Canada Furniture & Home Interiors Market Overview

- The Canada Furniture & Home Interiors Market is valued at USD 18 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, increased residential construction, a surge in real estate activities, and a growing trend towards sustainable and eco-friendly furniture options. The market has seen a significant shift towards online shopping, with e-commerce penetration accelerating sales and accessibility for consumers. Demand for ergonomic, multipurpose, and minimalistic furniture styles is also shaping purchasing patterns, alongside the popularity of DIY and smart home furniture solutions .

- Key cities dominating the market include Toronto, Vancouver, and Montreal. Toronto, as the largest city, benefits from a diverse population and a booming real estate market, while Vancouver's focus on sustainability and design innovation attracts consumers. Montreal's rich cultural heritage influences unique furniture styles, making it a hub for both local and international brands .

- The “Regulations Amending the Furniture and Furnishings (Fire Safety) Regulations, SOR/2023-100” were issued by Health Canada in 2023. These regulations require mandatory labeling for fire safety and eco-friendly materials, and provide incentives for manufacturers who adopt sustainable production methods. The regulations are designed to reduce environmental impact, ensure product safety, and encourage consumers to make informed choices about their furniture purchases by mandating clear labeling and compliance with sustainability standards .

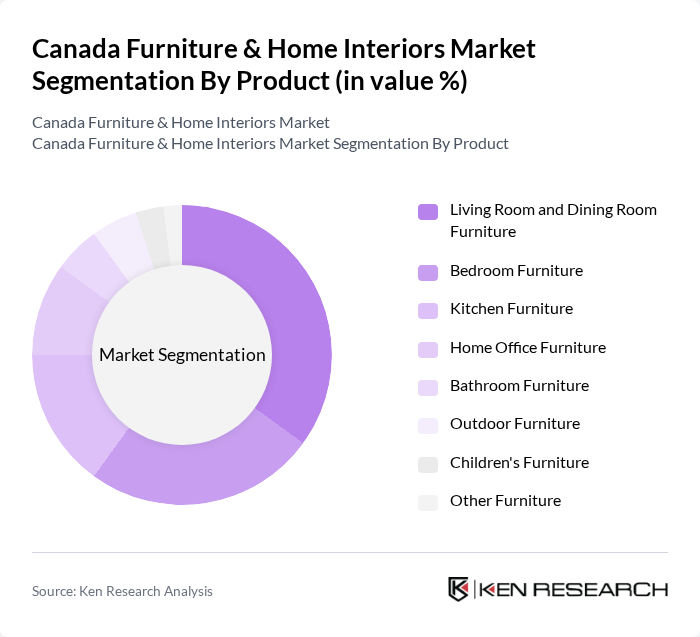

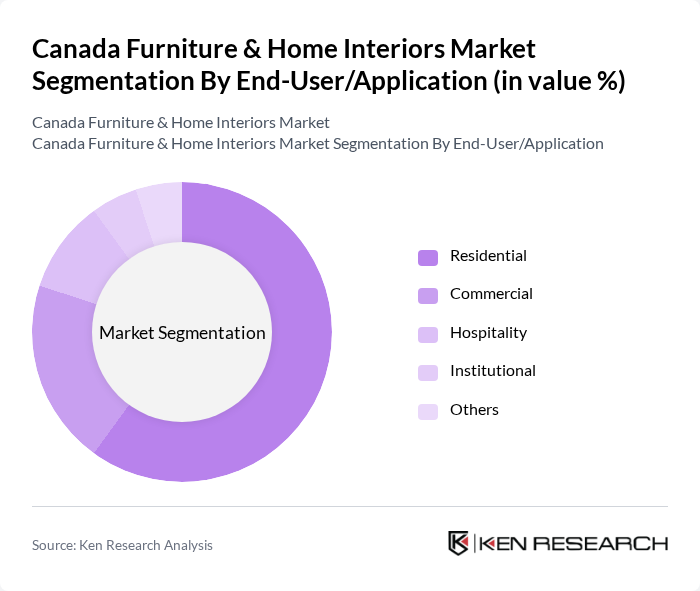

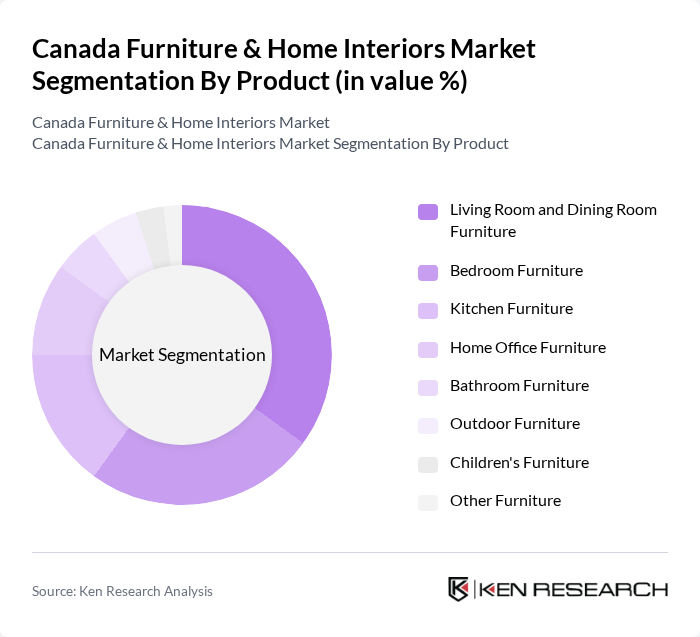

Canada Furniture & Home Interiors Market Segmentation

By Product:The product segmentation of the market includes categories such as Living Room and Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, Home Office Furniture, Bathroom Furniture, Outdoor Furniture, Children's Furniture, and Other Furniture. Among these, Living Room and Dining Room Furniture is the most dominant segment, driven by consumer preferences for stylish, functional, and versatile designs that enhance home aesthetics. The trend toward open-concept living spaces and the adoption of multipurpose furniture have further fueled demand in this segment. Wooden furniture, particularly solid wood, remains highly popular for living and dining rooms, reflecting both functional and lifestyle-driven needs .

By End-User/Application:The end-user segmentation includes Residential, Commercial, Hospitality, Institutional, and Others. The Residential segment is the largest, driven by the increasing trend of home renovations, rising housing demand, and the desire for personalized living spaces. Consumers are investing in furniture that reflects their style and meets functional needs, leading to robust demand in this category. The commercial and hospitality segments are also growing, supported by office renovations, ergonomic furniture adoption, and the expansion of hotels and restaurants .

Canada Furniture & Home Interiors Market Competitive Landscape

The Canada Furniture & Home Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Canada, Leon's Furniture Limited, The Brick Ltd., Structube, Wayfair Canada, Ashley HomeStore Canada, EQ3, Hudson's Bay Company, La-Z-Boy Canada, Palliser Furniture, Dufresne Group, Canadian Tire Corporation, Rona Inc., HomeSense, and Urban Barn contribute to innovation, geographic expansion, and service delivery in this space.

Canada Furniture & Home Interiors Market Industry Analysis

Growth Drivers

- Increasing Consumer Spending on Home Decor:In future, Canadian households are projected to spend approximately CAD 15 billion on home decor, reflecting a 5% increase from previous periods. This rise is driven by a growing emphasis on personalizing living spaces, with 60% of consumers indicating a willingness to invest in quality furnishings. The increase in disposable income, which is expected to reach CAD 1.1 trillion, further supports this trend, as consumers prioritize home aesthetics and comfort.

- Rise in Urbanization and Housing Developments:Urbanization in Canada is accelerating, with over 80% of the population expected to reside in urban areas in future. This shift is accompanied by a surge in housing developments, with an estimated 200,000 new housing units projected to be built. As urban dwellers seek to maximize limited space, the demand for stylish and functional furniture is expected to rise, driving market growth significantly in metropolitan regions.

- Growing Demand for Sustainable and Eco-Friendly Products:The Canadian furniture market is witnessing a notable shift towards sustainability, with sales of eco-friendly furniture projected to reach CAD 3 billion in future. This trend is fueled by consumer awareness, with 70% of buyers preferring products made from sustainable materials. Government initiatives promoting green practices and the increasing availability of certified sustainable products are further enhancing this demand, positioning eco-friendly furniture as a key growth driver.

Market Challenges

- Supply Chain Disruptions:The Canadian furniture industry continues to face significant supply chain challenges, with delays affecting over 30% of shipments in previous periods. Factors such as global shipping constraints and labor shortages have led to increased lead times, impacting inventory levels. As a result, retailers are struggling to meet consumer demand, which is projected to grow by 4% in future, creating a mismatch between supply and demand in the market.

- Intense Competition from E-commerce Platforms:The rise of e-commerce has intensified competition in the Canadian furniture market, with online sales expected to account for 25% of total furniture sales in future. Traditional retailers are challenged to adapt to this shift, as online platforms often offer lower prices and greater convenience. This competitive pressure is forcing brick-and-mortar stores to innovate and enhance their customer experience to retain market share amidst changing consumer shopping behaviors.

Canada Furniture & Home Interiors Market Future Outlook

The future of the Canadian furniture market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture is expected to rise. Additionally, the integration of smart technology into furniture design will likely attract tech-savvy consumers. With a growing focus on sustainability, manufacturers are anticipated to innovate further, creating eco-friendly products that align with consumer values, thereby enhancing market competitiveness and resilience.

Market Opportunities

- Expansion of Online Retail Channels:The shift towards online shopping presents a significant opportunity for furniture retailers. With e-commerce sales projected to grow by CAD 1 billion in future, businesses can leverage digital platforms to reach a broader audience. Investing in user-friendly websites and enhanced logistics will be crucial for capturing this expanding market segment and improving customer satisfaction.

- Customization and Personalization Trends:The demand for customized furniture solutions is on the rise, with an estimated CAD 500 million market potential in future. Consumers increasingly seek unique designs that reflect their personal style. Companies that offer tailored options and interactive design tools can capitalize on this trend, enhancing customer engagement and loyalty while differentiating themselves in a competitive landscape.