Region:North America

Author(s):Geetanshi

Product Code:KRAB1672

Pages:83

Published On:October 2025

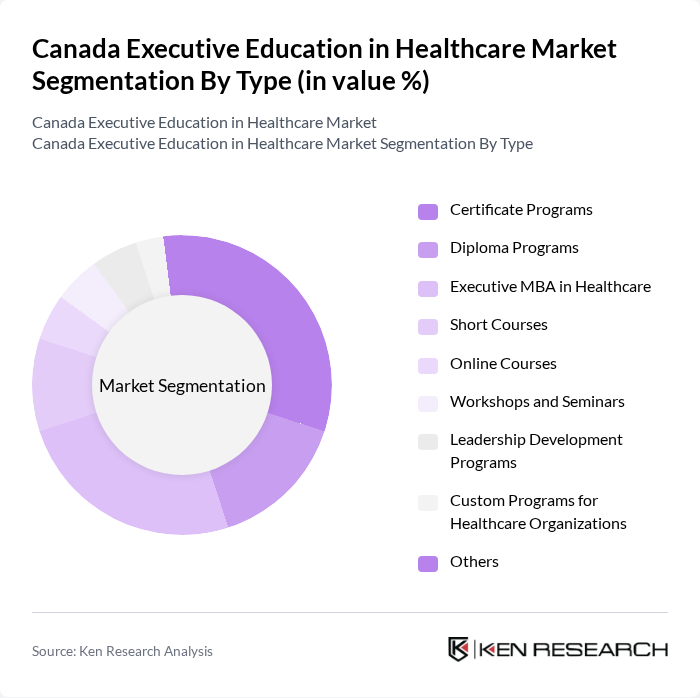

By Type:The market is segmented into a range of educational programs tailored for healthcare professionals. Certificate Programs and Executive MBA in Healthcare remain particularly prominent. Certificate Programs are preferred for their targeted curriculum and flexible duration, appealing to professionals seeking quick upskilling. The Executive MBA in Healthcare is increasingly sought after for its blend of advanced business management and healthcare-specific expertise, supporting career advancement into senior leadership roles .

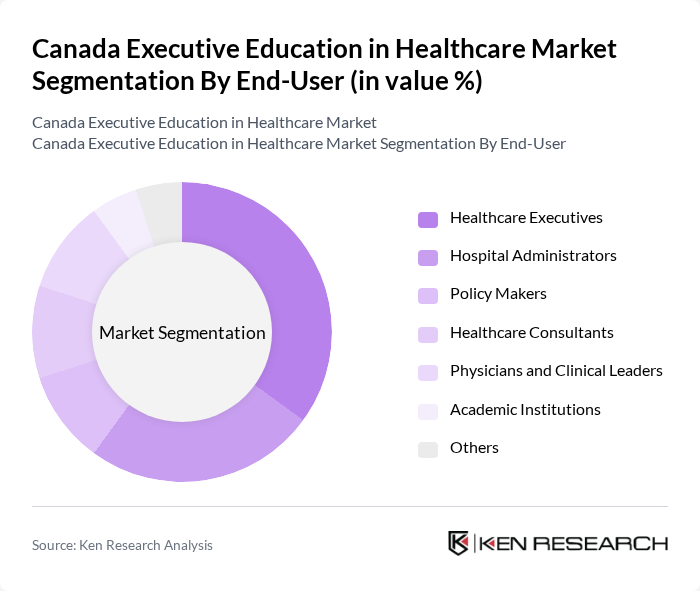

By End-User:The end-user segmentation reflects the broad spectrum of professionals pursuing executive education in healthcare. Healthcare Executives and Hospital Administrators constitute the largest segments, driven by the need for strategic leadership and operational excellence in healthcare organizations. The increasing complexity of healthcare delivery systems and regulatory requirements necessitates specialized training for these roles, making them a focal point for educational providers .

The Canada Executive Education in Healthcare Market features a dynamic mix of regional and international players. Leading institutions such as University of Toronto – Rotman School of Management (Health Sector Programs), McGill University – Desautels Faculty of Management (International Masters for Health Leadership), University of Alberta – Executive Education (Health Leadership Certificate), Western University – Ivey Business School (Health Sector Leadership Programs), University of British Columbia – Sauder School of Business (Healthcare Management Programs), York University – Schulich Executive Education Centre (Healthcare Executive Education), Queen’s University – Smith School of Business (Health Leadership Programs), University of Calgary – Haskayne School of Business (Health Leadership Development), University of Ottawa – Telfer School of Management (Health Systems Leadership), Dalhousie University – Rowe School of Business (Health Administration & Leadership), Simon Fraser University – Beedie School of Business (Executive Health Leadership), University of Saskatchewan – Edwards School of Business (Health Sector Executive Programs), University of Manitoba – Asper School of Business (Healthcare Management), University of New Brunswick – Faculty of Business Administration (Health Leadership), Canadian College of Health Leaders (CCHL), The Michener Institute of Education at UHN (Leadership in Healthcare), CHA Learning (Canadian Healthcare Association Learning), and Athabasca University – Faculty of Health Disciplines (Health Administration & Leadership) drive innovation, geographic expansion, and service delivery in this sector .

The future of executive education in Canada's healthcare sector appears promising, driven by the increasing integration of technology and a focus on leadership development. As healthcare organizations prioritize patient-centric care, educational institutions will likely adapt their curricula to meet these evolving needs. Additionally, the emphasis on interdisciplinary learning will foster collaboration among healthcare professionals, enhancing the overall quality of education. Institutions that embrace these trends will be well-positioned to thrive in a competitive landscape, ensuring that healthcare leaders are equipped for future challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Certificate Programs Diploma Programs Executive MBA in Healthcare Short Courses Online Courses Workshops and Seminars Leadership Development Programs Custom Programs for Healthcare Organizations Others |

| By End-User | Healthcare Executives Hospital Administrators Policy Makers Healthcare Consultants Physicians and Clinical Leaders Academic Institutions Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning Corporate Training Programs Simulation-Based Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3-6 months) Long-Term Programs (More than 6 months) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Professional Development Certifications CME/CPD Accredited Programs Others |

| By Geographic Focus | National Programs Regional Programs International Programs Others |

| By Price Range | Low-Cost Programs Mid-Range Programs Premium Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Executive Education Programs | 100 | Program Directors, Curriculum Developers |

| Healthcare Organizations Training Needs | 80 | HR Managers, Training Coordinators |

| Alumni Feedback on Executive Programs | 60 | Program Graduates, Healthcare Leaders |

| Industry Trends in Healthcare Education | 50 | Healthcare Consultants, Policy Analysts |

| Impact of Education on Healthcare Outcomes | 40 | Healthcare Practitioners, Academic Researchers |

The Canada Executive Education in Healthcare Market is valued at approximately USD 2.3 billion, reflecting robust growth driven by the increasing demand for advanced healthcare management skills and the complexities of the healthcare system.