Private Investments Government Grants Venture Capital Corporate Investments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Solutions for Crop Management | 100 | Agricultural Technologists, Farm Managers |

| Supply Chain Optimization Tools | 80 | Logistics Coordinators, Supply Chain Analysts |

| Data Analytics in Agriculture | 60 | Data Scientists, Agronomists |

| IoT Integration in Farming | 50 | Farm Equipment Operators, Technology Specialists |

| Cloud-Based Inventory Management | 70 | Inventory Managers, Procurement Specialists |

The Canada Cloud-Based Agri Supply Chain Tech Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the adoption of digital technologies in agriculture, including cloud-based platforms and AI-powered analytics.