Region:North America

Author(s):Shubham

Product Code:KRAA4974

Pages:81

Published On:September 2025

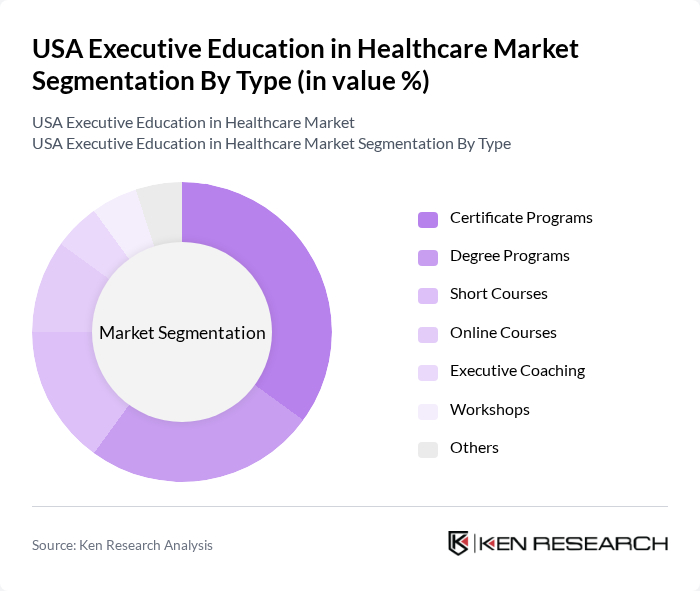

By Type:The market is segmented into various types of educational offerings, including Certificate Programs, Degree Programs, Short Courses, Online Courses, Executive Coaching, Workshops, and Others. Among these, Certificate Programs are particularly popular due to their flexibility and targeted approach, allowing healthcare professionals to quickly gain specific skills relevant to their roles. Degree Programs, while more comprehensive, require a longer commitment, which may deter some professionals seeking immediate advancement.

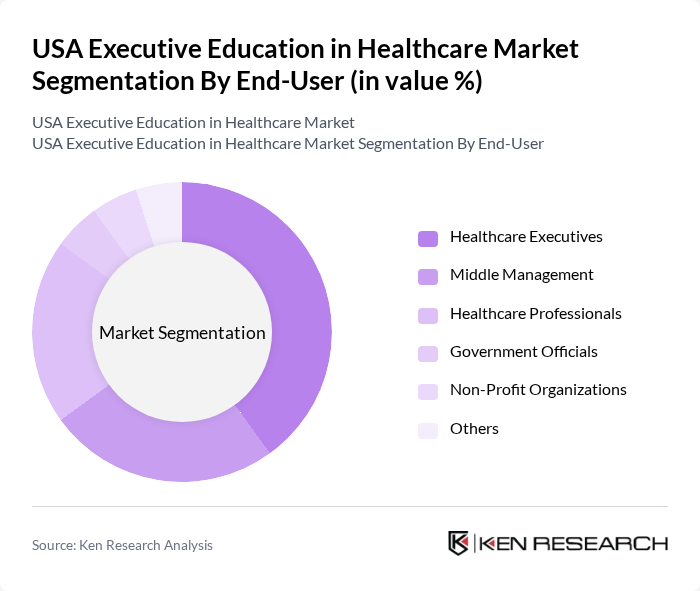

By End-User:This segment includes Healthcare Executives, Middle Management, Healthcare Professionals, Government Officials, Non-Profit Organizations, and Others. Healthcare Executives represent the largest group, as they are often required to enhance their leadership skills to navigate the complexities of the healthcare landscape. Middle Management and Healthcare Professionals also seek executive education to improve their operational effectiveness and career advancement opportunities.

The USA Executive Education in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Harvard Business School, Wharton School of the University of Pennsylvania, Stanford Graduate School of Business, Duke University - Fuqua School of Business, University of California, Berkeley - Haas School of Business, Columbia Business School, Northwestern University - Kellogg School of Management, University of Michigan - Ross School of Business, University of Chicago - Booth School of Business, MIT Sloan School of Management, University of Virginia - Darden School of Business, Yale School of Management, University of North Carolina at Chapel Hill - Kenan-Flagler Business School, University of Southern California - Marshall School of Business, Georgetown University - McDonough School of Business contribute to innovation, geographic expansion, and service delivery in this space.

The future of executive education in healthcare is poised for significant transformation, driven by the increasing complexity of healthcare systems and the need for skilled leaders. As organizations prioritize leadership development, the integration of technology and hybrid learning models will become essential. Furthermore, the emphasis on data-driven decision-making will shape curricula, ensuring that healthcare executives are equipped to tackle emerging challenges. The focus on networking opportunities will also enhance collaboration among professionals, fostering a culture of continuous learning and improvement in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Certificate Programs Degree Programs Short Courses Online Courses Executive Coaching Workshops Others |

| By End-User | Healthcare Executives Middle Management Healthcare Professionals Government Officials Non-Profit Organizations Others |

| By Delivery Mode | In-Person Training Online Learning Blended Learning Corporate Training Programs Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3-6 months) Long-Term Programs (More than 6 months) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Professional Development Certifications Others |

| By Industry Focus | Hospital Management Pharmaceutical Management Health Insurance Management Public Health Management Others |

| By Price Range | Low-End Programs (Under $1,000) Mid-Range Programs ($1,000 - $5,000) High-End Programs (Above $5,000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Executive Education Programs | 150 | Program Directors, Curriculum Developers |

| Healthcare Professionals Seeking Education | 200 | Healthcare Executives, Mid-level Managers |

| Alumni Feedback on Executive Programs | 100 | Graduates of Executive Education Programs |

| Industry Experts and Thought Leaders | 75 | Healthcare Consultants, Academic Researchers |

| Corporate Training Managers in Healthcare | 80 | HR Managers, Training Coordinators |

The USA Executive Education in Healthcare Market is valued at approximately USD 3.5 billion, reflecting a significant demand for advanced healthcare management skills and continuous professional development among healthcare leaders.