Region:Middle East

Author(s):Dev

Product Code:KRAD1799

Pages:89

Published On:November 2025

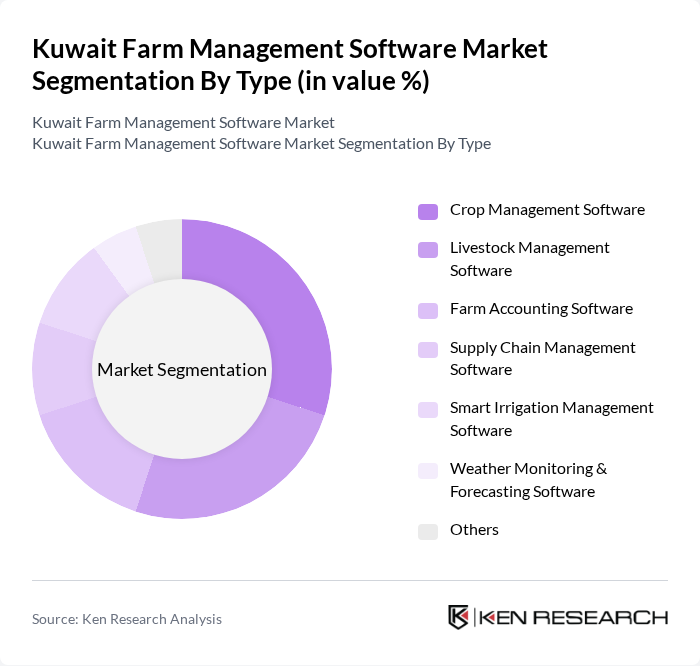

By Type:The market is segmented into various types of software solutions that address distinct aspects of farm management. Subsegments include Crop Management Software, which enables planning, planting, and yield tracking; Livestock Management Software for animal health and productivity monitoring; Farm Accounting Software for financial management and compliance; Supply Chain Management Software for logistics and inventory; Smart Irrigation Management Software for water resource optimization; Weather Monitoring & Forecasting Software for risk mitigation; and Others, covering niche and emerging applications. Each subsegment is integral to enhancing operational efficiency and sustainability in Kuwait’s agricultural sector.

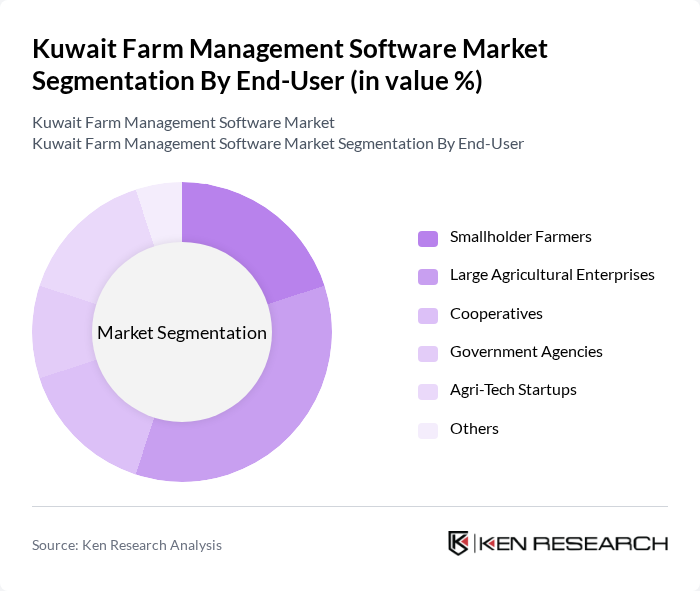

By End-User:The end-user segmentation comprises Smallholder Farmers, Large Agricultural Enterprises, Cooperatives, Government Agencies, Agri-Tech Startups, and Others. Smallholder Farmers increasingly adopt mobile-based solutions for resource optimization; Large Agricultural Enterprises leverage integrated platforms for scale and compliance; Cooperatives utilize collaborative management tools; Government Agencies focus on regulatory oversight and subsidy management; Agri-Tech Startups drive innovation and digital transformation; Others include research institutions and service providers. These segments reflect the diverse operational requirements and technology adoption patterns in Kuwait’s agricultural landscape.

The Kuwait Farm Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ag Leader Technology, Trimble Inc., Cropio, FarmLogs (Bushel Farm), Granular (Corteva Agriscience), Raven Industries, John Deere (Deere & Company), Climate Corporation (Bayer Crop Science), Taranis, FieldView (Bayer Crop Science), SmartFarm, AgriWebb, CropX, AgriTask, Agrivi, FarmERP (Shivrai Technologies), AgNext, and Local Kuwaiti Providers (e.g., Kuwait Agriculture Company, Wafra Farms - for digital solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait farm management software market appears promising, driven by technological advancements and increasing government support. As farmers become more aware of the benefits of precision agriculture, the adoption of cloud-based solutions and IoT technologies is expected to rise. Additionally, the integration of AI and machine learning will enhance data analytics capabilities, allowing for more informed decision-making. This evolution will likely lead to improved agricultural productivity and sustainability in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Crop Management Software Livestock Management Software Farm Accounting Software Supply Chain Management Software Smart Irrigation Management Software Weather Monitoring & Forecasting Software Others |

| By End-User | Smallholder Farmers Large Agricultural Enterprises Cooperatives Government Agencies Agri-Tech Startups Others |

| By Crop Type | Cereals and Grains Fruits and Vegetables Oilseeds Greenhouse Crops Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid Mobile-Based Others |

| By Functionality | Farm Planning Inventory Management Financial Management Compliance & Traceability Equipment & Resource Management Others |

| By Region | Al Asimah Hawalli Ahmadi Farwaniya Mubarak Al-Kabeer Jahra Others |

| By User Type | Individual Farmers Agricultural Consultants Agribusiness Companies Research Institutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Management Software Users | 70 | Farm Owners, Agronomists |

| Livestock Management Software Users | 60 | Livestock Farmers, Veterinary Technicians |

| Agri-Tech Software Developers | 40 | Software Engineers, Product Managers |

| Government Agricultural Policy Makers | 40 | Policy Analysts, Agricultural Advisors |

| Consultants in Agricultural Technology | 50 | Agri-Tech Consultants, Business Development Managers |

The Kuwait Farm Management Software Market is valued at approximately USD 11 million, reflecting a five-year historical analysis. This growth is driven by the adoption of advanced technologies in agriculture, enhancing productivity and operational efficiency.