Global Cosmetic Products Market Overview

- The Global Cosmetic Products Market is valued at USD 450 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for beauty and personal care products, influenced by rising disposable incomes, urbanization, and the growing trend of self-care and wellness among consumers. The market has seen a significant shift towards natural, organic, and vegan products, reflecting changing consumer preferences and heightened awareness regarding health, sustainability, and ethical sourcing. The expansion of e-commerce platforms and the influence of social media and beauty influencers are further accelerating market growth .

- Key players in this market include the United States, China, and Japan, which dominate due to their large consumer bases, advanced retail infrastructure, and strong presence of leading cosmetic brands. The U.S. is recognized for its innovation and marketing expertise, while China has rapidly emerged as a major market driven by its expanding middle class, digitalization, and robust e-commerce growth. Japan’s leadership is attributed to its focus on high-quality skincare and technological advancements in cosmetic formulations. Asia Pacific overall leads the global cosmetics market, accounting for the largest market share, with strong growth in South Korea and India as well .

- The EU Cosmetics Regulation (EC) No 1223/2009, issued by the European Parliament and Council, governs all cosmetic products marketed in the European Union. This regulation mandates that cosmetic products must be safe for human health when used under normal or reasonably foreseeable conditions. It requires comprehensive safety assessments, prohibits the use of certain hazardous substances, and enforces strict requirements for labeling, product information files, and notification to the Cosmetic Products Notification Portal (CPNP), ensuring consumer safety and transparency in ingredient labeling .

Global Cosmetic Products Market Segmentation

By Type:The cosmetic products market is segmented into various types, including skincare, haircare, makeup, fragrances & deodorants, personal hygiene, sun care, and others. Among these, skincare products hold the largest share, driven by increasing consumer focus on skin health, the popularity of anti-aging and moisturizing products, and the influence of social media beauty trends. The demand for clean, natural, and functional skincare continues to rise, with consumers seeking products that address specific concerns such as environmental protection and sensitive skin .

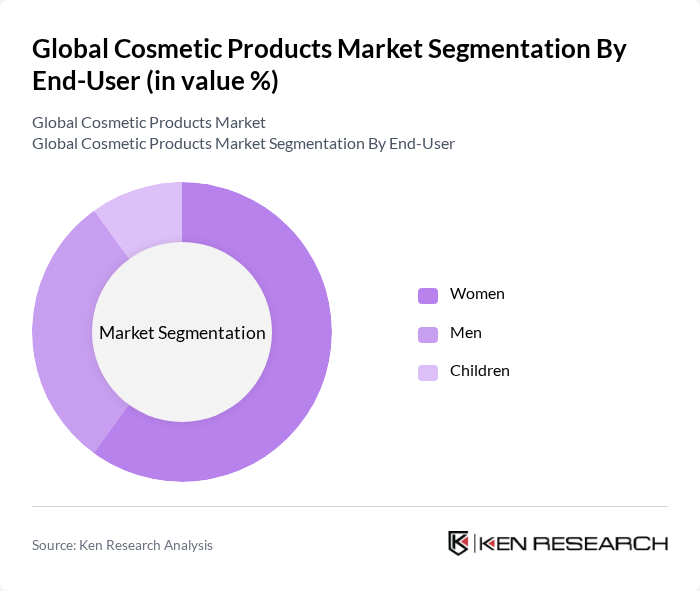

By End-User:The market is categorized by end-users into women, men, and children. Women represent the largest segment, reflecting higher spending on beauty and personal care products. The men’s segment is expanding rapidly, fueled by increased awareness of grooming and the introduction of targeted product lines. The children’s segment is growing due to rising demand for safe, gentle, and hypoallergenic products for young skin, with parents prioritizing quality and safety .

Global Cosmetic Products Market Competitive Landscape

The Global Cosmetic Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal S.A., The Estée Lauder Companies Inc., Procter & Gamble Co., Unilever PLC, Coty Inc., Shiseido Company, Limited, Revlon Inc., Johnson & Johnson Services, Inc., Amway Corporation, Mary Kay Inc., Avon Products, Inc., Beiersdorf AG, Henkel AG & Co. KGaA, Kao Corporation, Oriflame Holding AG, LG Household & Health Care Ltd., Natura &Co, LVMH Moët Hennessy Louis Vuitton SE, Amorepacific Corporation, and Clarins Group contribute to innovation, geographic expansion, and service delivery in this space.

Global Cosmetic Products Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Personal Care:The global cosmetic products market is experiencing a surge in consumer awareness regarding personal care, with 75% of consumers actively seeking products that enhance their well-being. This trend is supported by a recent report from the World Health Organization, indicating that personal care spending is projected to reach $600 billion. As consumers prioritize health and hygiene, brands are responding with innovative products that cater to these demands, driving market growth significantly.

- Rise in Demand for Organic and Natural Products:The demand for organic and natural cosmetic products is escalating, with the market for organic cosmetics expected to reach $30 billion in future. According to the Organic Trade Association, 65% of consumers prefer products with natural ingredients, reflecting a shift towards sustainability. This trend is further fueled by increasing concerns over synthetic chemicals, prompting brands to reformulate their offerings, thus enhancing market growth in the organic segment.

- Growth of E-commerce Platforms:E-commerce platforms are revolutionizing the cosmetic products market, with online sales projected to account for 35% of total sales in future. A report from Statista indicates that online beauty sales reached $90 billion, driven by convenience and accessibility. The rise of social media influencers and targeted online marketing strategies are further propelling this growth, allowing brands to reach a broader audience and enhance consumer engagement effectively.

Market Challenges

- Intense Competition Among Brands:The cosmetic products market is characterized by intense competition, with over 1,200 brands vying for market share. This saturation leads to price wars and reduced profit margins, as companies strive to differentiate their products. According to a recent industry report, the top 10 brands account for only 30% of the market, indicating a fragmented landscape that challenges new entrants and established players alike in maintaining profitability.

- Regulatory Compliance and Safety Standards:Navigating regulatory compliance poses a significant challenge for cosmetic brands, with over 250 regulations governing product safety and labeling in various regions. The European Union's REACH regulation, for instance, requires extensive testing and documentation, which can cost companies upwards of $1.5 million per product. This regulatory burden can hinder innovation and slow down product launches, impacting overall market growth and competitiveness.

Global Cosmetic Products Market Future Outlook

The future of the cosmetic products market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to invest in eco-friendly formulations and packaging solutions. Additionally, the integration of artificial intelligence in product personalization will enhance consumer experiences, allowing for tailored recommendations. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

Market Opportunities

- Growth in Emerging Markets:Emerging markets present significant growth opportunities, with countries like India and Brazil projected to see a 20% increase in cosmetic consumption in future. This growth is driven by rising disposable incomes and a burgeoning middle class, creating a demand for diverse cosmetic products tailored to local preferences and cultural nuances.

- Increasing Popularity of Men’s Grooming Products:The men’s grooming segment is rapidly expanding, with sales expected to reach $25 billion in future. This growth is fueled by changing societal norms and increased awareness of personal grooming among men. Brands that cater to this demographic with targeted marketing and product offerings stand to gain a competitive edge in this lucrative market segment.