Region:North America

Author(s):Geetanshi

Product Code:KRAA1325

Pages:93

Published On:August 2025

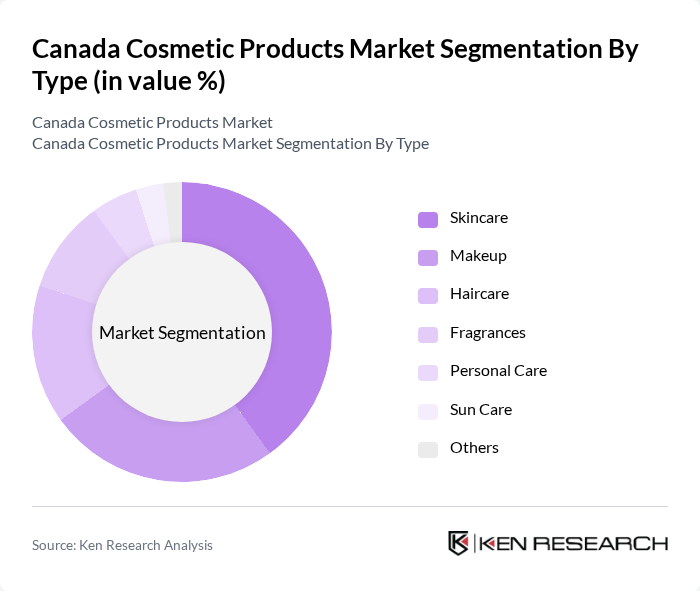

By Type:The market is segmented into various types, including Skincare, Makeup, Haircare, Fragrances, Personal Care, Sun Care, and Others. Skincare products represent the largest segment, driven by increasing awareness of skin health, rising demand for anti-aging and moisturizing products, and the influence of beauty influencers and social media. Innovation in product formulations and the introduction of multifunctional skincare items have further accelerated growth in this segment. Makeup and haircare also maintain significant shares, reflecting ongoing consumer interest in personal appearance and grooming .

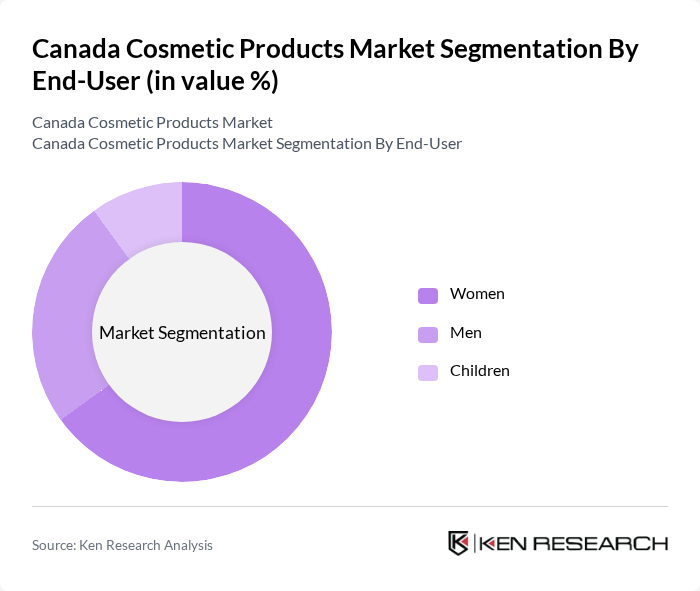

By End-User:The market is categorized into Women, Men, and Children. The Women segment holds the largest share, supported by a higher propensity to purchase cosmetic products and a broader range of offerings tailored to their preferences. The Men segment is expanding due to the growing trend of male grooming and increased marketing of men’s skincare and personal care products. The Children segment remains niche but is gradually growing with the introduction of safe and gentle products designed for younger skin .

The Canada Cosmetic Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Canada Inc., Estée Lauder Companies Inc., Revlon Canada Inc., Coty Inc., Procter & Gamble Canada, Shiseido Canada, Unilever Canada, Avon Canada, Mary Kay Cosmetics Ltd., Neutrogena Canada, CoverGirl Canada, Clinique Canada, Nivea Canada, The Body Shop Canada, Sephora Canada, Groupe Marcelle Inc., MAC Cosmetics (Make-up Art Cosmetics), Deciem Beauty Group Inc. (The Ordinary) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian cosmetic products market appears promising, driven by evolving consumer preferences and technological advancements. The demand for clean beauty products is expected to rise, with a focus on transparency and sustainability. Additionally, the increasing popularity of male grooming products will likely expand market segments. Companies that adapt to these trends and invest in innovative marketing strategies, particularly through digital channels, will be well-positioned to capture emerging opportunities in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Makeup Haircare Fragrances Personal Care Sun Care Others |

| By End-User | Women Men Children |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Direct Sales Others |

| By Price Range | Premium Mid-range Economy |

| By Packaging Type | Bottles Tubes Jars Pouches |

| By Ingredient Type | Natural/Organic Conventional/Synthetic |

| By Occasion | Daily Use Special Occasions Seasonal Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Sales | 100 | Brand Managers, Retail Buyers |

| Makeup Trends and Preferences | 90 | Cosmetic Retail Staff, Beauty Influencers |

| Haircare Product Insights | 80 | Salon Owners, Product Distributors |

| Fragrance Market Dynamics | 60 | Marketing Directors, Consumer Insights Analysts |

| Consumer Attitudes towards Natural Products | 50 | Health and Wellness Advocates, Eco-conscious Consumers |

The Canada Cosmetic Products Market is valued at approximately USD 2 billion, reflecting a significant growth trend driven by consumer demand for beauty and personal care products, particularly organic and natural options.